KEYTAKEAWAYS

- Celestia introduces a modular blockchain model, separating execution from data availability to enhance scalability and flexibility.

- TIA is Celestia’s native token, used for gas, staking, governance, and paying for data availability services.

- With Data Availability Sampling, Celestia enables light nodes to verify blocks without downloading full data—crucial for rollup security.

CONTENT

Learn what Celestia and TIA are, how modular blockchain architecture works, and why data availability is key to the future of scalable, decentralized Web3 infrastructure.

WHAT IS CELESTIA (TIA)?

If you’ve been around the crypto space for a while, you’ve probably heard about early network issues on Layer 1 blockchains like Solana and Aptos—think outages, congestion, and scalability bottlenecks. These problems largely stem from their monolithic architecture, where execution, consensus, and data availability are all handled by a single layer, often creating performance limits as demand grows.

Enter Celestia—a modular blockchain designed to fix these exact issues. Rather than trying to do everything on one chain, Celestia focuses specifically on data availability (DA), allowing developers to mix and match execution and consensus layers that best fit their needs. This modular design enables the network to scale more efficiently and securely with user demand.

Put simply, with Celestia, anyone can spin up their own blockchain in minutes. It unlocks a new level of flexibility and composability, giving rise to a growing ecosystem of chains that can interoperate and innovate without being bottlenecked by a single Layer 1’s limitations.

The team behind Celestia puts strong emphasis on decentralization and community autonomy. As they put it, “Our vision is rooted in a fundamental belief: communities have an unalienable right to self-organize.”

Now, let’s talk about TIA—Celestia’s native token. It plays a key role in powering the network. TIA is used to pay for blobspace (essentially blockspace for storing data), acts as a gas token, and can also be staked to participate in consensus and help secure the network.

As more developers and users embrace the modular blockchain era, Celestia and TIA are poised to become foundational pillars in the next generation of blockchain infrastructure.

HOW DOES CELESTIA WORK?

Celestia is the world’s first blockchain focused solely on data availability—but what exactly does “data availability” mean, and what problems is Celestia trying to solve?

🔍 What Is Data Availability?

In simple terms, data availability refers to the ability for any participant in the network to access and download transaction data in order to independently verify a block. It’s a foundational component of blockchain security, ensuring transparency and verifiability for all users—not just centralized validators.

📌 The Bottleneck with Traditional Blockchains

In traditional blockchain designs, nodes are required to download and store the full block data in order to verify its validity. As blockchains grow, this becomes increasingly burdensome for regular users, turning scalability into a major hurdle.

📌 Celestia’s Solution: Data Availability Sampling (DAS)

To overcome this limitation, Celestia implements a technique called Data Availability Sampling (DAS). With DAS, light nodes—which don’t store the entire dataset—can randomly sample small portions of block data to check whether the full block was published correctly.

This sampling is done over multiple rounds. With each successful round, the node gains higher confidence in the availability of the data. Once a predefined confidence level is reached, the block is considered available and valid—without needing to download the entire thing.

🔍 Why This Matters for Layer 2 Rollups

Layer 2 rollups, such as Optimism or Arbitrum, publish summaries or proofs of their transactions to Layer 1 chains like Ethereum for settlement. But if the underlying transaction data isn’t available, it becomes impossible to verify those transactions—leaving the door open for dishonest rollup operators.

That’s why rollups depend on robust data availability solutions like Celestia. It ensures that even lightweight nodes can verify blocks and keep the system secure and trustless.

>>> More to read: zkSync: Ethereum’s Latest Layer 2 Scaling Solution

WHAT IS TIA?

Launched alongside Celestia’s mainnet on October 31, 2023, TIA is the native cryptocurrency powering the modular blockchain’s ecosystem. It plays a central role in enabling transactions, network security, and governance within Celestia’s innovative infrastructure.

✅ Core Utilities of TIA

According to the official whitepaper, TIA serves four main functions:

- Gas Token for Rollups Built on Celestia

One of Celestia’s key design principles is to simplify blockchain deployment, allowing anyone to launch a new chain quickly and easily. With TIA, developers don’t need to create a custom token just to get started. Instead, they can use TIA directly as the gas token—much like how ETH is used for rollups on Ethereum—freeing them to focus on building applications and execution layers.

- Payment for Data Availability Services

Rollups interacting with Celestia must pay for data availability using TIA. This is done via “PayForBlobs” transactions, which include critical information such as the sender, namespace, data size, and signature. These transactions enable rollups to publish data to Celestia, ensuring its availability and verifiability—essential for secure off-chain scaling.

- Staking to Secure the Network

As a Proof-of-Stake blockchain built on CometBFT and the Cosmos SDK, Celestia uses TIA for staking. Token holders can delegate their TIA to validators to earn staking rewards while helping to maintain the network’s integrity. The network launched with an initial validator set of 100 and supports in-protocol delegation to encourage decentralized participation.

- Governance and Decision-Making

Unlike some governance models that restrict participation to stakers, Celestia allows any TIA holder to propose and vote on network changes. This includes adjustments to protocol parameters, ecosystem funding proposals, and management of the community pool—which receives 2% of all block rewards.

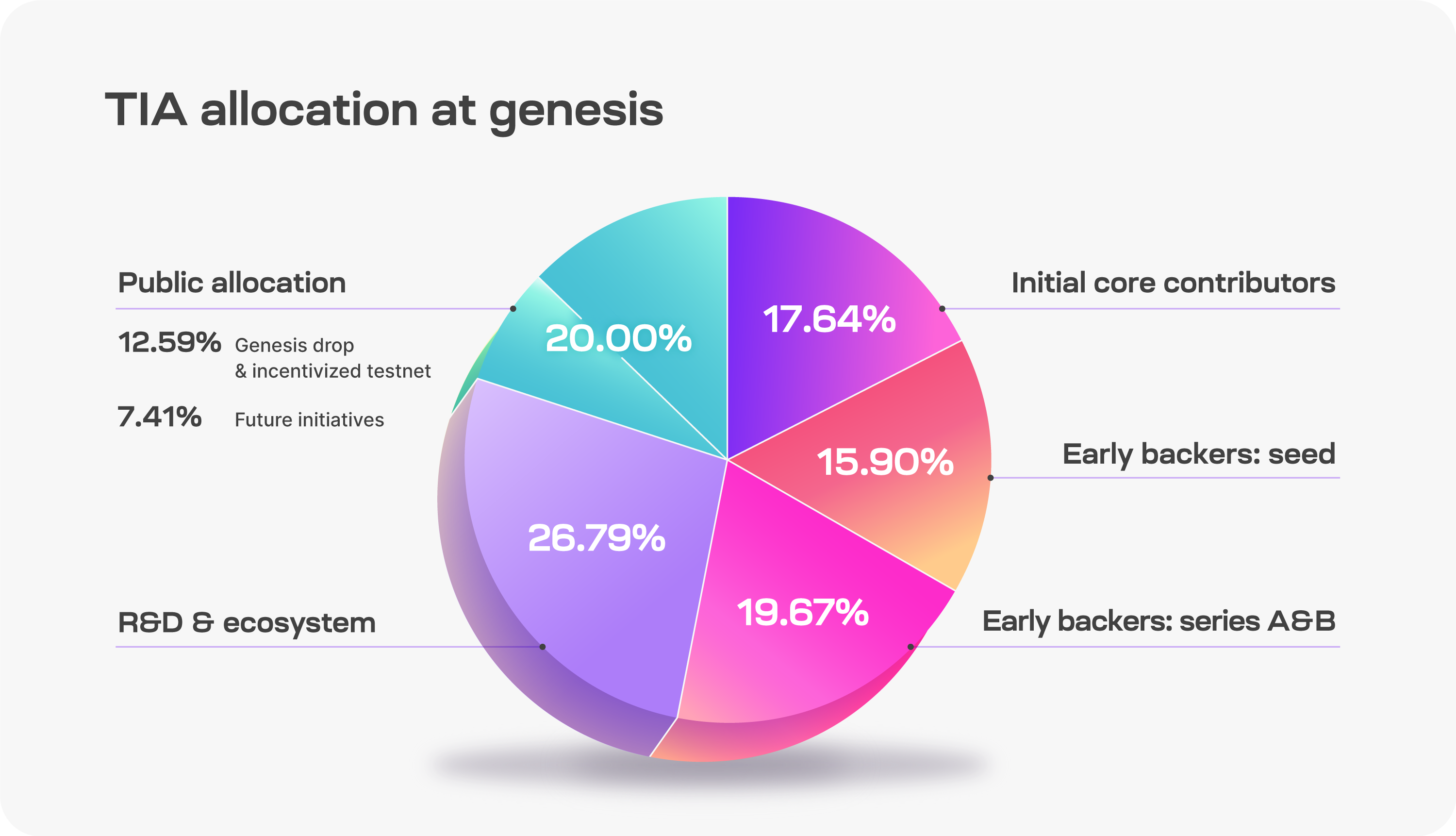

📌 TIA Tokenomics

Curious about the economic structure behind TIA? Here’s what you should know:

- Total Supply: 1 billion TIA

- Initial Circulating Supply: 14.1% (141 million TIA)

- Public Allocation: 20% of the total supply is reserved for testnet incentives and future ecosystem initiatives.

-

Inflation Schedule:

- Year 1: 8% inflation rate

-

Inflation will decrease by 10% each year until it hits a long-term floor of 1.5% annually

➤ Token Distribution Breakdown:

- Genesis Airdrop: 7.4%

- Community Incentives: 12.6%

- R&D and Ecosystem Fund: 26.8%

- Early Backers: 35.6%

- Team: 17.6%

In summary, TIA isn’t just a utility token—it’s the lifeblood of the Celestia ecosystem. From powering rollups and paying for data availability to securing the network through staking and enabling decentralized governance, TIA plays a crucial role in realizing Celestia’s modular, scalable, and community-driven vision for the future of blockchain infrastructure.