KEYTAKEAWAYS

- Kernel DAO redefines restaking by enabling users to restake assets like BNB and BTC across multiple chains, unlocking higher yield and enhanced security through shared infrastructure.

- The ecosystem includes three key protocols—Kernel, Kelp (rsETH), and Gain—designed to optimize rewards, enhance liquidity, and offer no-lockup farming strategies.

- $KERNEL is the native token used for governance, incentives, and restaking, with a community-first tokenomics model and planned expansion into RWA, BTC vaults, and multichain networks in 2025.

CONTENT

Kernel DAO is a multichain restaking protocol that maximizes asset yield and security while empowering users through governance, liquid staking, and a community-first token model.

WHAT IS KERNEL DAO?

Kernel DAO is a pioneering restaking protocol built on BNB Chain, designed to enhance both the security and utility of staked assets. Unlike traditional staking models—where assets often remain underutilized—Kernel DAO introduces a shared security mechanism that allows users to restake yield-generating assets like BNB and BTC. This approach not only safeguards their original investments but also amplifies potential returns.

Although it launched on BNB Chain, Kernel DAO has already expanded its reach across more than 10 major blockchains, including Ethereum, Arbitrum, and Optimism—demonstrating strong cross-chain compatibility and ecosystem growth.

$KERNEL is now live! 🍿

The day has arrived – our unified token is here.

This moment celebrates everyone who contributed to building our ecosystem. Thank you for your constant support.The future of restaking begins today. 🌽

Claim your tokens here: https://t.co/2HzE7vycnN… pic.twitter.com/qhTWESJB4a

— KernelDAO (@kernel_dao) April 14, 2025

To date, Kernel DAO has attracted over 300,000 users and secured more than $2 billion in total deposits. According to data from DeFiLlama, the protocol’s Total Value Locked (TVL) has surpassed $1.67 billion, highlighting its significant impact and growing trust within the DeFi landscape.

Further validating its influence, Kernel DAO has been featured in Binance’s newly launched Megadrop program—marking another major milestone in its rise within the crypto ecosystem.

>>> More to read: What is KAITO? Binance HODLer’s New Airdrop Project

HOW KERNEL DAO WORKS

Kernel DAO is powered by three core protocols—Kernel, Kelp Liquid Restaking (rsETH), and Gain—each playing a distinct role in optimizing asset utilization and maximizing staking rewards across multiple ecosystems.

✅ Kernel Protocol

As the flagship product, the Kernel protocol enables users to restake assets like BNB and BTC to enhance both security and yield. With integrated cross-chain functionality, it allows users to optimize returns without compromising the safety of their staked assets.

✅ Kelp Liquid Restaking (rsETH)

This protocol brings the concept of liquid restaking to life. Users can restake yield-generating assets such as BNB and BTC and earn rewards across Ethereum and other supported chains. By tapping into more than 50 DeFi protocols, Kelp enables users to maximize returns across various ecosystems without giving up asset liquidity.

✅ Gain – Automated Rewards Farming

Gain is designed for users looking for high-yield opportunities with minimal effort. It offers vaults with no minimum deposit requirement and no lock-up period, allowing users to farm multiple airdrops and returns seamlessly. With customizable yield strategies, users can tailor their investments for optimal performance.

In short, through the Kernel platform, users can stake BNB directly or via liquid staking tokens, integrating with Kernel smart contracts to unlock additional earning opportunities across multiple decentralized applications (dApps) within the network.

>>> More to read: What is Binance Launchpool? Earn Free Token

WHAT IS $KERNEL?

KERNEL is the native cryptocurrency of the Kernel DAO ecosystem, designed with a community-first philosophy that emphasizes user empowerment and long-term protocol sustainability.

The KERNEL token serves multiple purposes within the ecosystem. It acts as both a governance and incentive token. In the early stages, token holders can participate in governance decisions and earn rewards by providing liquidity—ensuring the community has a meaningful voice in shaping the protocol’s direction through collective decision-making.

Additionally, KERNEL can be restaked to further enhance the economic security of the protocol. Token holders who restake their KERNEL may also become eligible for airdrops from associated projects. To support token value and long-term stability, part of the protocol’s revenue is allocated to buy back KERNEL from the market.

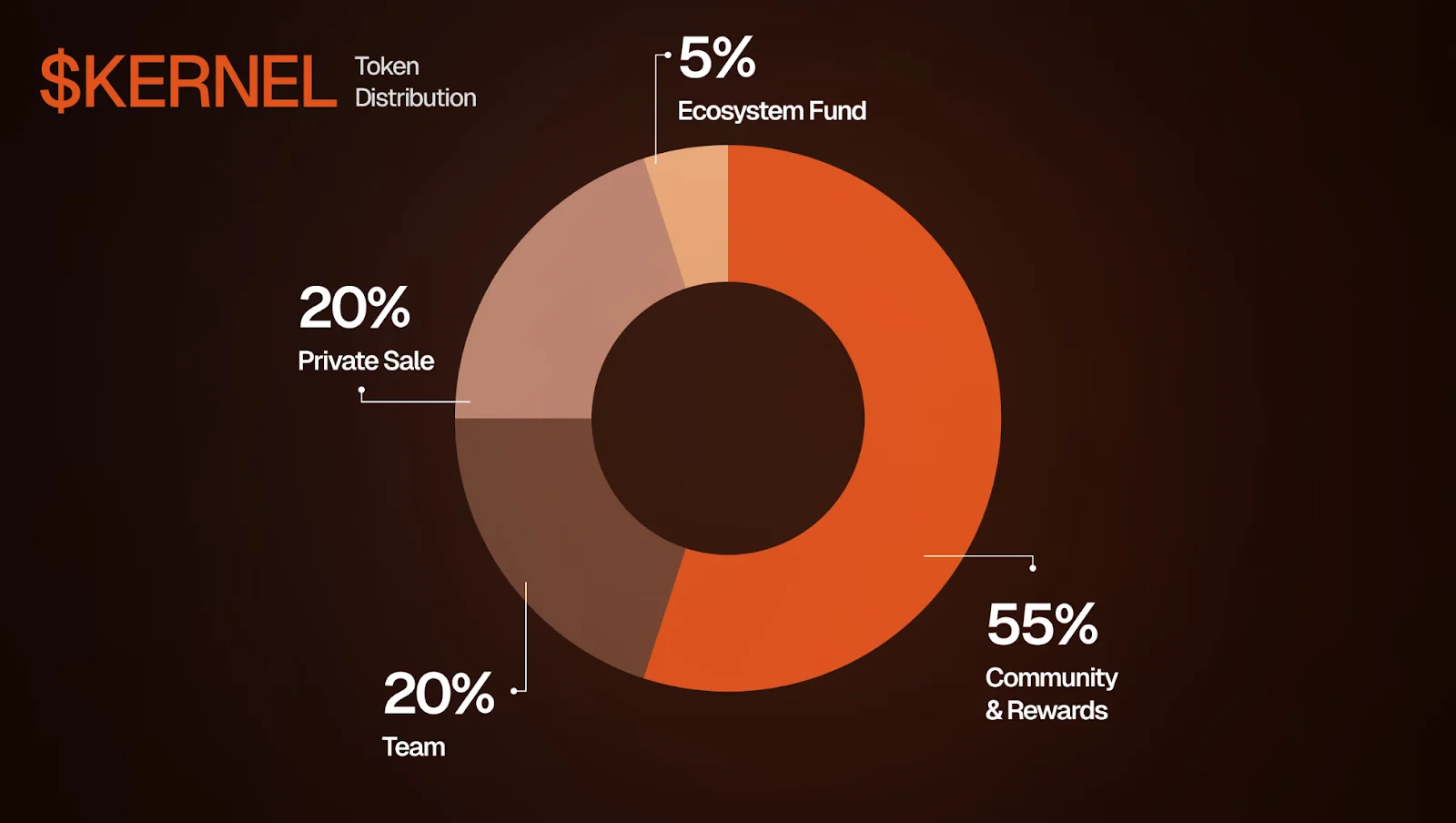

📌 KERNEL Tokenomics

The distribution of KERNEL follows a community-driven allocation model. The token has a maximum supply of 1,000,000,000, with an initial circulating supply of 162,317,496 (16.23% of the total supply) at launch. The allocation is structured as follows:

-

Community Rewards & Airdrops (55%)

20% is allocated for early airdrops, and 35% reserved for future community incentives.

-

Private Sale (20%)

This includes completed and upcoming private rounds. Tokens distributed through private sales will be subject to a 6-month lock-up period and a 24-month linear vesting schedule after the TGE (Token Generation Event).

-

Team & Advisors (20%)

Allocated to core contributors and advisors who are driving the long-term development of the project.

-

Ecosystem & Partnerships (5%)

Reserved for strategic partners and initiatives that expand the Kernel DAO ecosystem.

(Source:kerneldao.litepaper)

>>> More to read: What is Binance’s “Vote to List” Feature? How to Participate

KERNEL DAO (KERNEL) 2025 ROADMAP

To understand where Kernel DAO is headed, its 2025 roadmap offers a clear look into the protocol’s evolution. The roadmap outlines major developments across DeFi functionality, Bitcoin integration, Real World Assets (RWA), and multichain expansion.

✅ Q1 2025: Feature Enhancements and Protocol Expansion

- Launched 3 new vaults under the Gain protocol to enhance yield strategies.

- Expanded DeFi integrations for rsETH, improving access and returns for restaked assets.

🔎 Q2 2025: BTC Integration and CEX Growth

- Introduced Bitcoin-based yield opportunities, including BTC-only vaults within Gain.

- Strengthened partnerships with centralized exchanges (CEXs) to grow the KERNEL ecosystem’s market presence.

🌐 Q3 2025: RWA Launch and Economic Optimization

- Entered the Real World Asset space with new RWA products integrated into the Gain protocol.

-

Implemented a burn mechanism within Kernel to enhance tokenomics and control token supply.

🚀 Q4 2025: Multichain Scaling and RWA Expansion

- Scheduled to launch support for a new blockchain in June, extending Kernel DAO’s multichain capabilities.

-

Expanded RWA asset support within Gain, enabling broader cross-chain asset utility and yield opportunities.

📌 Kernel DAO Conclusion: Kernel DAO

Kernel DAO represents more than just a technical leap in restaking—it marks a transformation in how DeFi yield, security, and governance can coexist. By addressing the inefficiencies of traditional staking, and offering a robust set of protocols like Gain and rsETH, it unlocks diverse earning opportunities while maintaining asset flexibility.

What sets Kernel DAO apart is its ability to align the interests of developers, stakers, and the broader community into a unified ecosystem. With KERNEL as the cornerstone—serving governance, incentives, and restaking utility—the project creates a feedback loop of participation and growth.

As the roadmap moves toward RWA integration, BTC yield products, and multichain expansion, Kernel DAO is no longer just a restaking protocol—it’s shaping up to be a foundational layer for the next generation of DeFi infrastructure.

With strong momentum and an active community, Kernel DAO is positioned not as a short-term trend, but as a long-term force guiding the mainstream adoption of secure, efficient, and community-owned restaking.