KEYTAKEAWAYS

- Crypto market cap measures the total value of a cryptocurrency.

- It plays a crucial role in ranking cryptos and guiding investment decisions.

- KEY TAKEAWAYS

- INTRODUCTION

- DEFINITION OF CRYPTO MARKET CAP

- Why Is Crypto Market Cap Important?

- TYPES OF MARKET CAP IN CRYPTO

- HOW TO CALCULATE CRYPTO MARKET CAP

- Difference Between Market Cap and Fully Diluted Market Cap

- HOW MARKET CAP AFFECTS INVESTOR DECISIONS

- MARKET CAP AND MARKET MOVEMENTS

- LIMITATIONS OF CRYPTO MARKET CAP

- CONCLUSION

- DISCLAIMER

- WRITER’S INTRO

CONTENT

Cryptocurrency market capitalization (market cap) is a key metric that helps investors assess the size, stability, and value of a cryptocurrency. Learn how to calculate market cap, its significance in ranking cryptocurrencies, and how it impacts investment decisions.

INTRODUCTION

Cryptocurrency market capitalization, commonly referred to as “market cap,” is one of the most widely used metrics to evaluate the size and potential of a cryptocurrency. It offers investors an easy way to compare the total value of different cryptocurrencies, helping them gauge the overall market trend, stability, and risk associated with each coin or token. Understanding what market cap means and how it’s calculated is essential for anyone looking to make informed investment decisions in the volatile world of cryptocurrency.

DEFINITION OF CRYPTO MARKET CAP

What Does Market Cap Mean?

Market capitalization is a metric used to measure the total value of a cryptocurrency. It is calculated by multiplying the current price of a cryptocurrency by its circulating supply. The formula is simple:

Market Cap = Current Price × Circulating Supply

For example, if a cryptocurrency is priced at $50 and has 1 million coins in circulation, its market cap would be $50 million. The market cap allows you to compare the relative size of different cryptocurrencies, regardless of their individual prices. It is considered a more accurate measure of a crypto asset’s value than just looking at its price alone.

Why Is Crypto Market Cap Important?

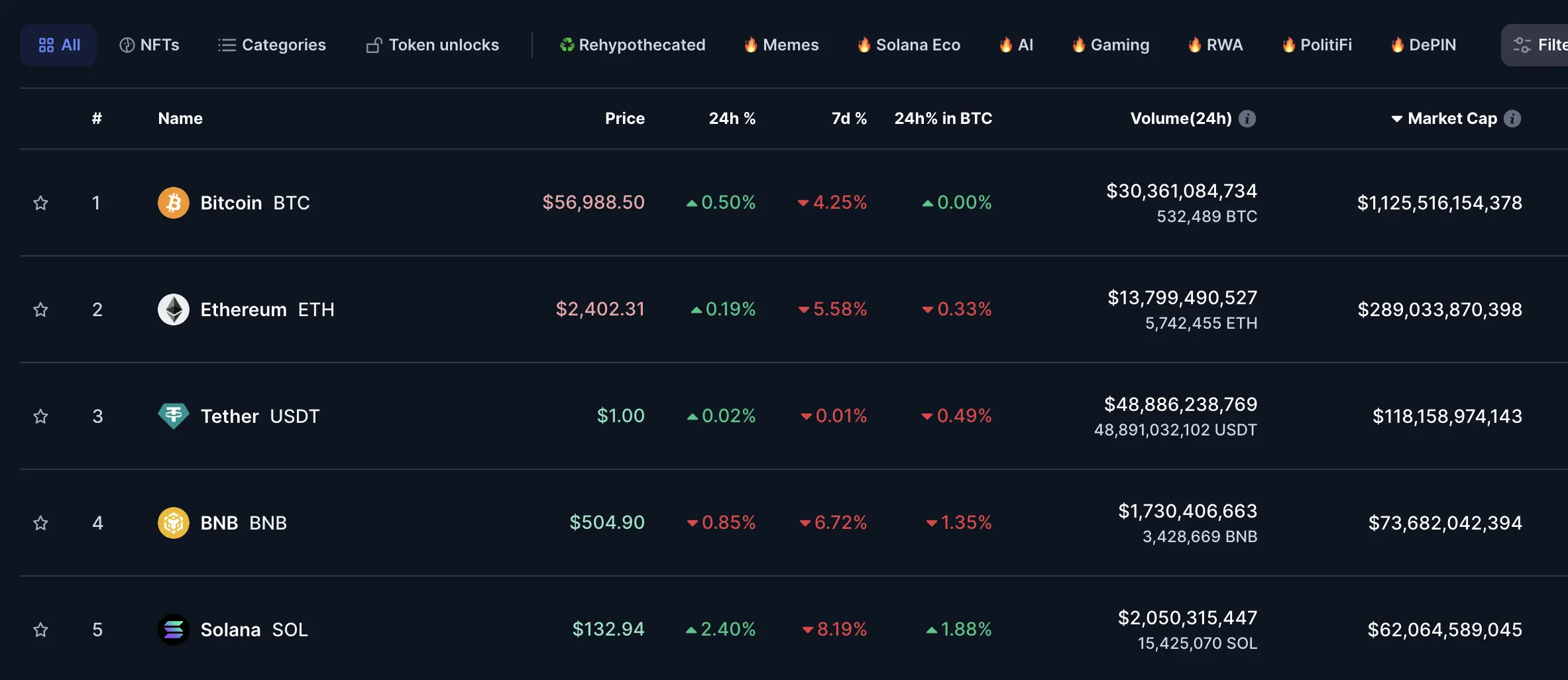

Market cap plays a crucial role in ranking cryptocurrencies. On platforms like CoinMarketCap, cryptocurrencies are listed by their market cap, giving investors a quick snapshot of which assets dominate the market. This ranking helps determine how established a cryptocurrency is, its potential for growth, and the level of risk involved in investing.

A higher market cap generally indicates a more stable investment, as larger cryptocurrencies are less likely to experience extreme price swings compared to smaller ones. However, market cap alone is not enough to assess the full value of a cryptocurrency.

(Source: CoinMarkeCap)

TYPES OF MARKET CAP IN CRYPTO

Large-Cap Cryptocurrencies (> $10 billion)

Large-cap cryptocurrencies are those with a market cap exceeding $10 billion. These assets, like Bitcoin and Ethereum, are considered to be the most established and stable. They are less likely to experience massive price swings and have a lower risk of failure compared to smaller cryptocurrencies. However, their growth potential might be limited due to their already significant market presence.

>> Check large-cap cryptocurrencies on TradingView

Mid-Cap Cryptocurrencies ($1~$10 billion)

Mid-cap cryptocurrencies have a market cap between $1 billion and $10 billion. These assets offer a balance between risk and reward, as they are typically more volatile than large-cap cryptos but still have room for significant growth. They are appealing to investors who are willing to accept moderate risk in exchange for potential gains.

Small-Cap Cryptocurrencies (< $1 billion)

Small-cap cryptocurrencies have a market cap under $1 billion. These are usually newer, less established projects and come with higher risk. Small-cap cryptos are often subject to high volatility, and their prices can fluctuate wildly based on market sentiment, speculation, or external factors. However, they can offer substantial returns if they gain market traction and adoption.

>> Also read: A Look Into Crypto Market Cap Comparison, Crypto Rankings and Much More

HOW TO CALCULATE CRYPTO MARKET CAP

Market Cap Calculation

Calculating the market cap of a cryptocurrency is straightforward. As mentioned earlier, the formula is:

Market Cap = Current Price × Circulating Supply

For example, if a cryptocurrency is currently trading at $100 and there are 500,000 coins in circulation, the market cap would be:

$100 × 500,000 = $50,000,000

This simple calculation helps investors compare the relative size of different cryptocurrencies and understand their value in the broader market.

Difference Between Market Cap and Fully Diluted Market Cap

While market cap looks at the circulating supply, fully diluted market cap takes the total supply into account, assuming all possible tokens are in circulation. The fully diluted market cap can provide insight into the future potential of a cryptocurrency, particularly if new coins or tokens are expected to be introduced through mining or staking.

For example, a project may have a circulating supply of 1 million coins and a total supply of 2 million. The market cap would be calculated based on the circulating supply, but the fully diluted market cap would be based on the total supply. This difference is important for investors looking to understand the long-term impact of token issuance on price and market cap.

HOW MARKET CAP AFFECTS INVESTOR DECISIONS

Market Cap vs. Price

Many new investors make the mistake of focusing solely on a cryptocurrency’s price, believing that a higher price equates to a higher value. However, market cap provides a more accurate picture of a cryptocurrency’s overall value. A low-priced cryptocurrency with a large circulating supply can have a higher market cap than a high-priced cryptocurrency with a smaller circulating supply.

For example, Bitcoin’s price may be significantly higher than other cryptocurrencies, but that doesn’t mean it is the best or most valuable investment. The market cap of a cryptocurrency is a better reflection of its true market value and is a more reliable metric for investors to use when comparing different assets.

Risk Assessment Based on Market Cap

Market cap is also a key factor in assessing the risk associated with a cryptocurrency. Large-cap cryptocurrencies like Bitcoin and Ethereum are seen as safer investments due to their stability and market dominance. Mid-cap cryptocurrencies offer higher potential returns but come with more risk, while small-cap cryptocurrencies are the most volatile and risky, but also the most likely to offer massive returns if they succeed.

Investors should balance their portfolios based on their risk tolerance, using market cap as a guide for which cryptocurrencies fit their investment strategy.

>> Also read: Crypto Trading Strategies for Beginners: Your First Step to Earning Millions

MARKET CAP AND MARKET MOVEMENTS

Market Cap Fluctuations

Market cap is directly tied to the price of a cryptocurrency. As the price fluctuates, so does the market cap. Sudden price surges or drops can significantly alter a cryptocurrency’s market cap, affecting its ranking among other cryptocurrencies.

Market cap is also impacted by changes in the circulating supply. For example, if a new batch of tokens is released or if coins are burned (removed from circulation), the market cap will adjust accordingly.

Supply Adjustments and Dilution

Supply adjustments such as mining new coins, staking, or token burns can influence the market cap. A sudden increase in circulating supply without a corresponding rise in price can dilute the market cap and impact the perceived value of the cryptocurrency.

Investors should monitor supply changes carefully, as they can significantly affect the market cap and, in turn, the market’s perception of a cryptocurrency’s value.

LIMITATIONS OF CRYPTO MARKET CAP

Market Cap Doesn’t Equal Real Value

While market cap is a useful metric, it does have limitations. A high market cap doesn’t always mean that a cryptocurrency is valuable or secure. Market cap can be influenced by factors like market manipulation, especially when large holders (often called “whales”) have significant control over the supply. If these holders sell off large amounts, the market cap can drop rapidly, impacting the overall perception of the cryptocurrency.

Market Cap and Market Sentiment

Market cap is also heavily influenced by market sentiment, which can fluctuate based on news, partnerships, or technological advancements. For example, a cryptocurrency’s market cap might spike if it gains media attention or signs a major partnership, but this does not necessarily reflect long-term value.

CONCLUSION

Crypto market cap is a critical metric for understanding the size, value, and potential of different cryptocurrencies. While it’s useful for comparing assets and assessing risk, it’s not a perfect indicator of real value. Investors should use market cap in combination with other metrics, such as trading volume, liquidity, and technological development, to make informed investment decisions. Understanding the nuances of market cap can help you navigate the complex world of cryptocurrency investing with greater confidence.

>> Also read:

- Crypto by Market Cap Ranking 2024 – Top 5 Cryptos You Should Know

- Crypto Market Place: What Insights Does CoinMarketCap Offer?

- 4 Best Low Market Cap Crypto to Consider if You’re Bored With Bitcoin