KEYTAKEAWAYS

- NAVI Protocol integrates lending and liquidity staking for a seamless DeFi experience on Sui Network.

- $NAVX token offers staking rewards, governance participation, and fee distribution, promoting ecosystem commitment.

- Navi's Health Factor and diverse asset support ensure robust risk management and user fund protection.

CONTENT

NAVI Protocol, the largest liquidity protocol on Sui Network, offering innovative lending, staking, and governance features to enhance DeFi accessibility and security.

WHAT IS NAVI PROTOCOL?

NAVI Protocol is an innovative lending protocol built on the Sui Network, inspired by Aave, one of the largest cryptocurrency lending platforms that allows users to borrow, lend, and earn interest on crypto assets without intermediaries.

NAVI is the largest liquidity protocol on Sui, offering services such as over-collateralized loans/borrowing with dynamic interest rates, flash loans, and liquid staking. The team has integrated lending and liquidity staking functions into a single project, providing users with a one-stop experience to enhance asset efficiency.

In NAVI Protocol, users can earn attractive APY returns by lending or becoming liquidity providers. This flexibility allows users to connect multiple assets, while the platform’s enhanced security features effectively protect user funds and reduce systemic risks.

NAVI is committed to providing essential infrastructure for the DeFi world, aiming to become a key player in the ever-evolving DeFi landscape within the Sui Network ecosystem. Currently, NAVI has become the DeFi protocol with the highest TVL in the Sui ecosystem.

Since its emergence in August 2023, NAVI has attained surprisingly excellent results:

- $200M+ Total Value Locked (TVL)

- 900,000+ Users

- $5B in Borrow Volume

And it is continuing to grow, with hopes of becoming a dominant project in the Sui ecosystem.

▶ NAVI Official Website: CLICK HERE!

-

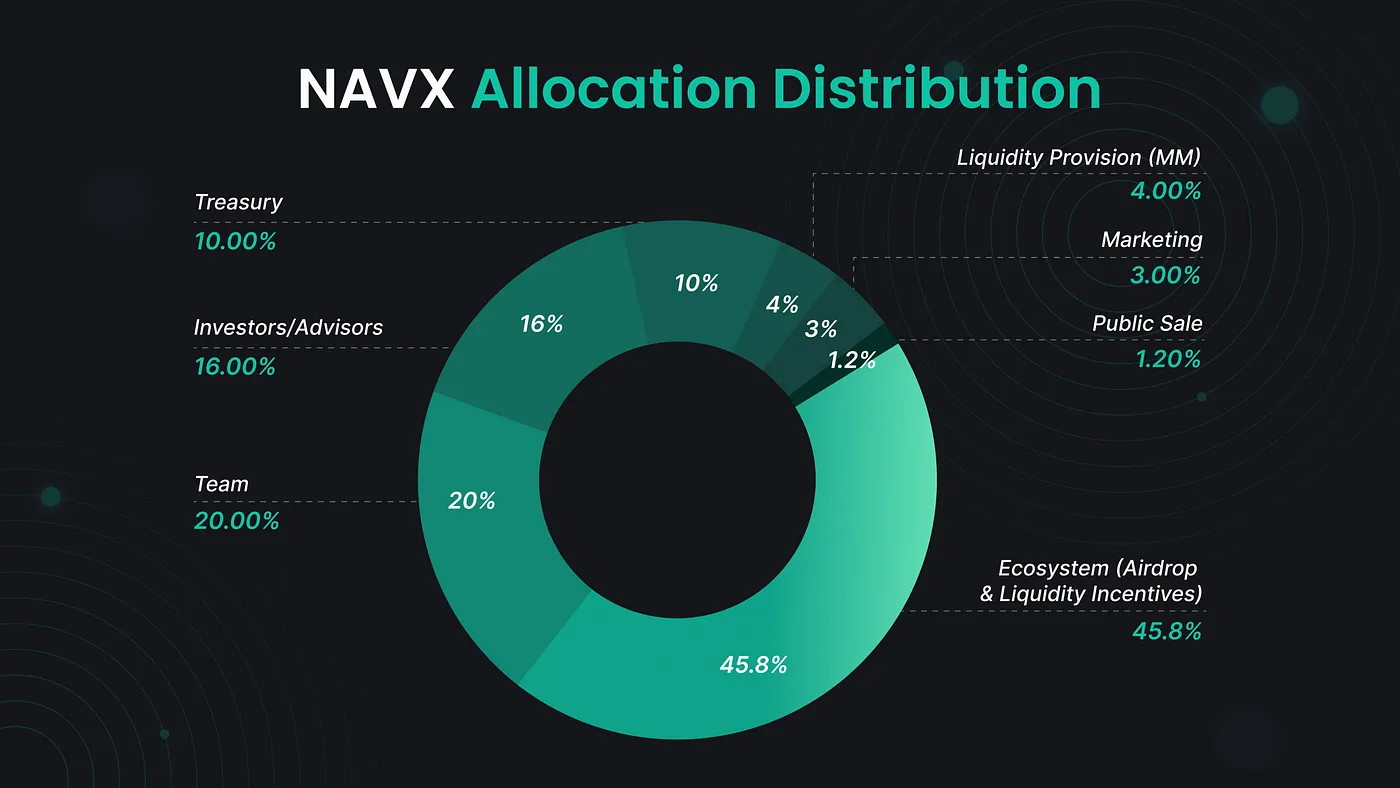

NAVI Native Token: $NAVX

$NAVX serves several key functions:

1. Staking

Users can stake their $NAVX to earn rewards in the form of transaction fees from the perpetual exchange and interest income from the lending platform. The distribution of rewards is proportional to the amount of staked native tokens, incentivizing long-term commitment to the ecosystem.

2. Governance

Token holders can participate in the governance of the NAVI Protocol by voting on proposals and updates, playing an active role in the protocol’s decision-making process.

3. Fee Collection and Distribution

NAVI Protocol charges fees on all transactions involving loans and perpetuals. A portion of these fees is distributed to stakeholders, while the remaining fees support the platform’s financial and other business operations.

Additionally, NAVI has introduced vote-escrowed tokens, veNAVI, to encourage users to stake and hold tokens long-term while continuing to participate in governance. This model provides confidence to many followers that the project will maintain long-term stability and positive development.

>> More to read : Exploring SUI: A Revolutionary Cryptocurrency on the Rise

HOW NAVI PROTOCOL WORKS

1. Supply & Earn

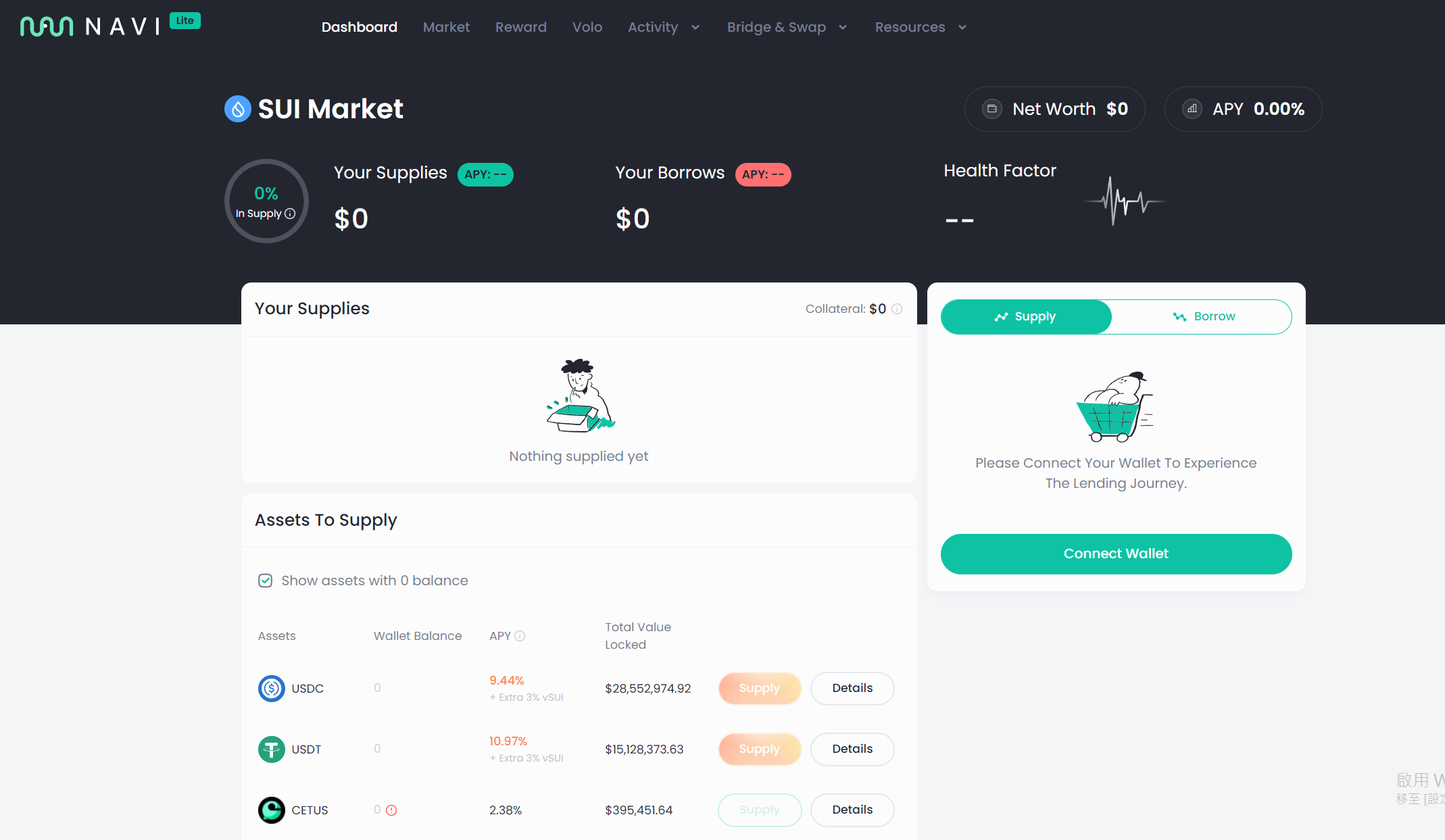

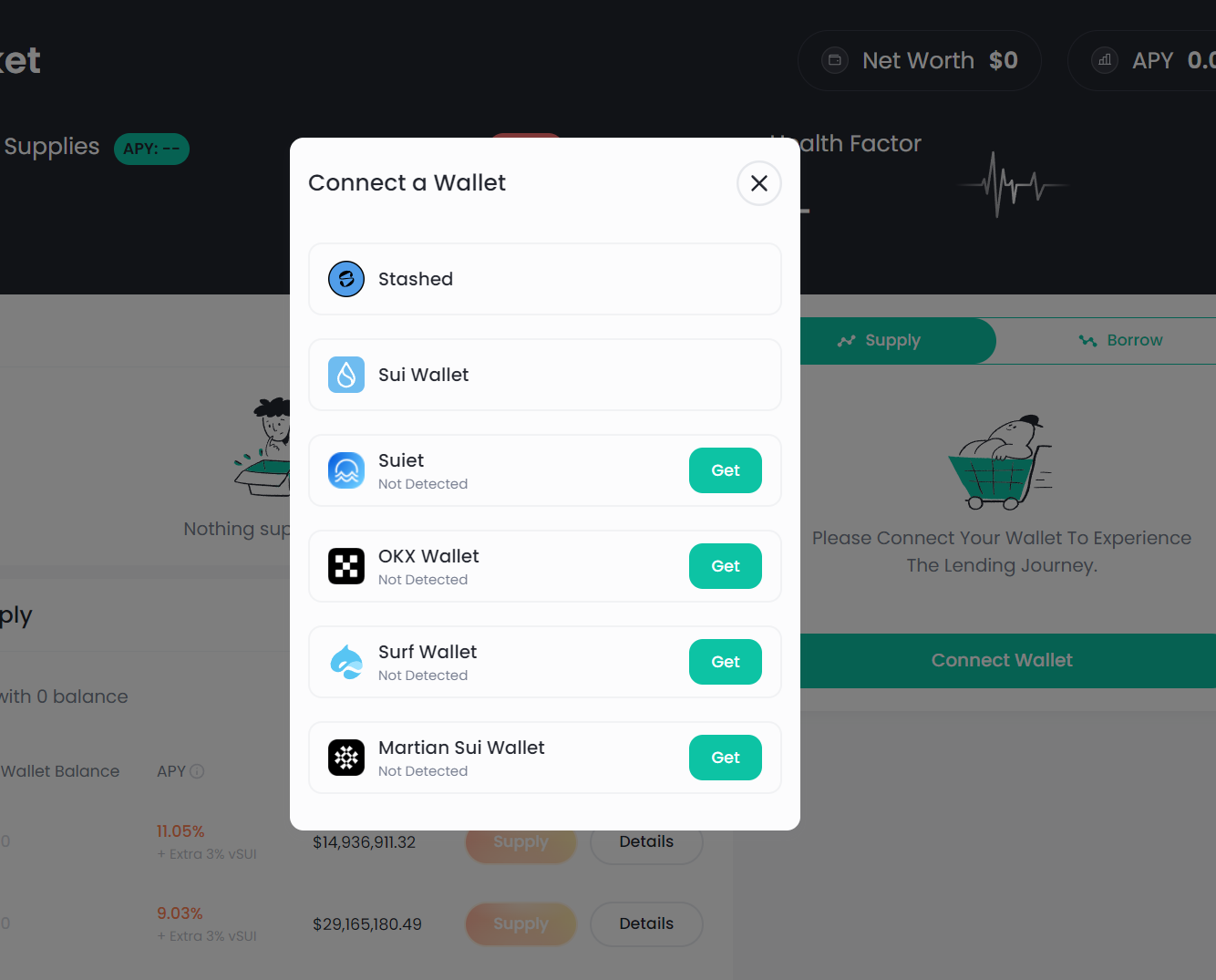

Connect Wallet

- Visit https://app.naviprotocol.io/ to access our app.

- To interact with NAVI, you need an SUI-compatible wallet.

- Click the “Connect Wallet” button at the top right corner of the screen and select your preferred wallet.

Deposit/Supply

- First, go to the dashboard page where you can supply assets and earn yield.

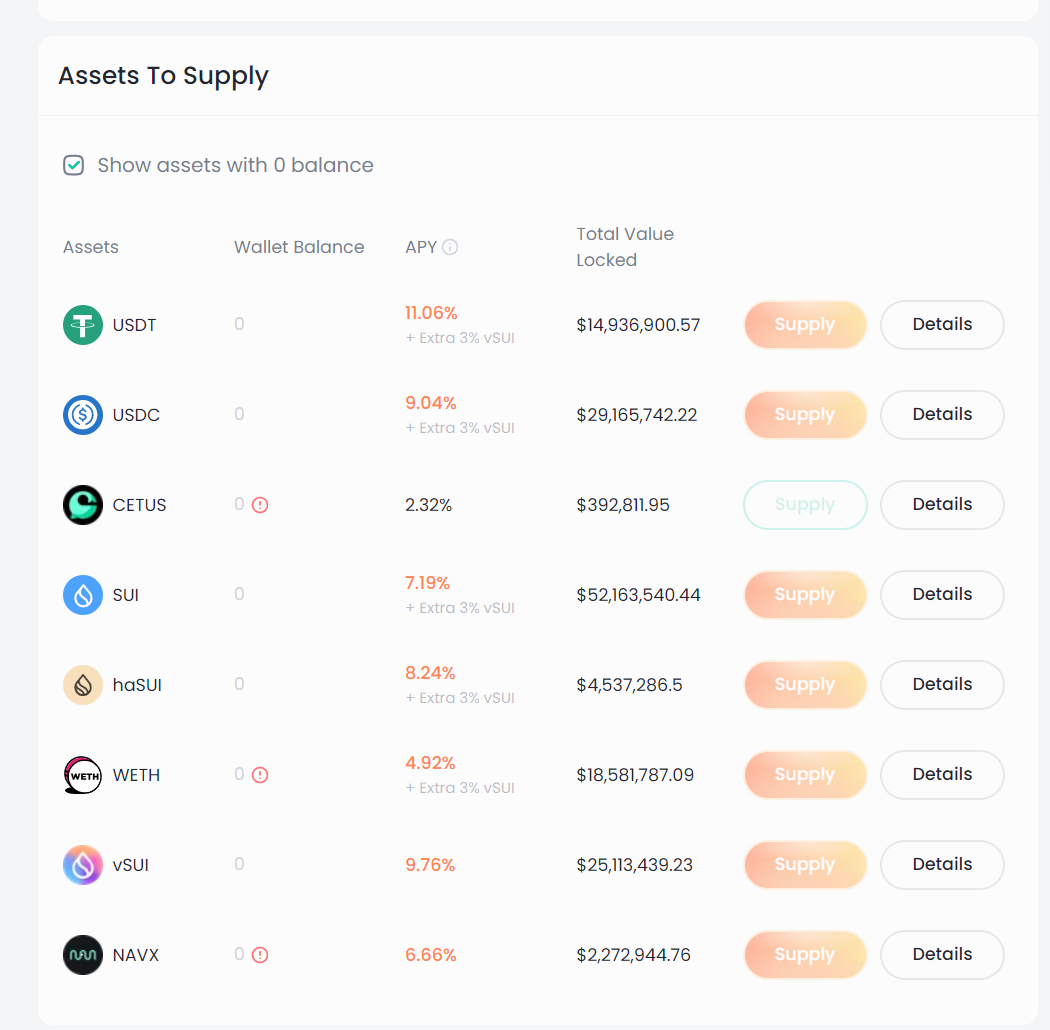

- In the “Assets To Supply” list on the left side of the page, you can view the available lending markets.

Once your wallet is connected, you can proceed to the next step. Click the “Supply” button for the asset you own, and you will be able to deposit your assets in the navigation window on the right. Click the “Details” button to view the asset information page.

Choose the asset you want to provide as collateral.

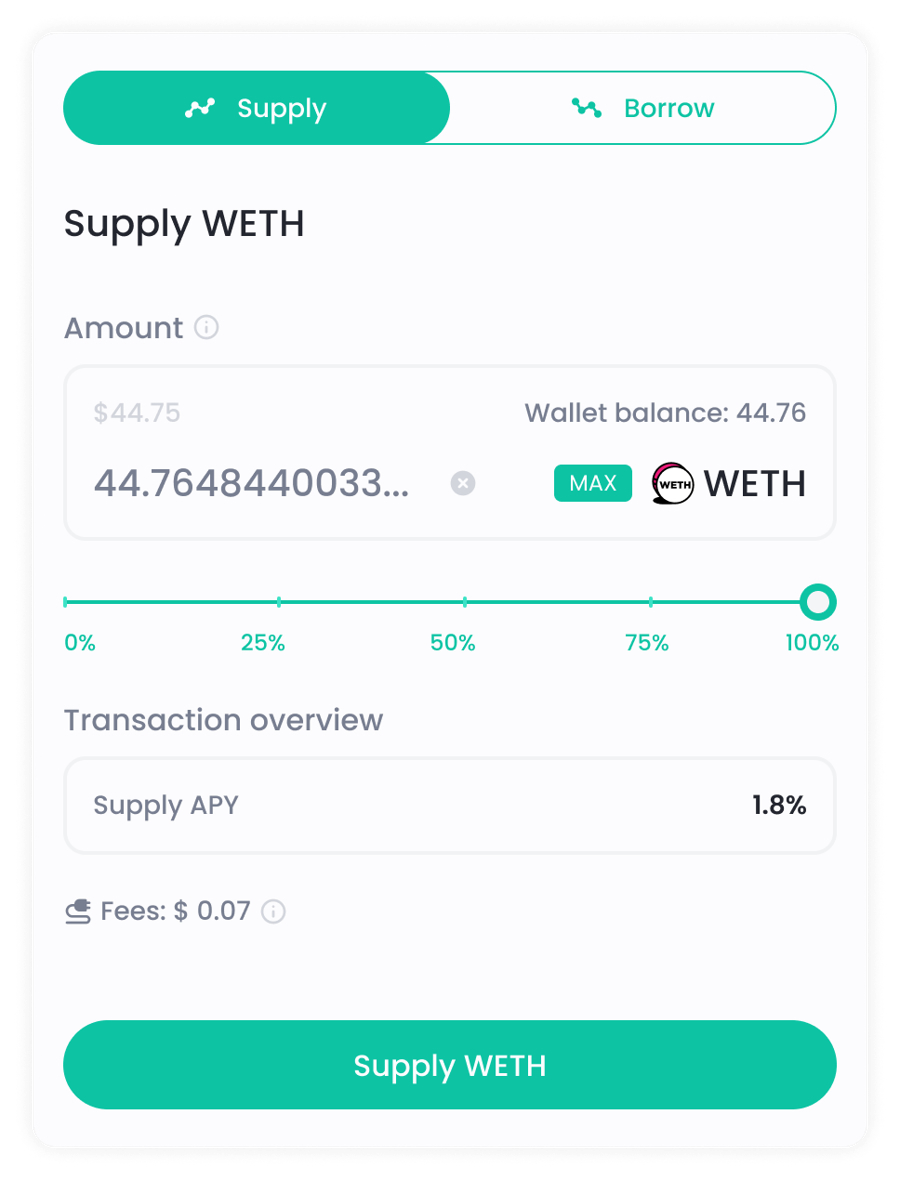

Enter the amount you want to deposit using manual input, the maximum value, or the slider.

Check the APY, Gas Fee, and Health Factor, then click confirm to supply.

Once the transaction is confirmed, your supply is successfully registered, and you will start earning interest.

2. Borrowing

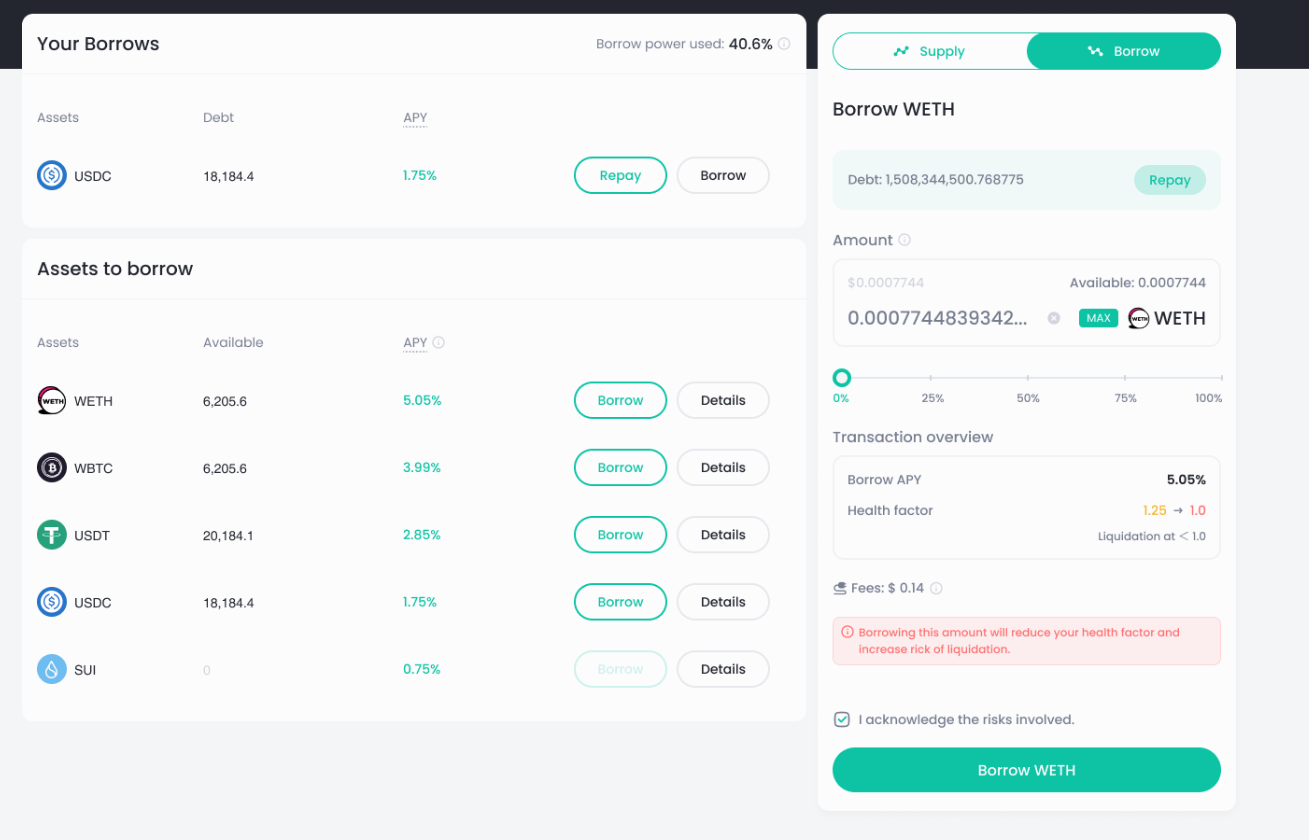

One of the key features offered by NAVI is over-collateralized borrowing. This means you can provide one type of asset as collateral and borrow another type of asset.

Before borrowing, ensure you have deposited assets as collateral. The maximum amount a user is eligible to borrow depends on the deposit value, asset type, and the available liquidity of the asset.

After depositing assets as collateral, select the asset you want to borrow from the dashboard page.

Click “Borrow” at the bottom of the panel, then enter the borrowing amount using manual input, the maximum value, or the slider.

Click “Confirm” and approve the transaction on the popup wallet. Note that the transaction will complete once approved in the wallet. Unlike most EVM wallets, Sui wallets do not have a two-step (approve and proceed) process.

>>> More to read : Scallop: The Future of DeFi on Sui

KEY FEATURES OF NAVI PROTOCOL

1. Lending and Borrowing

Before borrowing, users need to deposit collateral. The maximum borrowing amount depends on the value of the deposited assets and the liquidity of the collateral.

Once users deposit their assets, they start earning interest on the lent assets. Interest is accrued and paid periodically and can be withdrawn at any time along with any earnings.

If you wish to borrow assets, you can do so through collateralization. Users can repay the loan at any time to release their collateral, with interest charged based on the borrowed amount.

Additionally, NAVI provides asset risk management tools, including debt ceilings, supply caps, and borrowing limits.

2. NAVI’s Health Factor

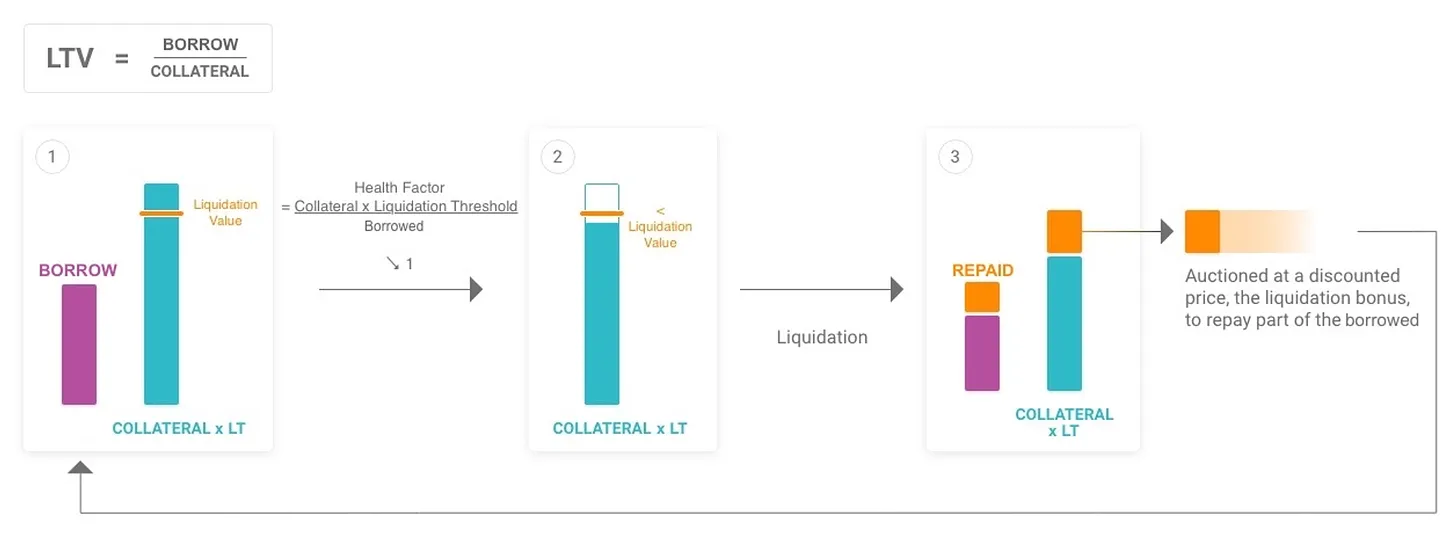

To enhance user experience, NAVI has designed the health factor, allowing users to intuitively understand if they are approaching liquidation, eliminating the need to manually calculate their current loan status.

The health factor is closely related to the value of the collateral user provides. When the health factor rises, it means user’s borrowing situation has become more stable, and the risk of liquidation decreases.

Conversely, if the value of user’s collateralized assets falls relative to the value of borrowed assets, the health factor will decrease. A decrease in the health factor leads to an increase in the risk of liquidation. In simple terms, changes in the health factor reflect the stability of user’s borrowing status and directly affect the possibility of liquidation.

Additionally, NAVI Protocol employs various oracles such as Supra and Pyth, and price sources from CEX exchanges like Binance, OKX, Bybit, and Coinbase. This ensures the security, reliability, and scalability of user support for all assets.

3. Supported Assets

- Blue-Chip Assets

The platform supports lending and borrowing of the following assets:

- USD Coin bridged from Ethereum mainnet through Wormhole (USDCet)

- Tether USD bridged from Ethereum mainnet through Wormhole (USDTeth)

- Sui Token (SUI)

- Wrapped Ethereum (wETH)

- Cetus Token

- voloSUI (LST Token)

- haSUI (LST Token)

- Yield-Bearing Tokens

NAVI supports users in collateralizing yield tokens (liquid staked derivative tokens, such as mSUI, stETH and LP tokens) for capital use in the DeFi ecosystem.

- Long-Tail Assets

In economic terms, the “long tail” refers to products with lower demand or sales but high market share and low sales costs, offering long-term profitability for businesses or organizations. Traditional markets like AAVE and Compound find listing exotic and long-tail assets challenging. If a long-tail asset pool is attacked or incurs bad debts, NAVI uses an isolation mode strategy to mitigate risks and prevent impacts on the entire project.

- NAVI Acquires Liquidity Staking Solution Volo

In January 2024, NAVI acquired the Volo protocol, making it a sub-brand of NAVI. Volo offers liquidity staking services on Sui, helping users convert $SUI into the LSD token $vSUI. By combining NAVI’s lending features with Volo’s LSD capabilities, it has become the largest one-stop liquidity protocol on Sui in terms of TVL (NAVI + Volo).

4. Flash Loans

NAVI also offers flash loans, enabling users to borrow assets without collateral in a single transaction.

- Flashloan

This flash loan type enables users to borrow liquidity from the pools mentioned above. Both the borrowed funds and the debt receipt are sent to the address initiating the transaction.

- Flashloan with AccountCap

This flash loan type also allows users to borrow liquidity from the aforementioned pools. However, the borrowed funds are sent to the account cap address, while the debt receipt is sent to the address that started the transaction. The initiator must destroy the receipt by the end of the block to complete the transaction.

>>> More to read : Sui Ecosystem in 2024: Stunning Evolution, Rapid Growth, and Upcoming Projects Unveiled

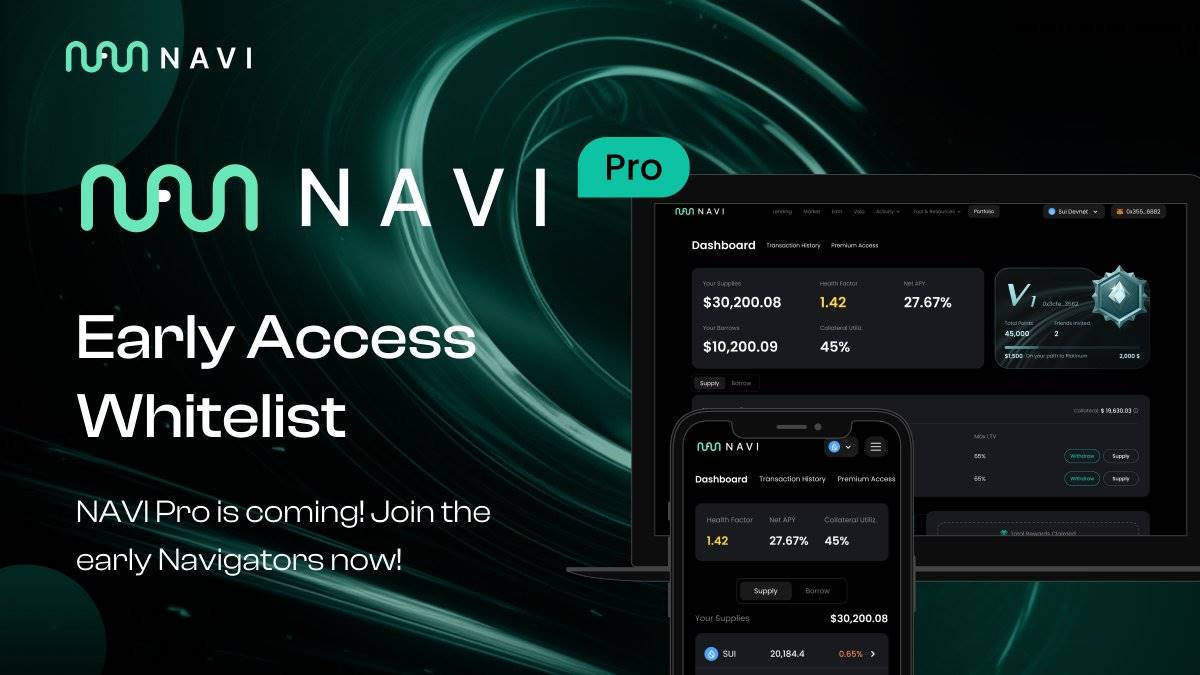

NAVI PRO LAUNCHED WITH STRONGER FUNCTIONS

In July 2024, NAVI Protocol unveiled NAVI Pro, an upgraded version aimed at delivering a superior experience to its users.

Key improvements include:

- Refined User Interface (UI)

- Access to Advanced DeFi Strategies

- Optimized Liquidity Management

- Community-Building Tools

- Streamlined Developer Onboarding

With more features on the horizon.

Here are three standout features of NAVI Pro:

1. Liquidation Forecast

This tool provides investors with a visual, comprehensive analysis of account health and liquidation risks. Additionally, it offers a real-time price table for all supported assets, keeping investors informed about market conditions.

2. Revamped NAVI Protocol Website

The redesigned site aims to offer a more engaging experience. Visitors can explore sections highlighting major milestones, partnerships, exchange listings, and media coverage.

The new design also emphasizes support for Sui network builders. It includes a NAVI Developers Onboarding page with resources for hackathons and dev initiatives. The NAVI Ecosystem Fund page details how developers can apply for grants from the 10M NAVX pool to build with NAVI, Volo, NAVX, and vSUI.

3. Enhanced Dashboard

NAVI Pro introduces a more powerful dashboard. Users can easily view their positions’ Supply/Borrow details and directly interact with pools to manage assets. This upgrade significantly improves the overall investment experience.

>> More to read : Sui: 2024 Q1 News, Recent Statistics, and Price Predictions

NAVI PROTOCOL FUTURE

NAVI Protocol is an innovative leader in the DeFi space, distinguished by its simplicity, security, and user-centric design. With the recent launch of NAVI Pro, it brings revolutionary features to make DeFi on Sui more accessible and efficient. The platform now includes a rich UI, advanced DeFi strategies, improved liquidity management, community-building tools, developer guides, and more.

As blockchain and cryptocurrency continue to redefine finance, and with the ongoing development of the Sui ecosystem, NAVI Protocol is poised to play a pivotal role in shaping the decentralized finance landscape in the coming years.

NAVI Protocol Contact

- Company Name: NAVI PROTOCOL LABS INC.

- Contact Person: Ivan Djordjevic

- Email: team@naviprotocol.io

- Website: https://naviprotocol.io/

FAQ

- What is NAVI Protocol ?

NAVI Protocol is a lending protocol built on the Sui Network, allowing users to connect multiple assets. The project’s enhanced security features protect user funds and reduce systemic risks.