KEYTAKEAWAYS

- Real-Time Market Insights – The Order Book provides live updates on buy and sell orders, helping traders understand market trends and liquidity.

- Essential for Price Transparency – It displays bid and ask prices, offering a clear view of supply and demand dynamics in crypto trading.

- Useful for Strategy Development – Traders analyze order book depth to identify potential price movements and optimize their trade execution.

CONTENT

The Order Book is a real-time list of buy and sell orders in crypto trading. It helps traders assess market depth, liquidity, and price trends for better decision-making.

WHAT IS ORDER BOOK?

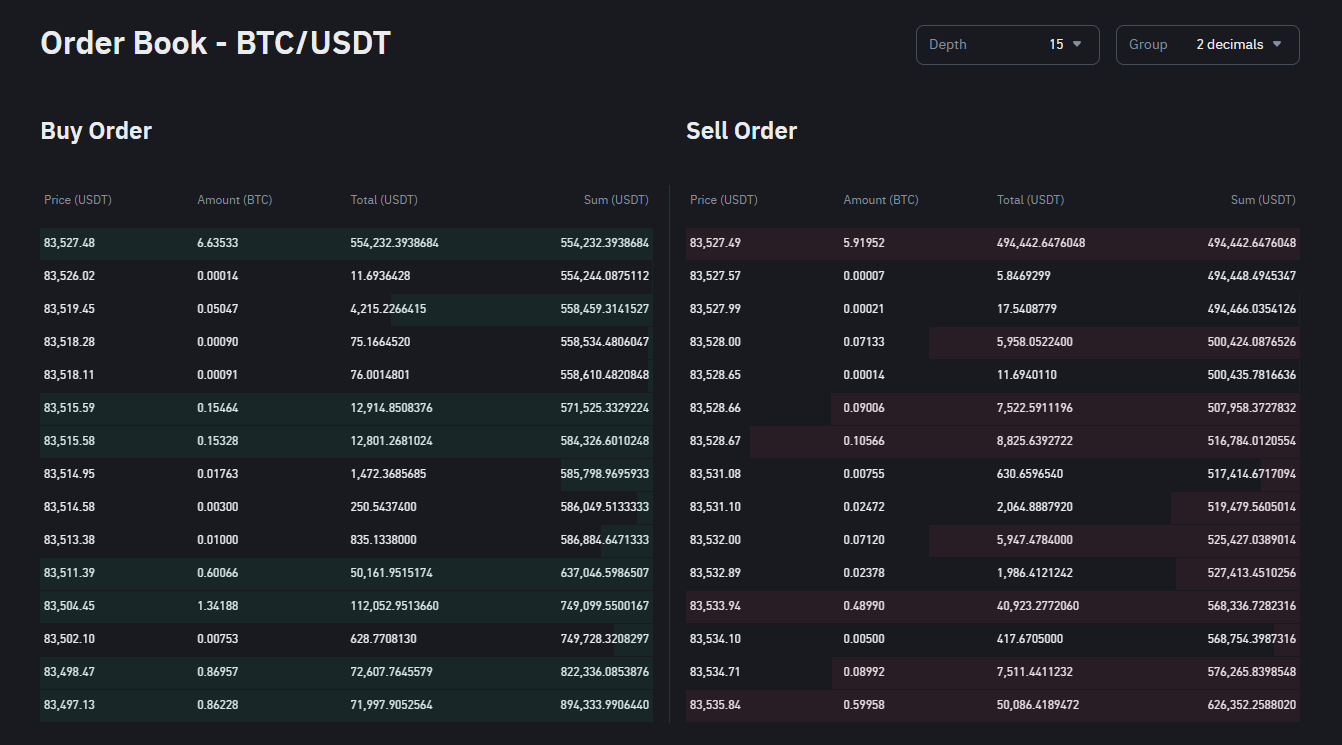

In crypto trading, an Order Book is a real-time, price-sorted list that records all buy and sell orders in the market. Most centralized exchanges (CEXs) operate using this mechanism, where Makers place limit orders at different price levels, which are then logged in the Order Book, while Takers execute trades by matching these orders.

(Source: binance.com)

The Order Book serves as a live snapshot of the supply and demand for a specific asset, such as stocks, commodities, or cryptocurrencies. It displays the bid prices (the highest prices buyers are willing to pay) and ask prices (the lowest prices sellers are willing to accept), providing crucial insights into market depth, price trends, and liquidity conditions.

>>> More to read: Market Order & Limit Order | What’s the Difference?

HOW DOES THE ORDER BOOK WORK?

In high-liquidity markets, the Order Book is constantly updating in real time, reflecting the latest buy and sell orders. When new orders are placed, they are added to the list, and when trades occur, the corresponding orders are removed. Essentially, open orders represent buyers and sellers negotiating prices, while the Order Book serves as a tool to track these ongoing transactions.

If you’re a buyer, your order enters the Order Book based on the highest price you’re willing to pay. If you’re a seller, your order is listed according to the lowest price you’re willing to accept.

📌 Order Book Mechanism

1. Receiving Orders: When a trader places a buy or sell order, the exchange receives and processes it.

2. Recording Order Details: Each order contains key information such as trade direction (buy/sell), quantity, price, and timestamp.

3. Sorting Orders: The Order Book organizes buy and sell orders by price—bids are ranked from highest to lowest, while asks are ranked from lowest to highest. Orders at the same price level are grouped together.

4. Updating the Order Book: As new orders come in, they are inserted at the appropriate price level, ensuring the Order Book remains accurate.

5. Matching Trades: When a buy order and a sell order meet at the same price, a trade is executed.

6. Updating Order Depth: Each time an order is matched or canceled, the Order Book updates its order depth, which reflects the total volume of buy and sell orders at each price level.

7. Real-Time Updates: The Order Book continuously refreshes on the exchange, displaying new orders and completed trades, enabling traders to make informed decisions based on the latest market data.

By understanding how the Order Book functions, traders can gain insights into market liquidity, price action, and potential trading opportunities.

>>> More to read: What is Support & Resistance in Crypto Trading?

THE IMPORTANCE OF THE ORDER BOOK

✅ Price Transparency: The Order Book provides real-time visibility into buy and sell orders, allowing traders to clearly understand current market price levels. This transparency helps in making informed trading decisions.

✅ Market Depth Assessment: A market with greater depth is generally more attractive because it offers higher liquidity and tighter bid-ask spreads. This reduces slippage, making it easier for traders to execute buy and sell orders efficiently.

✅ Market Monitoring and Analysis: By analyzing changes in the Order Book, traders can assess the balance between buying and selling pressure. This information helps in developing trading strategies and forecasting potential price movements.

Understanding the Order Book is essential for traders who want to navigate market trends effectively, identify liquidity levels, and optimize their execution strategies.

>>> More to read: Crypto Beginner’s Guide | What, Why, Where, When, Who

📌 Conclusion

In simple terms, the Order Book is a powerful tool for understanding market supply and demand. Whether you’re trading stocks, commodities, or cryptocurrencies, knowing how to interpret the Order Book can help you make more informed trading decisions.

However, orders can be placed and removed rapidly. Be aware that buy walls and sell walls are sometimes used to create an illusion of supply and demand. To minimize risk, it’s best to complement your Order Book analysis with other technical indicators and trading tools.

>>> Learn more trading tools:

What is the Average Directional Index(ADX) in Crypto?

What Is RSI, and How Do You Use It in the Crypto Market?

What is Moving Average (MA)? How Does It Work

▶ Buy Crypto at Bitget

ꚰ CoinRank x Bitget – Sign up & Trade!