KEYTAKEAWAYS

- Decentralized Prediction Market – Polymarket enables betting on real-world events with transparent and fair trading using blockchain technology.

- AMM for Liquidity – Automated Market Maker (AMM) ensures smooth trading without needing a counterparty, making transactions instant and efficient.

- UMA for Dispute Resolution – The Optimistic Oracle model determines event outcomes, but large token holders may influence results, posing governance risks.

CONTENT

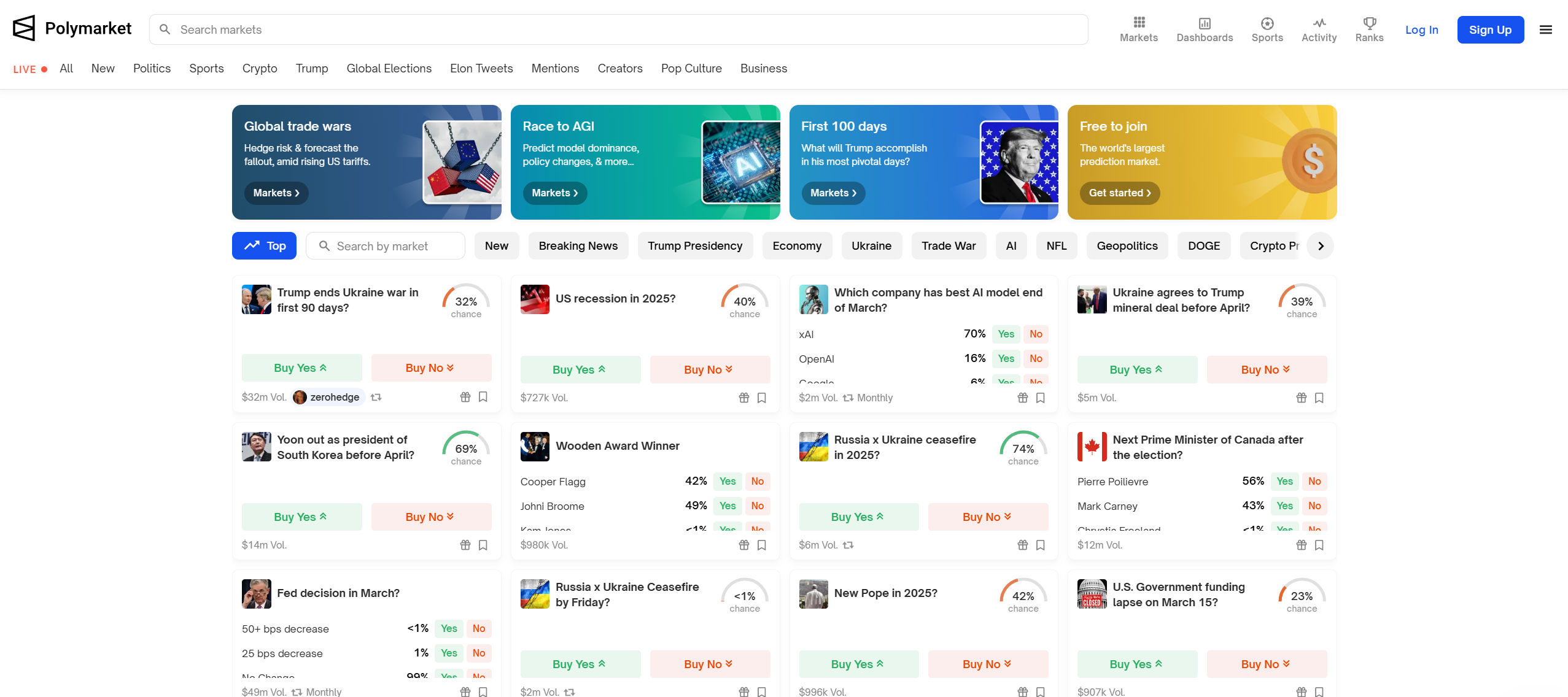

Polymarket is a decentralized prediction market on Polygon, using USDC for transparent, trustless event betting. Powered by AMM for liquidity and UMA for dispute resolution.

WHAT IS POLYMARKET?

Polymarket is a decentralized prediction market built on the Polygon blockchain, allowing users to bet on various real-world events using cryptocurrencies, such as the USD-pegged stablecoin USDC.

Unlike traditional betting platforms, Polymarket operates through a “prediction shares” mechanism, where market participants buy and sell shares based on their expectations of an event’s outcome. Leveraging blockchain technology, the platform ensures transparent, trustless, and fair trading. By utilizing USDC as the primary currency, Polymarket minimizes volatility risks and ensures financial stability for its users.

➤ Official Website: https://polymarket.com/

📌 What is a Prediction Market?

Prediction markets have existed in some form since the 16th century. At their core, these markets allow participants to wager on the outcome of future events—provided that a market for the event exists.

On Polymarket, users can bet on a wide range of topics, including:

- Political elections (e.g., Will a certain candidate win?)

- Financial markets (e.g., Will Bitcoin surpass a specific price?)

- Sports events (e.g., Will a particular team win the championship?)

- Trending topics (e.g., Will a movie win an Academy Award?)

The concept is straightforward: If your prediction is correct, you make a profit; if it’s wrong, you lose your staked amount. Since prices fluctuate based on supply and demand, prediction markets also serve as a form of “collective intelligence,” reflecting the aggregated beliefs of market participants about the probability of an event occurring.

📌 What Makes Polymarket Unique?

✅ Decentralized Operation – Transactions are fully transparent and trustless, eliminating the need for intermediaries.

✅ Stablecoin Transactions – Uses USDC for trading, reducing exposure to cryptocurrency price volatility.

✅ Smart Contracts – Automates transactions and enforces fairness without the need for a centralized authority.

✅ Low Trading Costs – Fees are relatively low, mainly covering network costs and incentivizing liquidity providers.

>>> More to read: Crypto Beginner’s Guide | What, Why, Where, When, Who

HOW DOES POLYMARKET WORK?

Polymarket operates using an Automated Market Maker (AMM) model and the Universal Market Access (UMA) oracle mechanism, enabling seamless market liquidity and decentralized dispute resolution.

📌 Automated Market Maker (AMM) – Ensuring Liquidity

Unlike traditional betting platforms that require finding a counterparty to match bets, Polymarket utilizes an AMM system to provide liquidity automatically. This means users don’t need to wait for someone to take the opposite side of their bet—trading occurs instantly based on algorithmically determined prices.

Anyone can create a prediction market on Polymarket, and once the market concludes, the outcome must be verified. Here’s where the UMA oracle comes into play.

📌 UMA (Universal Market Access) – Decentralized Oracle

UMA acts as a decentralized oracle to determine the official outcome of events. Instead of a centralized authority deciding the results, Polymarket adopts an “Optimistic Oracle” model, assuming that most participants act in good faith.

How UMA Works on Polymarket:

- Initial Outcome Submission – Once a prediction market ends, any user can submit the result.

- Challenge Period – If someone disagrees with the submitted outcome, they can stake a deposit to challenge it.

- Dispute Resolution Committee – If multiple users challenge the outcome, the dispute is escalated to UMA’s Dispute Resolution System, where $UMA token holders vote to determine the final outcome.

Voting follows a majority-rule principle—those who vote in alignment with the majority are rewarded, while dissenters are penalized. In essence, money talks: those with more $UMA tokens hold more influence over dispute resolutions.

📌 Potential Risks of the Optimistic Oracle Model

While the Optimistic Oracle approach assumes that the majority will act honestly, it is not without risks. In extreme cases, a whale with substantial $UMA holdings could manipulate the system by controlling the voting outcome. This creates a potential vulnerability where well-funded entities could distort results in their favor.

By integrating AMM for liquidity and UMA as a dispute resolution oracle, Polymarket ensures a smooth and decentralized prediction market experience. However, while the platform minimizes trust dependencies, users should remain aware of the Optimistic Oracle’s inherent risks and the influence of large token holders in governance decisions.

>>> More to read: What is AMM & How Does It Work?

POLYMARKET CONCLUSION

Polymarket brings prediction markets into the Web3 era by combining blockchain technology with a transparent, fair, and decentralized trading system. With USDC as the primary currency, smart contract automation, and low transaction fees, users can engage in real-world event predictions while benefiting from a secure and efficient market structure. Whether you’re interested in politics, finance, or entertainment trends, Polymarket is a powerful platform for tapping into market sentiment and making informed predictions.

By integrating AMM for liquidity and UMA as a dispute resolution oracle, Polymarket ensures a smooth and decentralized prediction market experience. However, while the platform minimizes trust dependencies, users should remain aware of the Optimistic Oracle’s inherent risks and the influence of large token holders in governance decisions.

▶ Buy Crypto at Bitget

ꚰ CoinRank x Bitget – Sign up & Trade!