KEYTAKEAWAYS

- Bitcoin's June peak at $71k quickly reversed due to heavy selling by miners and ETF outflows.

- Ethereum's performance dipped 13%, influenced by market speculation and the ZKsync airdrop fallout.

- Key July events: Potential Ethereum ETFs, U.S. inflation data, and presidential campaign impacts on crypto regulations.

CONTENT

June 2024: Bitcoin peaked at $71k, followed by significant sell-offs amid inflation concerns and Federal Reserve’s hawkish stance.

The cryptocurrency market experienced significant volatility in June, characterized by initial strength followed by substantial sell-offs and liquidation events. Despite a strong start to the month with Bitcoin reaching over $70,000, the market encountered major headwinds mid-month, leading to widespread declines across most digital assets.

>>> Read more:

BITCOIN PERFORMANCE

Bitcoin’s performance in June was marked by notable fluctuations, ultimately closing lower by month-end. The leading cryptocurrency started the month with momentum hitting $71k. However, it failed to break through this critical resistance level, triggering a series of events that led to a market retreat.

Key Developments for Bitcoin in June

1. Large-scale selling by miners and early holders as prices neared $70,000. Over 3,200 BTC were sold in one day, representing one of the largest daily volumes since March.

(source: TradingView)

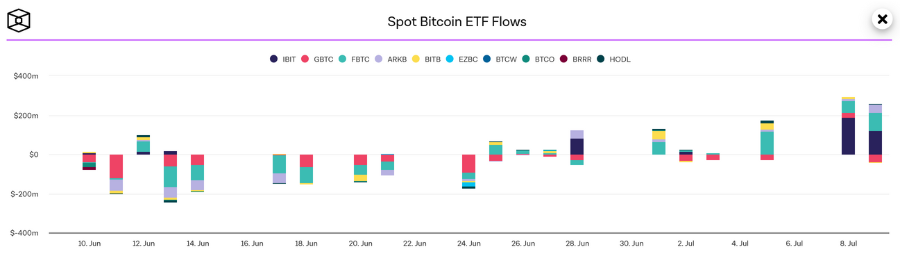

2. Significant outflows from Bitcoin ETFs, particularly towards the end of the month. Over eight trading days, these funds saw net outflows of approximately $1 billion, a stark contrast to the strong inflows observed earlier in the year.

(source: The Block)

>>> Read more: Bitcoin ETF Investors Capitalize on Market Dip: Daily Inflows Surge to $295M

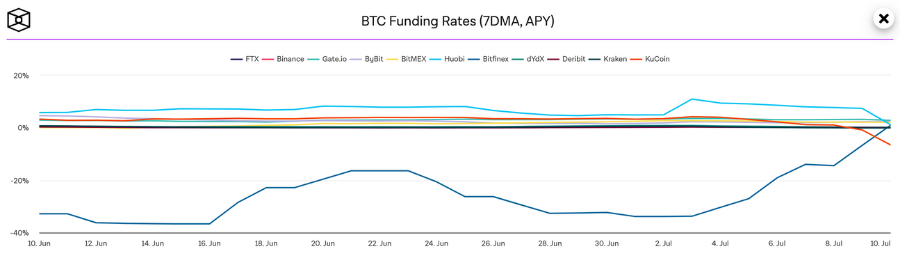

3. A decline in the Bitcoin futures funding rate, dropping from an average of +16% annualized in 2024 to 8-9% by the end of June. This decrease potentially signaled a reduction in bullish sentiment among traders.

(source: The Block)

>>> Read more: Crypto Futures Trading: A Way to Multiply Your Crypto Returns

ETHEREUM AND ALTCOIN PERFORMANCE

Ethereum underperformed in June, declining by approximately 13% from its 2024 highs. Despite positive news regarding potential SEC approval of Ethereum ETFs, the second-largest cryptocurrency struggled to maintain its momentum.

The market witnessed:

1. Increased speculation in the crypto futures market, with traders adding $4.4 billion in Bitcoin and Ethereum positions combined over just three weeks.

2. A sharp decline following the highly anticipated ZKsync airdrop, which fell 38% immediately after launch, sending shockwaves through the crypto markets.

3. Breaking of critical support levels, potentially signaling further downside risk.

The broader altcoin market experienced even more severe declines.

1. An average drawdown of 50% from 2024 highs among major altcoins.

2. Solana (SOL), a previous market leader, experienced a sharp decline during the month, breaking critical support levels.

3. Many memecoins and smaller altcoins saw double-digit percentage losses, underperforming the broader market.

>>> Read more:

Key Factors Influencing the Market in June

Several critical factors contributed to the market’s performance in June:

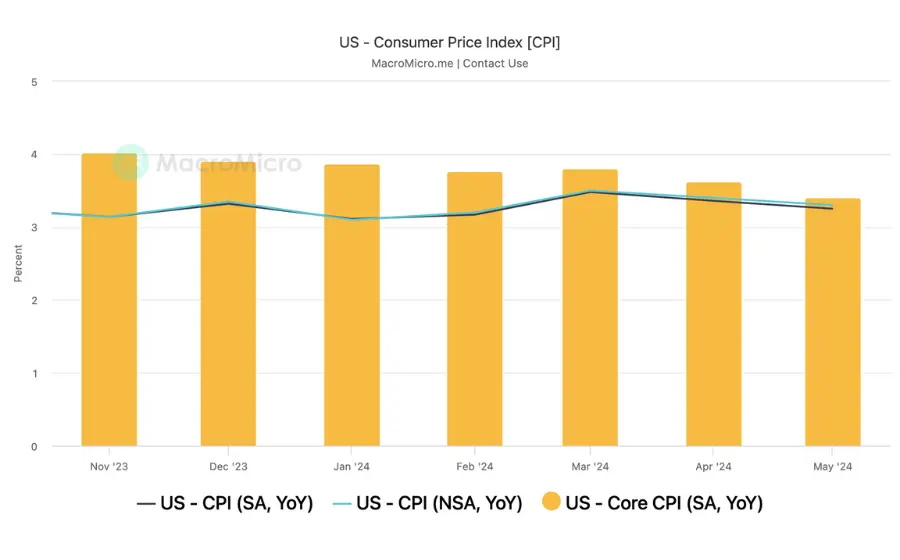

1. Inflation Data and Federal Reserve Policy: The US Consumer Price Index (CPI) came in at 3.3% in May, slightly lower than previous months. However, the Federal Reserve maintained a hawkish stance, dampening hopes for imminent interest rate cuts.

(source: MacroMicro)

>>> Read more:

- H1 2024 Review and Outlook: Us Economy, Inflation, Fed Policy

-

Fed’s Dilemma: Job Market Trends and Economic Outlook for 2024

2. Token Unlocks: A series of major token unlocks totaling $483 million occurred in June, including releases from projects like Aptos, IMX, STRK, SEI, ARB, APE, and UNI. This influx of supply put significant selling pressure on the market.

3. Declining Crypto Liquidity: Stablecoin minting slowed dramatically after the Bitcoin halving in April, reducing overall market liquidity. This decrease in fresh capital entering the ecosystem limited buying pressure.

>>> Read more:

4. Futures Market Dynamics: The decline in Bitcoin’s funding rate and the excessive positioning in Ethereum futures contributed to market instability and increased liquidation risks.

WHAT TO WATCH IN JULY

As we move into July, several important events and factors could shape the crypto market’s direction:

1. Ethereum ETF Developments: Approval of Ethereum ETFs appears imminent, with expectations for approval by early July. This could significantly impact both Ethereum and the broader market, though the market’s reaction may be unpredictable.

2. Inflation and Federal Reserve Policy: Continued monitoring of inflation data and any shifts in Federal Reserve rhetoric will be crucial. The market will be particularly sensitive to any hints of potential interest rate cuts, although the Fed might not cut rates this year due to sticky inflation.

3. Options Expiry Impact: The expiration of $10 billion worth of Bitcoin and Ethereum options on June 28 could lead to increased volatility and potentially set new trading ranges for major cryptocurrencies.

4. US Presidential Race: The ongoing presidential campaign, including any debates, could influence crypto sentiment. The market is watching how different candidates’ stances might affect future crypto regulations.

>>> Read more: 2024 U.S. Presidential Election Series

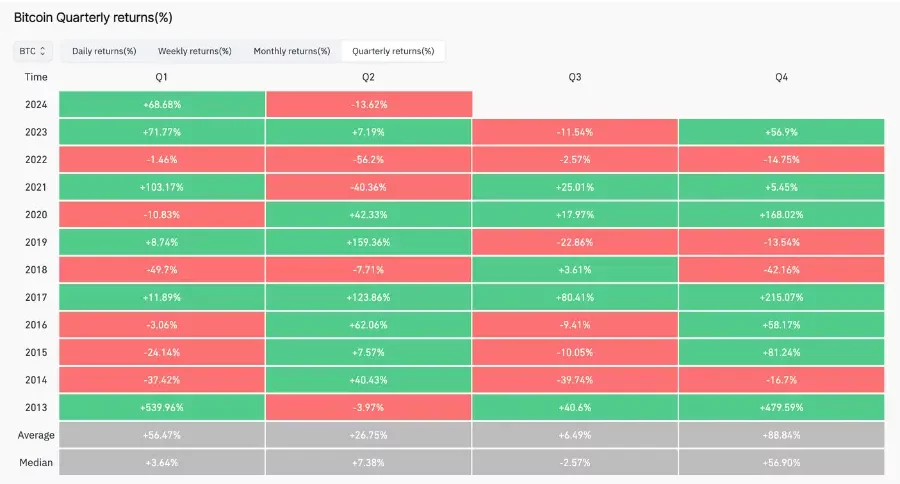

5. Seasonal Trends: Historically, Q3 (July, August, September) has been the weakest quarter for Bitcoin, with average returns of just 6% over the past 10 years. This seasonal weakness could exert additional pressure on prices.

(source: CoinGlass)

6. Miner Behavior: Continued monitoring of miner selling activity will be important, especially if Bitcoin prices approach or fall below $60,000, which is close to the average miner’s breakeven cost after the halving.

7. Market Structure and Liquidity: The crypto market will be watching for signs of improved liquidity, including potential increases in ETF inflows, stablecoin minting, or futures leverage, which could support price growth.

THE NEXT CHAPTER

The crypto market enters July with increased caution, as several technical and fundamental factors point to potential further downside. Traders and investors should stay informed about: (1) The convergence of macro economic factors, (2) regulatory developments, and (3) crypto-specific dynamics. In the meantime, keep calm and carry on.

>>> Read more:

▶ Buy Bitcoin and Ethereum at Binance

Enjoy up to 20% off on trading fees! Sign up Now!

Looking for the latest scoop and cool insights from CoinRank? Hit up our Twitter and stay in the loop with all our fresh stories!