KEYTAKEAWAYS

-

Bitcoin and Ethereum Events: The approval of a Bitcoin spot ETF and discussions on an Ethereum spot ETF, along with Bitcoin's halving and Ethereum's Dencun 2.0 upgrade, are pivotal moments for 2024.

-

AI Tokens Rise: Rapid innovation at the AI and blockchain intersection is driving significant interest in AI tokens, enhancing blockchain functionality and broadening application scopes.

-

DePIN Revolution: Decentralized Physical Infrastructure Networks (DePIN) are merging digital and physical realms, offering scalable solutions for infrastructure needs and challenging traditional monopolies.

- KEY TAKEAWAYS

- CRYPTO MARKET: WHAT DID WE SEE AND EXPECT FROM 2024 Q1?

- 1 OVERVIEW OF AI TOKENS AND THEIR SIGNIFICANCE

- 1.1 TOP AI TOKEN PROJECTS

- 1.2 THE FUTURE OF AI TOKENS

- 2 OVERVIEW OF FLASH PROTOCOL AND ITS SIGNIFICANCE

- 2.1 FLASH PROTOCOL’S TECHNOLOGICAL INNOVATIONS

- 2.2 THE FUTURE OF FLASH PROTOCOL

- 3 OVERVIEW OF DEPIN AND ITS SIGNIFICANCE

- 3.1 TOP DEPIN PROJECTS

- 3.2 THE FUTURE OF DEPIN

- DISCLAIMER

- WRITER’S INTRO

CONTENT

CRYPTO MARKET: WHAT DID WE SEE AND EXPECT FROM 2024 Q1?

2024 undoubtedly marks another year filled with surprises and challenges for the blockchain and cryptocurrency market. Just in January, we have already witnessed the approval of a Bitcoin spot ETF in the United States, while discussions around a potential Ethereum spot ETF are buzzing.

Also, the eagerly anticipated Bitcoin halving coming in April and the Ethereum Dencun 2.0 upgrade happening this month are significant events that will likely impact both the practical benefits of blockchain and investment.

In our analysis of the cryptocurrency market for Q1 2024, we delve into three main themes: market trends, blockchain projects worth paying attention to, and changes in cryptocurrency market regulations. These topics aim to provide readers with the most comprehensive and timely understanding of the market in the shortest possible time.

Let’s also look forward to witnessing more groundbreaking developments and applications in the blockchain space following Q1 of 2024.

First, let’s dive into the upcoming/potential projects in the crypto market.

1 OVERVIEW OF AI TOKENS AND THEIR SIGNIFICANCE

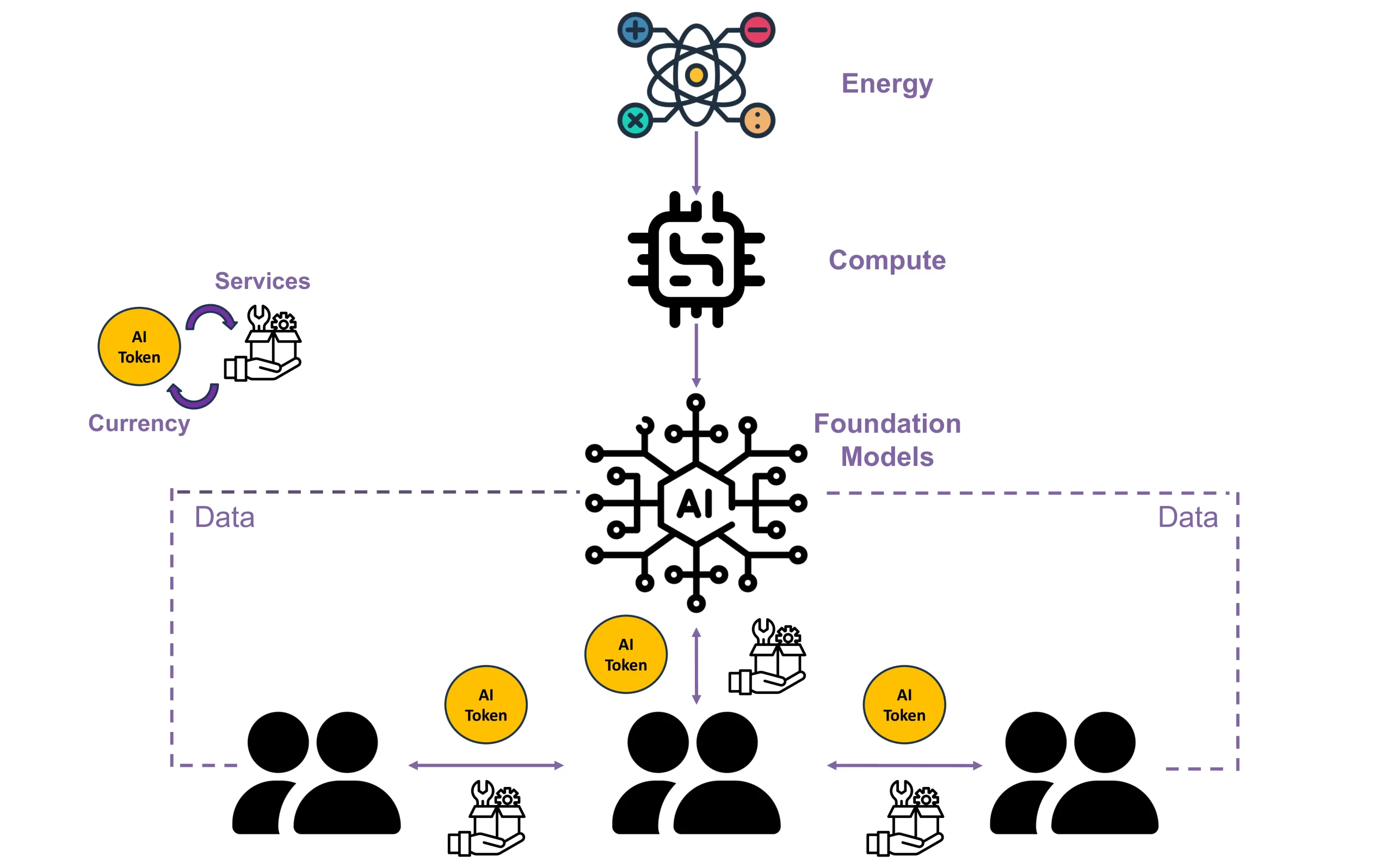

The current AI (artificial intelligence) market, particularly at the convergence of AI and blockchain technology, is marked by rapid innovation and interest in AI tokens. These tokens are redefining the possibilities within both fields by offering decentralized solutions and leveraging AI for blockchain operations, enhancing security, efficiency, and automation. The interest in AI tokens has surged, reflecting a wider trend in the tech industry towards integrating these advanced technologies to create more intelligent, autonomous, and trustless systems.

Definition and Importance

AI tokens are digital assets incorporating artificial intelligence algorithms within a blockchain framework, operating on decentralized networks. This infrastructure ensures secure and transparent transactions, devoid of intermediaries, and propels the development of AI-powered applications across industries.

AI Token Creation Process

- Token Development: Begins with crafting AI-powered tokens using blockchain protocols and smart contracts.

- Initial Offering: Launch through ICOs (Initial Coin Offering), introducing tokens to the market for initial funding.

- Market Participation: Post-issue, tokens are tradable on exchanges, with their value influenced by market dynamics.

- Application Integration: Utilized across various AI services and platforms, fostering a broad adoption spectrum.

Benefits of AI Tokens

- Access to AI Services: Users can leverage AI tokens to tap into a variety of AI-driven services, such as natural language understanding, machine learning, data analysis, and more.

- Involvement in AI Governance: By holding AI tokens, users gain the ability to contribute to the decision-making processes of AI projects. This includes having a say in the development and future direction of AI technologies by staking their tokens.

- Quick and Safe Transactions: AI tokens facilitate fast and secure transactions within the AI space. This allows for easy and efficient token transfers internationally, eliminating the need for intermediaries.

- Digital Currency Benefits: AI tokens also serve as a digital currency, offering an alternative payment option and acting as a store of value.

Use Cases of AI Tokens

- AI in Financial Trading: AI tokens support the creation of advanced algorithms for financial trading, enabling quick and precise analysis of vast financial data to make informed trades based on market trends.

- Data Analysis and Forecasting: These tokens power algorithms that sift through large datasets for predictive analytics, crucial in sectors like e-commerce, insurance, and healthcare for strategic decision-making.

- Intelligent Chatbots: AI tokens help develop smart chatbots that use machine learning and natural language processing to understand and respond to user queries, improving customer service and operational efficiency.

- Autonomous Vehicle Development: They play a role in developing self-driving cars, utilizing AI for real-time navigation decisions, object recognition, and obstacle detection.

- Cybersecurity Enhancement: AI tokens enhance cybersecurity by employing AI algorithms to monitor network traffic, identify suspicious activities, and prevent threats, ensuring advanced protection for digital assets.

1.1 TOP AI TOKEN PROJECTS

-

NEAR Protocol (NEAR)

A scalable blockchain designed to support decentralized applications with ease, emphasizing user accessibility and developer friendliness.

-

Bittensor (TAO)

Decentralizes AI development by incentivizing the sharing and monetization of machine learning models across a blockchain network.

-

Render (RNDR)

Connects creators needing GPU power for rendering with GPU owners, facilitating cost-effective and decentralized 3D rendering.

-

The Graph (GRT)

Enables serverless applications by indexing and querying blockchain data in a decentralized manner, simplifying access to blockchain information.

-

Theta Network (THETA)

Decentralizes video streaming and data delivery by allowing users to share excess bandwidth and resources, enhancing video quality and reducing costs.

1.2 THE FUTURE OF AI TOKENS

AI tokens are poised for growth with continuous technological advancements in AI and blockchain. Their integration into blockchain ecosystems promises innovation across decentralized finance, digital identity, and healthcare, among others. The evolution of regulatory standards, interoperability, scalability, and emerging use cases will be crucial in defining the trajectory of AI tokens.

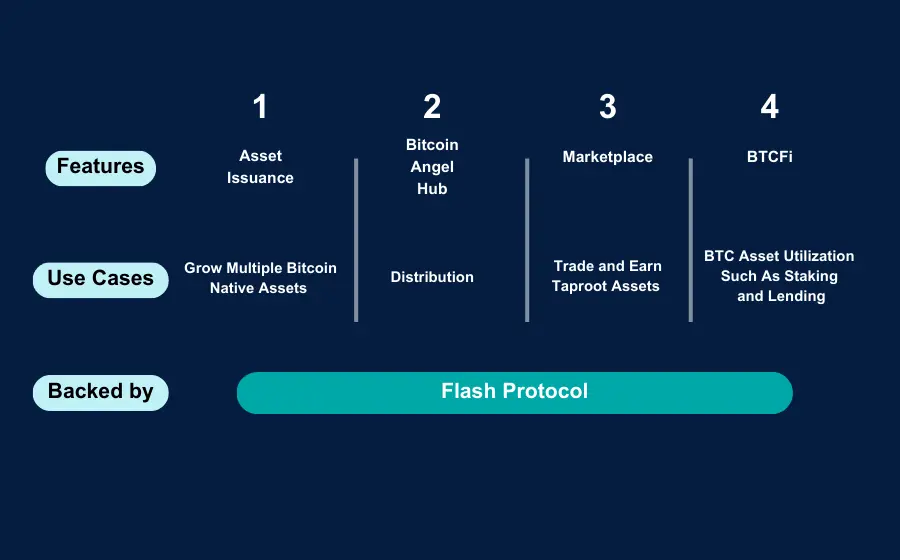

The Flash Protocol emerges as a pioneering asset minting, circulation, and trading framework within the Bitcoin ecosystem. It is designed to enhance the Bitcoin infrastructure by enabling efficient, secure, and versatile financial operations. By leveraging the robustness of Bitcoin’s foundational technology, Flash Protocol introduces a new dimension of asset management and innovation, promising to unlock unprecedented opportunities for users and developers alike.

2 OVERVIEW OF FLASH PROTOCOL AND ITS SIGNIFICANCE

Definition and Importance

Flash Protocol materializes as an innovative framework within the Bitcoin ecosystem, aimed at facilitating the creation, distribution, and trading of Bitcoin’s native assets, including Taproot Assets and NFTs. This development marks a significant leap forward by weaving DeFi capabilities into the Bitcoin blockchain, thus elevating its functionality beyond mere currency transactions. By marrying DeFi with Bitcoin’s inherently secure and decentralized infrastructure, Flash Protocol plays a crucial role in broadening Bitcoin’s appeal as more than just a digital currency or store of value. This symbiosis promises to foster greater adoption and enable a wider spectrum of financial applications on the Bitcoin network, highlighting the protocol’s importance in the evolution of digital finance.

2.1 FLASH PROTOCOL’S TECHNOLOGICAL INNOVATIONS

- Asset Minting and Circulation: The protocol allows for the creation and distribution of digital assets, leveraging Bitcoin’s security without compromising on flexibility.

- Smart Contracts: Introduces smart contract functionalities that are executable directly on the Bitcoin blockchain, marking a significant advancement in how Bitcoin can be utilized for complex financial operations.

- Interoperability: Ensures compatibility with other blockchain networks, facilitating a seamless flow of assets across different ecosystems.

The chart below indicates how Flash Protocol stands out from peers:

Recent Developments and Integrations

- User Experience Enhancements: Continuous updates are being implemented to improve the user interface and functionality, making DeFi services more accessible to a broad audience.

- Security Upgrades: Advances in ensuring the safety and reliability of transactions within the protocol, safeguarding users’ assets.

- Expansion of Services: Continues to broaden the scope of DeFi services available on Bitcoin, introducing novel financial instruments and opportunities for users.

Use Cases of Flash Protocol

- Taproot Assets Issuance: The protocol empowers the creation of assets through the innovative FlashScript, tailored for permissionless and cost-effective transactions on the Bitcoin blockchain.

- Bitcoin Angel Hub: The Angel Hub revolutionizes fund raise by bridging Taproot Assets project builders with vast supporters, creating an optimal gitcoin-like crowdfunding market for Bitcoin native assets.

- Bitcoin Native Asset Marketplace: Facilitate Taproot Assets trading through a peer-to-peer marketplace and an orderbook-based DEX, setting the stage for the integration of sophisticated DeFi features such as yield farming and liquidity pools.

- BTCFi Introduction: BTCFi functionalities such as lending and staking are realized on Flash Chain. FlashVM, a computational engine built on Flash Chain is the infrastructure to make BTCFi a reality in the Bitcoin ecosystem.

2.2 THE FUTURE OF FLASH PROTOCOL

As it continues to evolve and refine its offerings, the protocol is expected to further unlock the liquidity of Bitcoin’s native assets, significantly broadening the spectrum of Bitcoin’s application beyond mere asset issuance, circulation, and trading. The integration of advanced DeFi functionalities, coupled with the protocol’s commitment to improving transaction efficiency through the Lightning Network, suggests a trajectory towards a more versatile and inclusive financial ecosystem on Bitcoin. This evolution could catalyze a new era of financial instruments and services, rooted in the security and decentralization that Bitcoin provides.

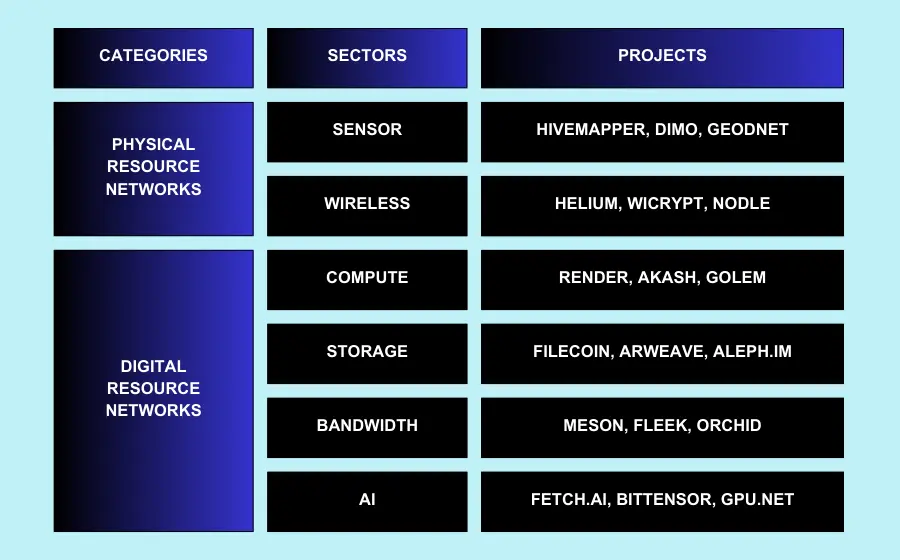

3 OVERVIEW OF DEPIN AND ITS SIGNIFICANCE

The DePIN (Decentralized Physical Infrastructure Networks) concept marks a revolutionary blend of blockchain technology with tangible infrastructure elements. Utilizing advanced technologies like Schnorr signatures and MAST (Merkle Abstract Syntax Trees), this inventive strategy enhances transactional efficiency and confidentiality, and establishes the foundation for a solid Web3 ecosystem. It signifies a novel era in merging the digital and physical realms.

Definition and Importance

DePINs, a transformative model for decentralized peer-to-peer networks, revolutionize infrastructure access by using decentralization to meet hardware needs, offering an open marketplace for services like data storage and wireless connectivity, supported by cryptocurrencies and token incentives. Moving away from centralized control, DePINs make crucial services more accessible, challenging the traditional dominance of large corporations. Their economic model, driven by token-based incentives, not only encourages infrastructure development but also creates a self-sustaining ecosystem. As the value of DePIN tokens rises, it attracts more investors, providers, and users, driving a cycle of growth and broader adoption. This approach democratizes infrastructure access and fosters a vibrant, expanding network.

DePIN projects can be broadly classified into two groups:

- Physical Resource Networks (PRNs): Focus on tangible, non-fungible goods and services in the real world, such as mobility solutions, energy distribution systems, and connectivity infrastructures. Examples include Helium for decentralized wireless networks and Andrena for enabling consumers and SMEs to become micro-Internet service providers.

- Digital Resource Networks (DRNs): Focus on fungible, digital resources like storage capacities, bandwidth allocation, or computing power within digital environments. Prominent projects include Filecoin for decentralized storage and Render Network for decentralized GPU rendering.

Benefits of DePIN

- Enhanced Security: By distributing infrastructure across many nodes, DePINs eliminate single points of failure, improving resilience and security, especially crucial for sectors like finance and healthcare.

- Efficient Resource Use: DePINs enable dynamic and efficient resource allocation, scalable to meet evolving needs without the burden of maintenance or administrative costs.

- Community Empowerment: They promote a community-driven approach, allowing local decision-making to ensure infrastructure meets community needs.

- Open Market Access: DePINs challenge Big Tech monopolies, providing equal opportunities for individuals and smaller entities to access essential resources like GPUs.

- Cost Efficiency: Offering competitive pricing through decentralized markets, DePINs emerge as a cost-effective alternative for infrastructure needs, supported by a robust community of service providers.

Use Cases of DePIN

- Urban Infrastructure: DePINs are pivotal in constructing smart cities by developing sustainable energy grids, enhancing transportation systems, and managing waste and water more efficiently. This is vital for accommodating the growing needs of the global population.

- Remote and Underserved Areas: For regions lacking in traditional infrastructure, DePINs can deploy decentralized energy, water purification, and wireless communication solutions, allowing local communities to establish their own networks and access essential services.

- Supply Chain Management: In the business realm, DePINs contribute to greater transparency, traceability, and operational efficiency, transforming supply chains, especially in critical sectors like food and pharmaceuticals, by leveraging the IoT (Internet of Things).

- Agriculture: Leveraging technology such as sensors and drones, DePINs can collect and analyze data on various environmental factors, empowering farmers with actionable insights for better resource management and crop health.

3.1 TOP DEPIN PROJECTS

-

Filecoin (FIL)

Revolutionizing data storage, Filecoin transforms data storage into a decentralized model, allowing users to become storage providers with FIL token collateral. It promotes a secure, user-to-provider interaction, leveraging FIL tokens for incentives and ensuring a trustless data storage ecosystem.

-

Render (RNDR)

Render utilizes spare GPU power for 3D rendering and computational tasks, compensating contributors with RNDR tokens. The project’s move to Solana underscores its commitment to scalability and efficiency, offering a dynamic marketplace for computational resources.

-

Theta Network (THETA)

Theta Network decentralizes content delivery, encouraging users to share resources for video streaming. It features a dual-token system with THETA for governance and Theta Fuel (TFUEL) for operations, innovating content distribution through a peer-to-peer network.

3.2 THE FUTURE OF DEPIN

The future of DePIN is marked by immense promise, tempered with challenges that need addressing. As these networks continue to evolve, they have the potential to revolutionize the way we manage and interact with real-world infrastructure through blockchain technology. However, hurdles such as token price volatility, user awareness, and the complexity of maintaining a decentralized network at scale loom large. Addressing these issues requires innovative solutions like stablecoin integration to mitigate financial instability, improving user interfaces for greater accessibility, and ensuring robust financial planning for infrastructure upkeep.