KEYTAKEAWAYS

- Bitcoin's 8.7% correction is normal and healthy for bull markets, with historical data showing multiple 15%+ drops during previous halving cycles.

- Based on historical patterns and on-chain indicators, we're still in early bull market stages, with potentially another year of growth ahead.

- Altcoin season could begin around January 2025, with key sectors to watch including L1 blockchains, AI projects, GameFi, and select memecoins.

CONTENT

Analyze Bitcoin’s recent correction from $99,518 to $90,820, understand why early bull market corrections are beneficial, and discover when altcoin season might begin. Plus, learn which cryptocurrencies to watch in 2024 and 2025.

*Ready to explore these opportunities? Trade on Bitget now. Remember: This content is informational only – always trade responsibly.

Over the past two weeks, Bitcoin surged from around $60,000 to reach a high of $99,518 (according to Bitget data), coming within less than 1% of the milestone $100,000 mark. However, yesterday saw a significant correction, with prices dropping as low as $90,820 at the time of writing – a decrease of $8,698 or 8.7%. This pullback also triggered sharp declines in many altcoins that hadn’t seen much prior growth: Ethereum fell from $3,545 to $3,253 (8.2% drop), while other altcoins experienced even steeper drops of 20% or more.

Don’t panic just yet – this type of volatility is quite common. As we discussed in our previous article “Why Won’t Bitcoin Continue to Rise Steadily After a Rate Cut?“, each halving bull market typically experiences numerous sharp corrections.

For example:

- First halving bull market: 25 instances of daily drops exceeding 15%

- Second halving bull market: 17 instances of daily drops exceeding 15%

- Third halving bull market: 8 instances of daily drops exceeding 15%

Experienced investors are well familiar with the dramatic crashes of previous bull markets, like 9/4, 3/12, and 5/19. In fact, these early bull market corrections are actually healthy – each dip presents a buying opportunity. Successful investing often means going against human nature: being greedy when others are fearful and fearful when others are greedy. This approach paves the way to financial freedom.

MARKET ANALYSIS: WHY EARLY CORRECTIONS SIGNAL BULL MARKET STRENGTH

As mentioned above, Bitcoin typically experiences several major corrections during each halving bull market. So how can we determine whether this is a normal correction or the start of a prolonged downturn?

The answer lies in identifying the current market phase. In the early stages of a bull market, corrections serve to shake out weak hands and build a stronger foundation for future gains.

So is this still the early phase of the bull market? We can analyze this from two perspectives:

1. Historical Data Previous halving bull markets lasted:

- First bull market: 1 year (January to December 2013)

- Second bull market: 1 year 4 months (September 2016 to December 2017)

- Third bull market: 1 year 6 months (May 2020 to November 2021)

The crypto market has matured significantly, with more participants entering the space, particularly Wall Street institutions. The recent approval of Bitcoin spot ETFs has added another catalyst for this bull run. Since the fourth halving in April 2024, only 7 months have passed. Even if this cycle matches the duration of the third halving bull market, we still have about a year remaining – suggesting we’re still in the early stages.

2. On-Chain Indicators

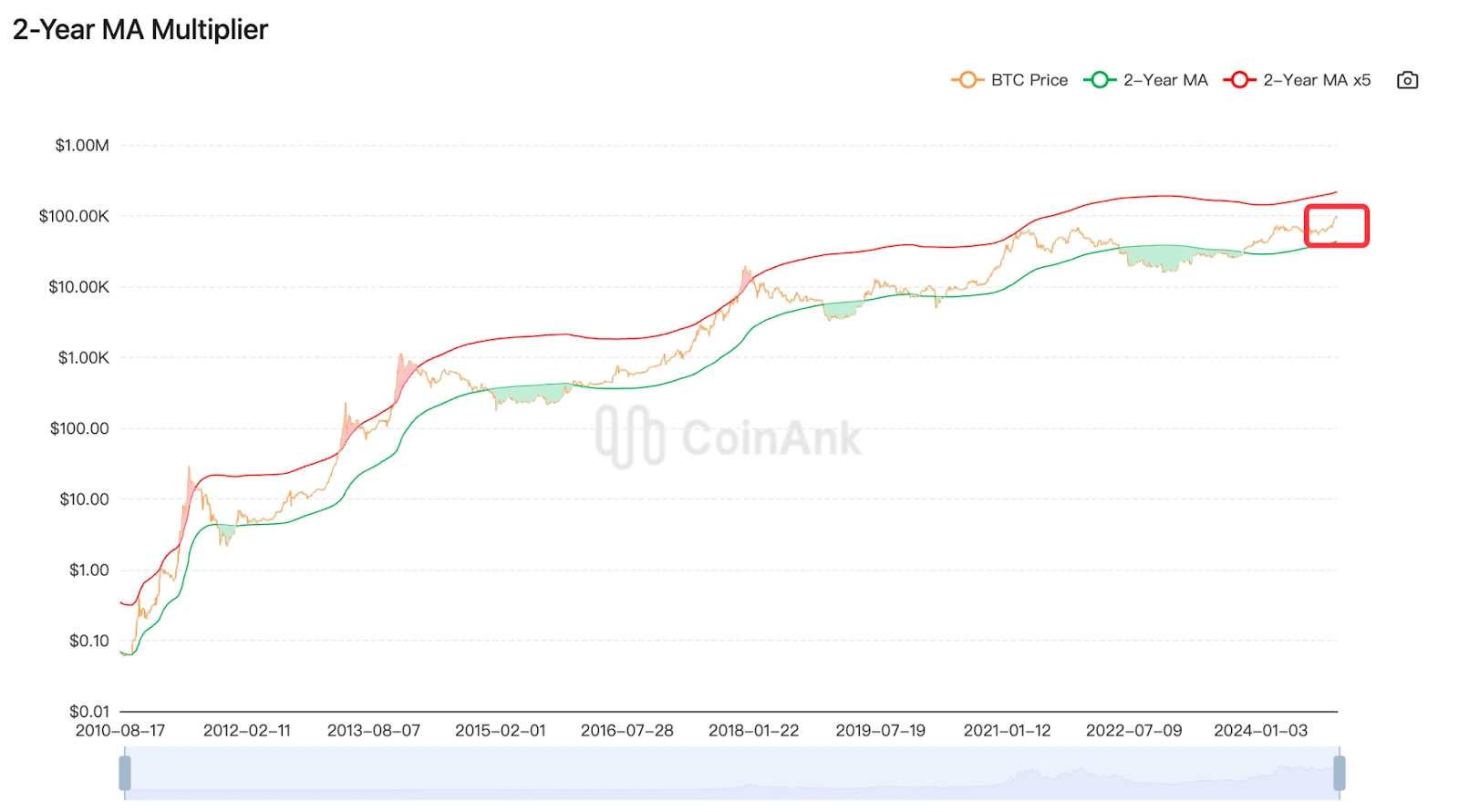

a) 2-Year MA Multiplier is a long-term investment tool that highlights periods when buying or selling Bitcoin can generate significant returns. When the price exceeds 5x the 2-year moving average (red line), it signals a potential top and selling opportunity.

(Source: CoinAnk)

Currently, the price sits between the red and green lines, indicating Bitcoin is far from its peak compared to previous cycle tops in April 2021, December 2017, and December 2013.

b) Pi Cycle Top Indicator has historically identified market cycle peaks within three days. A top signal occurs when the short-term moving average (111-day) reaches twice the value of the 350-day moving average. Currently, these values show the opposite relationship, indicating we’re far from a market top.

(Source: CoinAnk)

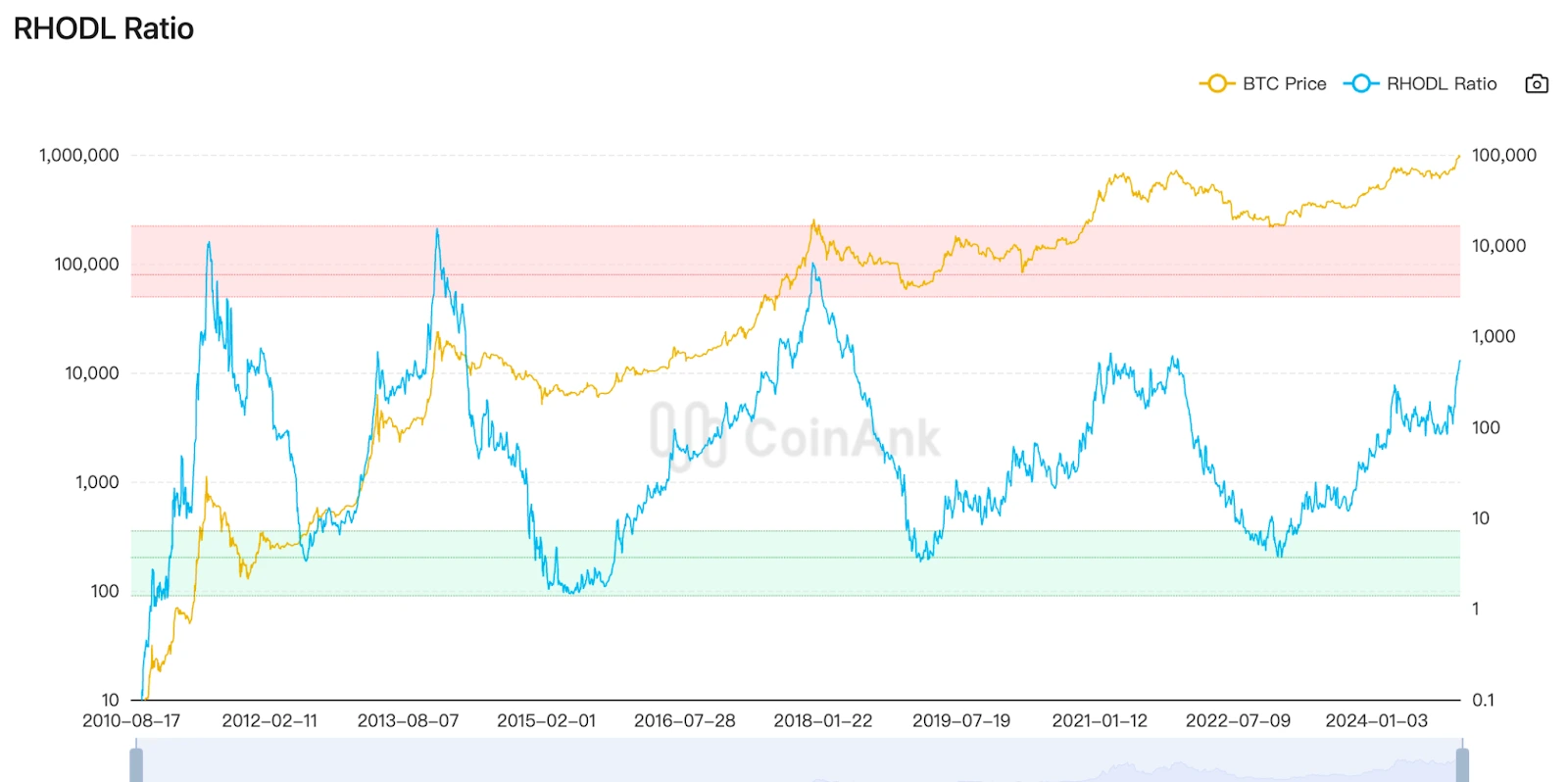

c) The RHODL Ratio has accurately identified Bitcoin’s previous macro cycle peaks. When this indicator enters the red zone, it suggests the market is approaching its cycle top. Currently, it’s far from the red zone but similar to its position in November 2021, which might explain the recent pullback.

(Source: CoinAnk)

In summary, based on both the duration of the bull market and price indicators, Bitcoin appears far from its cycle peak. We’re still in the early stages with significant potential ahead, and the current correction appears relatively mild.

INDICATORS POINT TO AN IMMINENT SHIFT IN ALTCOIN MARKET DYNAMICS

During this uptrend, Bitcoin has been the lone performer, with most altcoins lagging behind in terms of price appreciation. Since most retail investors hold altcoins, Bitcoin’s rally hasn’t benefited the majority of investors. Therefore, the market’s biggest question is: when will altcoin season begin?

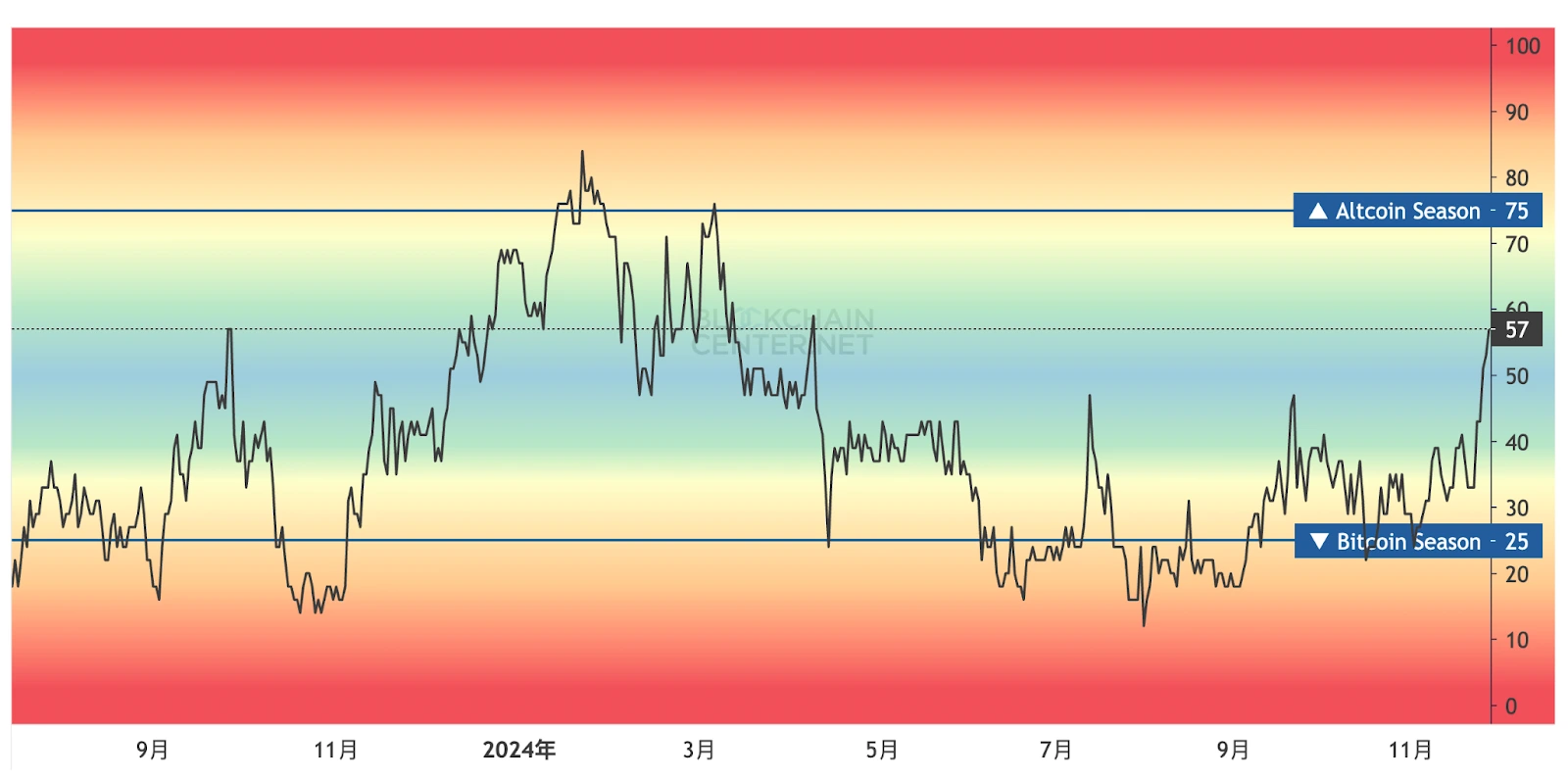

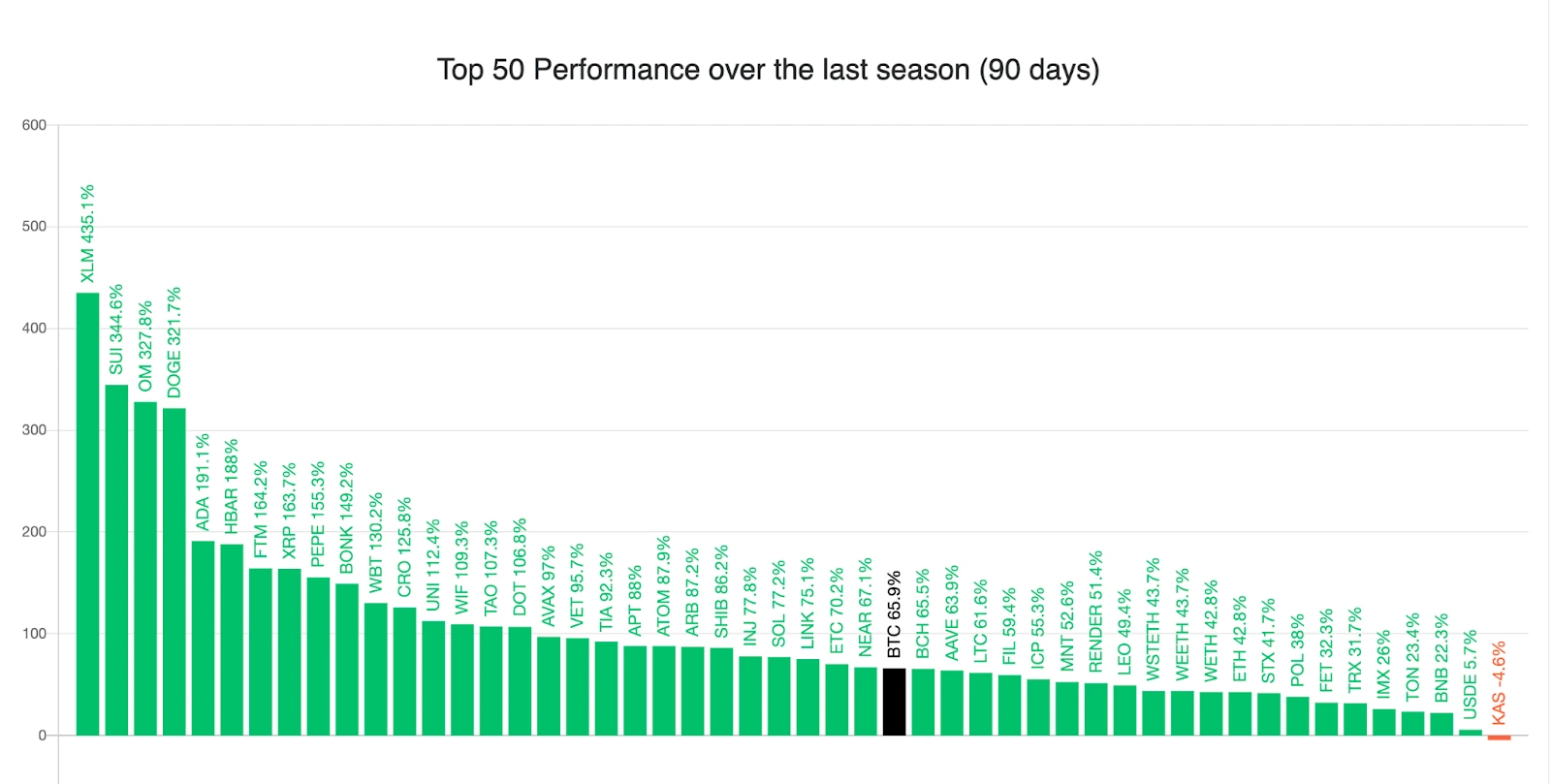

Let’s look at the altcoin season index, which currently stands at 57. According to the theory, alt season occurs when 75% of the top 50 tokens outperform Bitcoin over a 90-day period. At 57, we’re clearly not in alt season yet, both by the numbers and market performance.

Altcoin Season Index

(Source: Blockchaincenter)

Altcoin season, or “altseason,” typically occurs when mainstream alternative cryptocurrencies significantly outperform Bitcoin. It’s usually characterized by increased market activity, trading volume, and bullish sentiment toward altcoins.

Before discussing timing, let’s examine the conditions and indicators for altcoin season:

The most crucial condition is market liquidity. Currently, the main source of liquidity comes from central banks, particularly the Federal Reserve. The Fed’s rate cuts in September and November, with another expected 25-basis-point cut at the December 17-18 meeting, are significant. Looking ahead to 2025, there are eight Fed meetings scheduled, with the first three on January 28-29, March 18-19, and May 6-7. The market generally maintains an optimistic outlook for rate cuts at these meetings.

If things proceed as expected, by January, three months after December’s rate cut, this additional liquidity should begin flowing into the crypto market. This timing suggests alt season could begin around January next year.

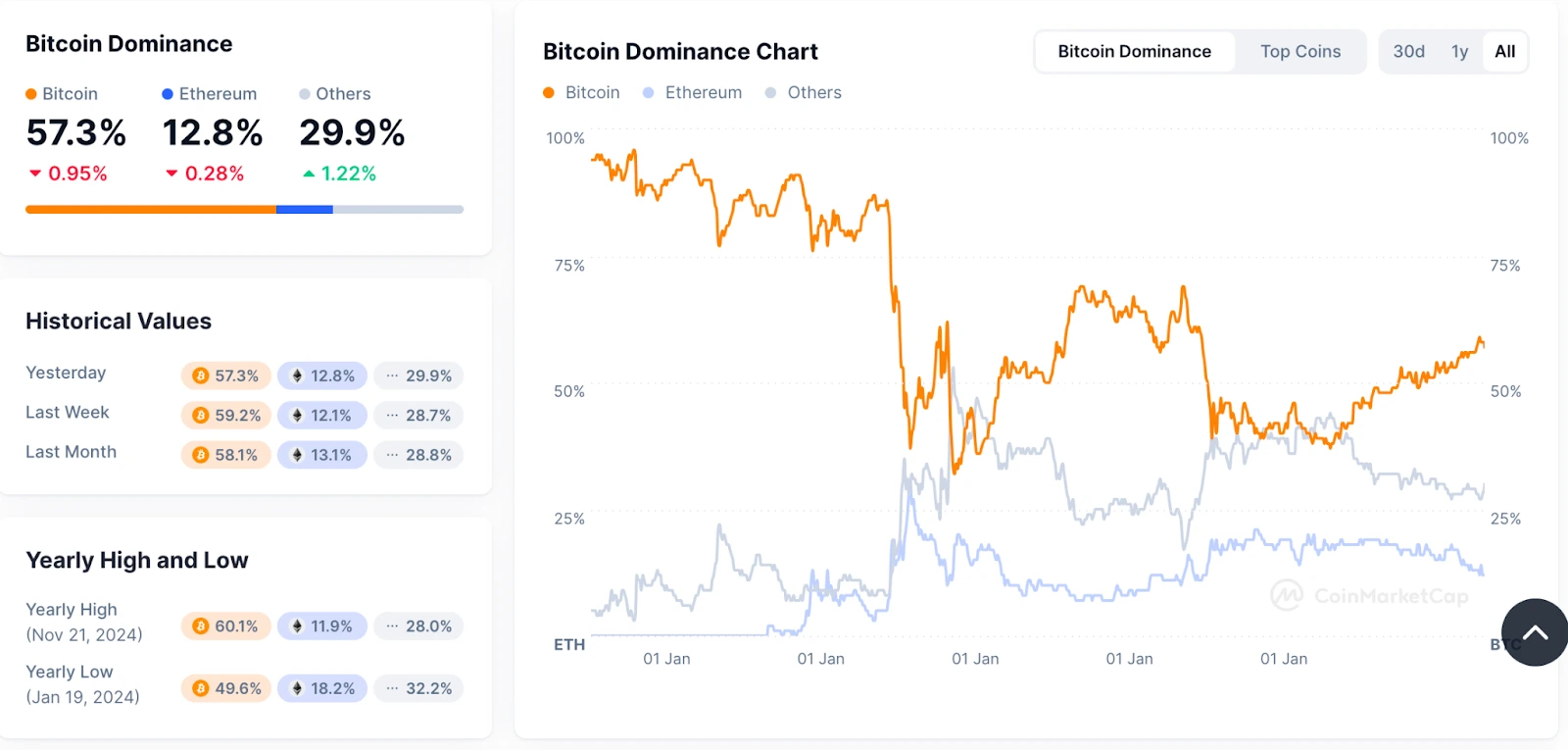

Another indicator is Bitcoin’s market dominance, which typically needs to fall below 50% (sometimes even lower) to signal altcoin season. Currently at 57.3%, with an upward trend since January, this suggests altcoin season isn’t imminent.

(Source: CoinMarketCap)

Key indicators of altcoin season include:

- Bitcoin price stabilization or sideways movement

- Heightened investor sentiment and social media activity around altcoins

- Increased project and community activity

- Emergence of new tokens and projects

Based on these factors, altcoin season is likely to begin before late January next year, though this is the author’s personal assessment for reference only.

INVESTMENT SPOTLIGHT: CRITICAL TOKENS FOR 2024-2025

We can approach this from three angles:

1. Previous research by CoinRank and Agen highlighted potential/trending coins in their report series:

- CoinRank’s Market Watch: From Top 10 to Top 200 – Investment Analysis of DOGE, SUI and PIXEL

- CoinRank’s Market Watch: Rising Stars Analysis – PNUT, TIA, XRP, and DOGS

2.Look for established projects in the top 50 by market cap that outperform Bitcoin.

(Source: Blockchaincenter)

3. Focus on trending sectors in this halving cycle:

- Layer-1 Blockchains: Every halving bull market features breakout blockchain projects. Besides the leaders ETH and SOL (suitable for high-net-worth individuals), promising newer chains include SUI, APT, TIA, and TON. Established projects include ADA, DOT, AVAX, TRX, MATIC, and NEAR.

- AI: Given AI’s prominence across industries, this sector is likely to see several breakout projects. Current leaders include FET, AGIX, AI, and WLD.

- GameFi: As the blockchain sector with the most real-world users, this space is likely to remain hot. Leading projects include SAND, MANA, GALA, PIXEL, and ENJ.

- Memecoins: While incredibly popular, this sector requires careful selection due to many worthless tokens. Current leaders include DOGE, SHIB, PEPE, FLOKI, TROLL, DOGS, and ACT.

▶ Buy Crypto at Bitget