KEYTAKEAWAYS

- Both Bitcoin and gold derive value from scarcity—gold through geological limits, Bitcoin via a capped supply of 21 million coins.

- Gold offers stability and wealth preservation, while Bitcoin provides high-risk, high-reward growth potential for tech-savvy investors.

- Bitcoin and gold are likely to complement each other, balancing traditional safe-haven stability with digital innovation and growth opportunities.

CONTENT

Explore the battle between Bitcoin and gold as safe-haven assets. Discover their similarities, differences, and how they can coexist in a diversified investment portfolio.

INTRODUCTION

In an era of increasing global economic uncertainty, the search for safe-haven assets has become a critical focus for investors. Gold, with its millennia-long history, has long been regarded as the quintessential store of value.

Bitcoin, a digital asset introduced in 2009, has emerged as a modern contender, often dubbed “digital gold.” As Bitcoin experiences dramatic price swings and gold maintains its steady appreciation, the debate over whether Bitcoin can supplant gold as the new safe-haven asset has intensified.

This article explores the similarities and differences between Bitcoin and gold, examining their supply scarcity, decentralization, market positions, security, and future risks. It also considers the potential roles and interplay of these two assets in the global economy.

SIMILARITIES BETWEEN BITCOIN AND GOLD

Supply Scarcity: The Foundation of Value

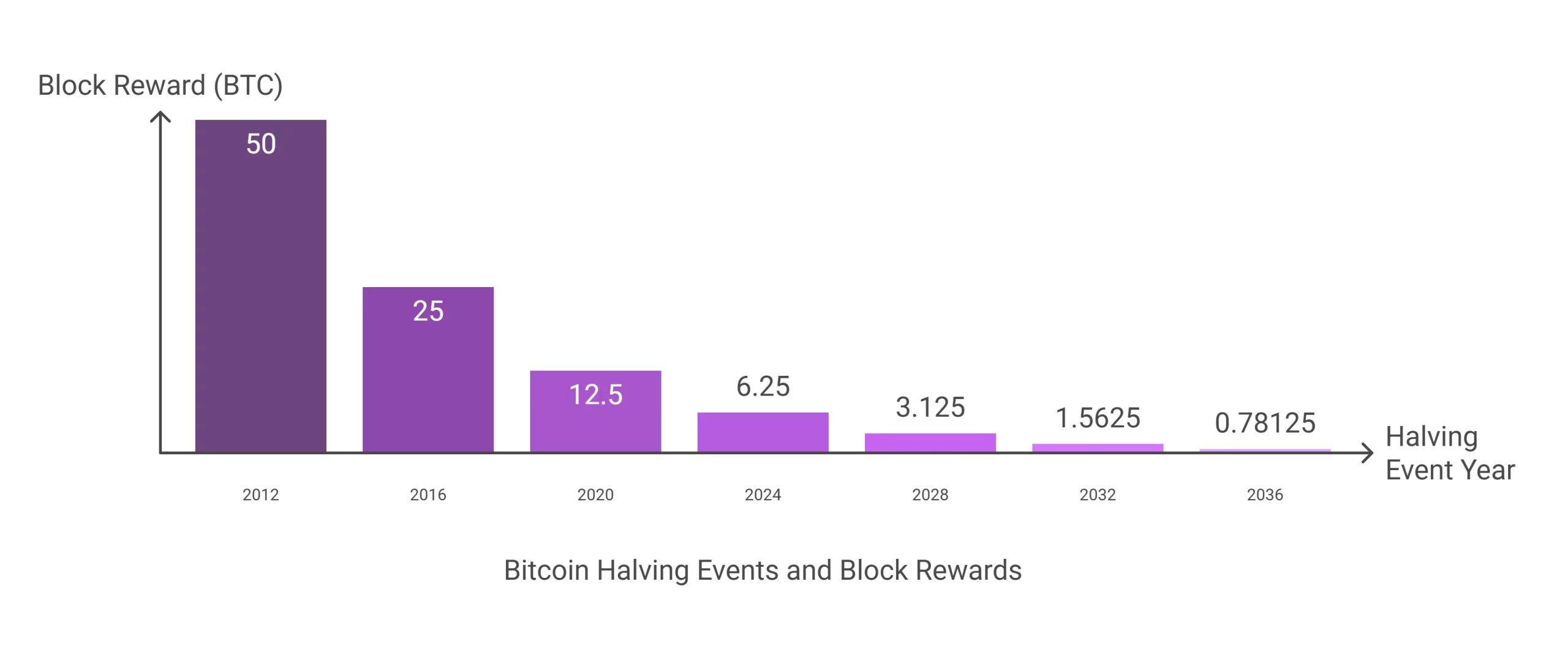

Both Bitcoin and gold derive their value from inherent scarcity. Gold’s scarcity is geological, with limited above-ground reserves and increasingly difficult mining conditions. Bitcoin’s scarcity is algorithmic, with a fixed supply of 21 million coins and a halving mechanism that reduces the rate of new coin creation over time.This scarcity underpins their roles as stores of value, making them attractive during times of inflation or currency devaluation.

Decentralization and Non-Sovereign Nature

Neither Bitcoin nor gold is controlled by a central authority. Gold has historically transcended political and economic systems, maintaining its value across borders. Bitcoin, built on blockchain technology, operates through a decentralized network, free from government or institutional control.This decentralization makes both assets resilient to sovereign risks, such as currency devaluation or political instability.

Hedge and Speculative Properties

Gold is a traditional safe-haven asset, performing well during economic crises, geopolitical tensions, and inflationary periods. Bitcoin, while occasionally exhibiting safe-haven properties (e.g., during the early stages of the COVID-19 pandemic), is more volatile and speculative, appealing to risk-tolerant investors seeking high returns.Gold is favored by conservative investors, while Bitcoin attracts those willing to embrace higher risk for potentially greater rewards.

Also Read:

Bitcoin Outshines Gold as Safe-Haven in Inflationary Era, Says Arthur Hayes

DIFFERENCES BETWEEN BITCOIN AND GOLD

Physical vs. Virtual Assets

Gold is a tangible asset with intrinsic value and diverse industrial applications, such as in jewelry, electronics, and aerospace. Bitcoin, by contrast, is purely digital, existing on a blockchain and lacking physical utility.This distinction makes gold more appealing to traditional investors, while Bitcoin resonates with tech-savvy individuals and those bullish on digital innovation.

Market Position and Competitive Landscape

Gold has dominated the precious metals market for centuries, with no close competitor. Bitcoin, while leading the cryptocurrency market with a 56.72% share, faces competition from other digital assets like Ethereum and Binance Coin.Bitcoin’s market position is not guaranteed, as emerging cryptocurrencies with unique use cases could challenge its dominance.

(Source:TradingView)

Security and Risks

Gold’s risks are primarily logistical, involving secure storage and transportation. Bitcoin, however, faces digital risks such as hacking, loss of private keys, and technological vulnerabilities.While gold’s security challenges are physical, Bitcoin’s are tied to cybersecurity and the reliability of digital infrastructure.

Also Read:

Gold and Bitcoin’s Surprising Connection: What It Means for Investors

COMPLEMENTARITY BETWEEN BITCOIN AND GOLD

Roles in Investment Portfolios

Gold and Bitcoin serve different purposes in a portfolio. Gold provides stability and long-term wealth preservation, making it ideal for risk-averse investors. Bitcoin offers high growth potential, appealing to those willing to take on greater risk.Combining both assets can create a balanced portfolio, leveraging gold’s stability and Bitcoin’s growth potential.

Performance in Different Economic Environments

Gold thrives during financial crises, geopolitical tensions, and inflationary periods. Bitcoin, on the other hand, excels in environments characterized by technological innovation and digital transformation.As the world becomes more digitized, Bitcoin’s role in cross-border payments, decentralized finance (DeFi), and smart contracts could enhance its value proposition.

FUTURE OUTLOOK FOR BITCOIN AND GOLD

Bitcoin’s Potential and Challenges

Bitcoin’s future is promising, with potential applications in cross-border payments, DeFi, and smart contracts. However, it faces challenges such as regulatory uncertainty, price volatility, and scalability issues.Its adoption by traditional financial institutions and regulatory clarity will be key to its long-term success.

Gold’s Continued Value

Gold’s historical role as a store of value and safe-haven asset remains robust. Its demand in industrial applications and as a reserve asset for central banks ensures its enduring relevance.Despite the rise of digital currencies, gold is likely to remain a cornerstone of conservative investment strategies.

Bitcoin and Gold Coexisting

Rather than competing, Bitcoin and gold are likely to coexist, each serving distinct roles in the global economy. Bitcoin represents the future of digital value storage, while gold embodies centuries of trust and stability.Together, they offer investors a diversified approach to wealth preservation and growth.

CONCLUSION

Bitcoin and gold share key attributes, such as scarcity and decentralization, but differ fundamentally in their physical nature, market dynamics, and risk profiles. While Bitcoin holds immense potential as a digital store of value, it has yet to fully replace gold as the traditional safe-haven asset. Gold’s historical reliability and tangible nature continue to make it a preferred choice for risk-averse investors.

For investors, Bitcoin offers a high-risk, high-reward opportunity, while gold provides stability and long-term wealth preservation. As global economic uncertainty persists, both assets are likely to play complementary roles, offering diversified options for investors navigating an increasingly complex financial landscape.

▶ Buy Crypto at Bitget

CoinRank x Bitget – Sign up & Trade to get $20!