KEYTAKEAWAYS

- Trump may push Bitcoin to become a national reserve, reshaping global finance and boosting its role in international trade.

- Institutional interest in crypto ETFs is surging, with the market expected to exceed $200 billion by 2025, driven by regulatory improvements.

- Stablecoins are revolutionizing global payments with low costs, fast settlements, and potential to replace traditional systems like SWIFT and Visa.

CONTENT

Trump’s presidency could reshape the crypto market: Bitcoin as a reserve asset, ETF growth, stablecoin adoption, asset tokenization, and meme token rise. Explore the 2025 crypto trends.

The cryptocurrency market in early 2025 is set to make history. Just days before his inauguration, President-elect Donald Trump launched his personal token, $TRUMP. Within hours, its value skyrocketed by 15,000%, reaching a market cap of over $4.8 billion and a fully diluted valuation of $24.3 billion.

On January 20, as Trump prepared to take the oath of office as the 47th President of the United States, First Lady Melania Trump introduced her own token, $MELANIA, which quickly achieved a market cap of $2 billion. This unprecedented “Presidential token” phenomenon has sent ripples through the global cryptocurrency community.

Throughout his campaign, Trump emphasized his vision of positioning the U.S. as a global leader in cryptocurrency innovation, even proposing the creation of a national Bitcoin reserve. His actions, from launching personal tokens to highlighting digital finance in his inaugural address, signal a strong commitment to advancing the crypto sector.

Now, as the 47th President, Trump’s policies are expected to have far-reaching global implications. Based on his campaign promises and recent crypto-related activities, we anticipate a transformative year for the cryptocurrency market in 2025. Here are five key trends to watch.

Also Read:

January 2025 Crypto Calendar: Trump, Fed, and Bitcoin’s $120K Target

BITCOIN AS A NATIONAL RESERVE ASSET

Under Trump’s pro-crypto administration, Bitcoin could undergo a significant transformation. Recently, the Texas House of Representatives proposed legislation to accept Bitcoin for taxes, fees, and donations, aiming to build a strategic Bitcoin reserve. This initiative, designed to enhance fiscal stability and position Texas as a leader in Bitcoin innovation, has sparked nationwide discussions about establishing a national Bitcoin reserve, which could gain momentum in 2025.

Trump’s Vision

At the Bitcoin2024 conference in July 2024, Trump unveiled a plan for a national Bitcoin reserve, vowing that the government would “never sell” its Bitcoin holdings. He described this strategy as a long-term financial safeguard for the nation.

State-Level Momentum

The idea has received bipartisan support, with figures like California Congressman Ro Khanna and Wyoming Senator Cynthia Lummis advocating for Bitcoin reserves. Lummis even proposed a bill to acquire 1 million Bitcoin over five years to address the national debt. States such as Pennsylvania and Ohio are exploring similar initiatives, laying the groundwork for a potential national Bitcoin reserve.

(Source:CNBC)

The impact of the world’s largest economy holding Bitcoin as a reserve asset would be profound. Emerging economies might follow suit, using Bitcoin to hedge against dollar dominance and prepare for the digital economy. Bitcoin’s role in international trade settlements could expand, particularly in geopolitically sensitive regions.

Analysts predict that by the end of 2025, sovereign nations could hold 8%-12% of Bitcoin’s circulating supply. Such large-scale institutional adoption would fundamentally alter Bitcoin’s supply-demand dynamics, potentially leading to a new pricing model. More importantly, this shift would cement Bitcoin’s status as a strategic reserve asset, enhancing its value as a store of wealth.

THE RISE OF CRYPTOCURRENCY ETFS

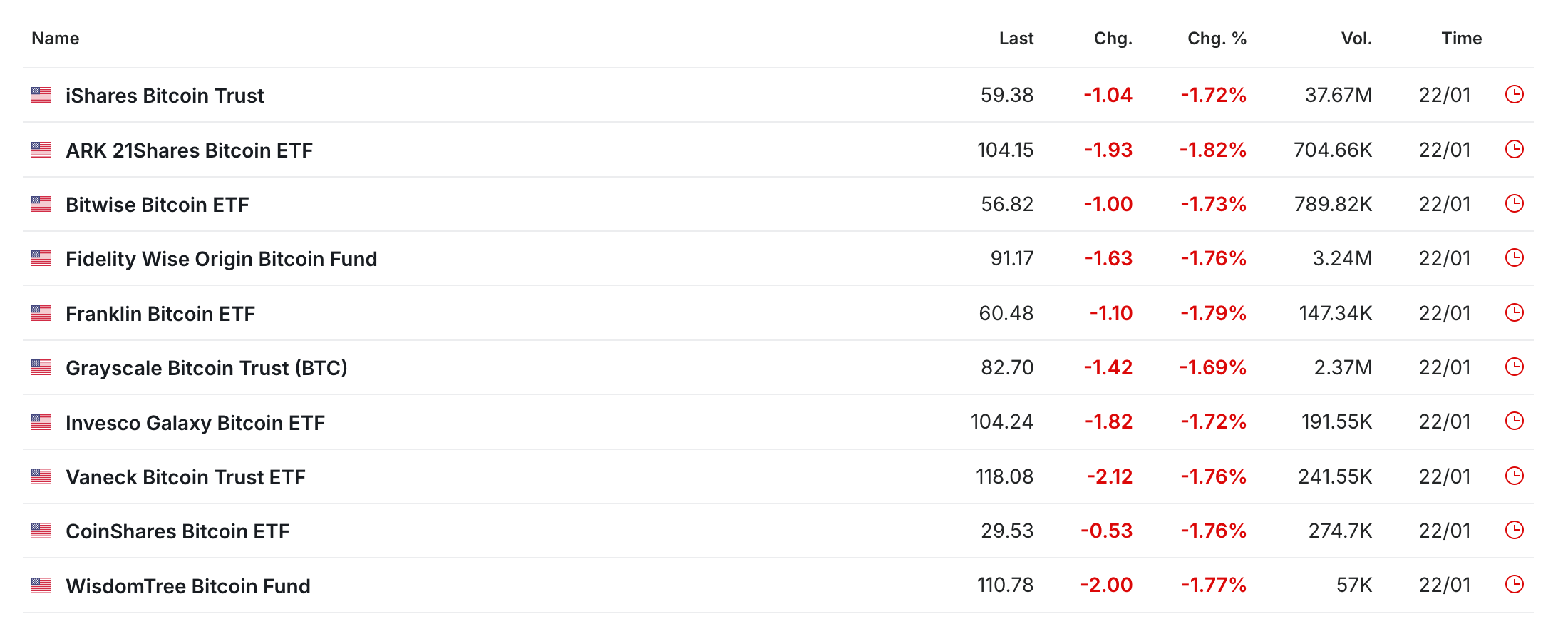

Bitcoin ETFs have already demonstrated strong institutional interest in digital assets. BlackRock’s IBIT, for example, reached $40 billion in assets under management within 200 days. This trend is expected to accelerate under Trump’s more open regulatory environment, with the total market size of crypto ETFs potentially surpassing $200 billion by 2025, marking a new era for traditional financial institutions entering the crypto space.

Regulatory Progress

As regulations evolve, more crypto ETFs are likely to gain approval, driving market growth. In 2024, the SEC approved spot Bitcoin and Ethereum ETFs, signaling a more favorable stance toward crypto assets. This shift could pave the way for additional crypto ETF applications. Trump’s administration is expected to adopt more flexible and innovative regulatory policies, further boosting the crypto market.

(Source: Investing)

Institutional Demand

As Bitcoin and Ethereum gain broader acceptance, demand for ETFs tied to emerging crypto assets like SOL and XRP is increasing. Institutional investors such as BlackRock are ramping up their investments, reflecting strong market confidence. Advances in technology and infrastructure are making trading and storage safer and more transparent, bolstering regulatory confidence in approving ETFs.

Traditional financial institutions bring expertise in risk management, market pricing, and operations, contributing to a more regulated and mature crypto market. We may see the emergence of innovative ETF products, such as cross-chain asset ETFs and DeFi yield ETFs.

Overall, crypto ETFs offer investors safer, compliant investment options and could lead the market into a new phase of growth. With more financial tools and relaxed regulations, the future of cryptocurrency is bright.

Also Read:

BTC Mining Hashrate Drops 5.796%: What’s Next for PoW Tokens?

STABLECOINS: REVOLUTIONIZING GLOBAL PAYMENTS

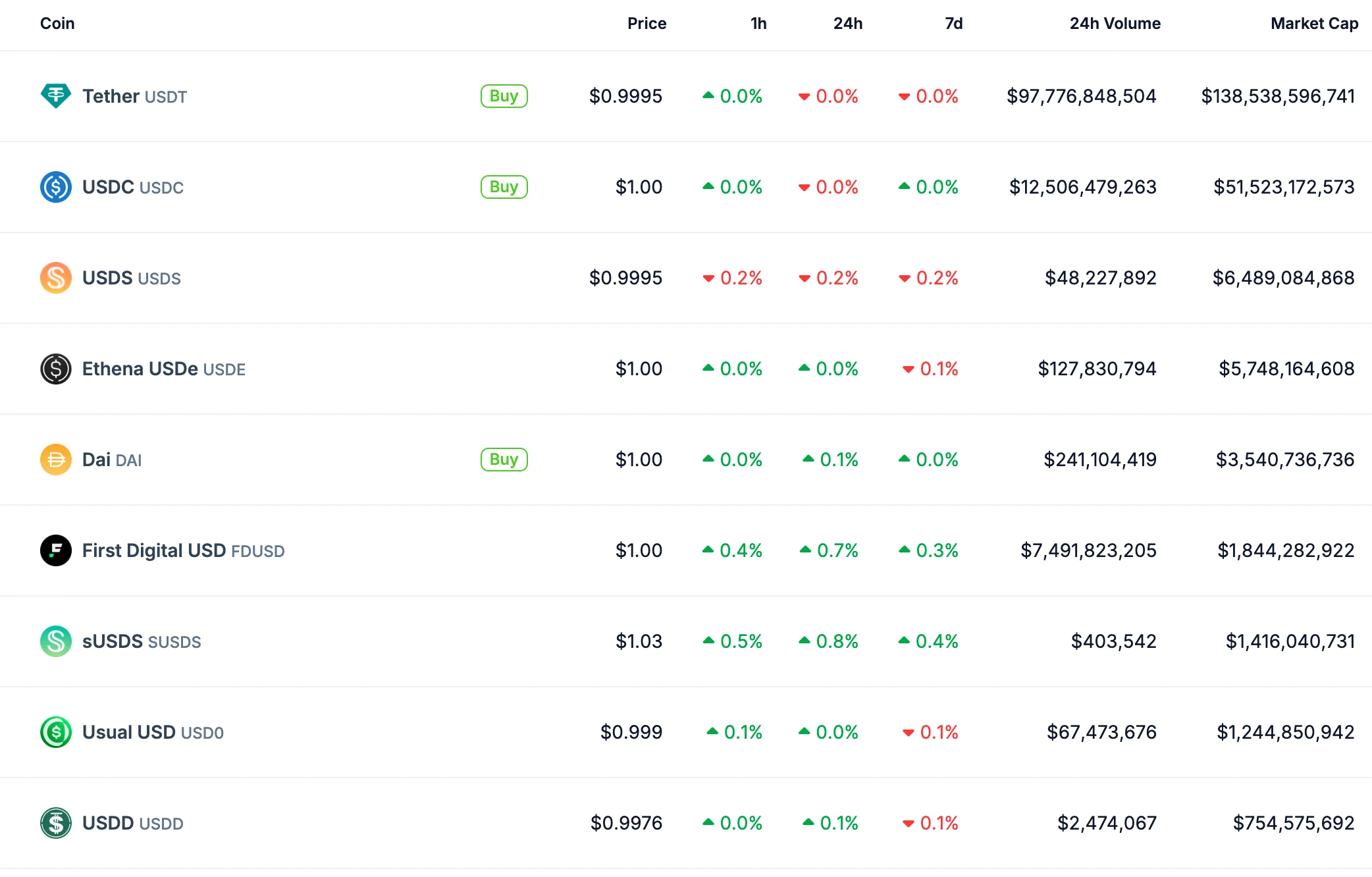

In a more open policy environment, stablecoins could transform global payments. Traditional international payments often take 2-3 business days and incur high fees. In contrast, stablecoins enable near-instant settlements at a fraction of the cost, thanks to their decentralized nature and blockchain technology.

(Source:Coingecko)

Cost and Efficiency

Stablecoins significantly reduce cross-border payment costs, averaging 0.5%-3.0%, compared to traditional systems that charge around 6.35%. Settlement times are also drastically reduced, from days to minutes. This high-efficiency, low-cost model is ideal for global commerce. By 2030, cross-border capital flows are expected to reach $76 trillion, providing a vast market for stablecoin adoption.

Expanding Applications

Stablecoins are increasingly used in personal transfers (P2P), business transactions (B2B), and international trade. They streamline real-time clearing in supply chain finance, boosting efficiency. As global manufacturing and cross-border trade grow, stablecoins will underpin a more efficient and cost-effective global supply chain.

Innovation and Financial Transformation

Smart contracts enable automated transaction validation, clearing, and settlement, enhancing efficiency and security. As stablecoins gain wider acceptance, decentralized cross-border payments are accelerating. Stablecoins could eventually replace traditional networks like SWIFT, Visa, and Mastercard, decentralizing and diversifying global payment systems.

Looking ahead to 2025, stablecoins will play a pivotal role in reshaping global payments with their cost-efficiency, technical innovation, and disruption of traditional finance. With regulatory improvements and rising market demand, their future looks promising.

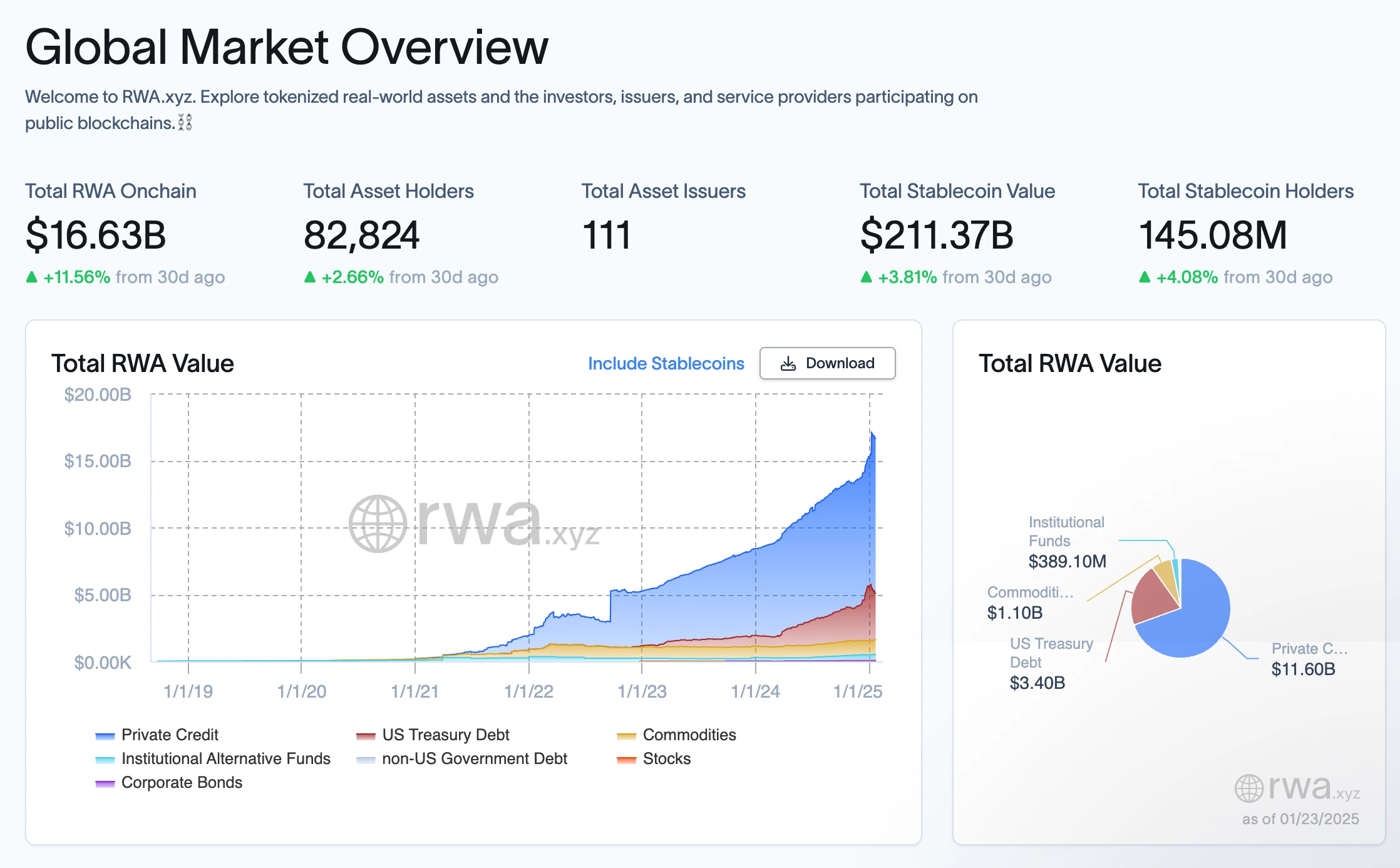

RWA: TRANSFORMING TRADITIONAL FINANCE

(Source:rwa.xyz)

Market Demand and Digital Transformation

As global capital markets digitize, RWA bridges traditional finance and blockchain, meeting investors’ demand for diverse assets. By 2030, the RWA market could reach $16 trillion. Tokenization offers small investors access to real estate and other traditional assets while enabling asset owners to manage portfolios more flexibly. RWA also advances supply chain finance by tokenizing accounts receivable, improving SME financing.

Technological Advancements

Blockchain maturity provides efficient, secure solutions for asset tokenization, enhancing transparency. Smart contracts enable automated, secure asset trading, increasing RWA liquidity. DeFi and decentralization accelerate RWA market growth, attracting investors with transparency and accessibility.

Institutional and Policy Support

Major institutions like BlackRock and Goldman Sachs are investing in RWA, boosting market confidence. Regulatory frameworks like the EU’s MiCA are removing barriers, fostering compliance and adoption. Institutional participation and supportive policies will further popularize RWA.

Also Read:

Smart Contract 101: How Blockchain Makes Digital Agreements Smarter

MEME TOKENS: ENTERING A NEW ERA

The Trump family’s token launches have brought unprecedented attention and legitimacy to Meme tokens. Once considered niche, Meme tokens are set for standardized growth thanks to favorable policies and innovations.

Internet Culture and Social Dynamics

Meme tokens often stem from online culture and humor, attracting younger investors. They are more than financial tools—they are social identity symbols. Meme tokens leverage social media and online communities for viral growth, creating vibrant ecosystems.

Economic Environment and Institutional Interest

In a low-yield traditional investment climate, high-risk assets like Meme tokens attract capital. Venture capital and traditional institutions are showing interest in Meme tokens and their infrastructure, increasing market credibility.

Platforms and Fair Distribution

New trading platforms lower entry barriers, allowing users to invest in crypto via Apple Pay, PayPal, etc. Meme tokens often adopt fair distribution models without pre-mining or team allocations, fostering community cohesion and liquidity.

Also Read:

Why Do Bitcoin and U.S. Stocks Tend to Rise and Fall Together?

CONCLUSION

With Trump’s strong push, cryptocurrencies are moving from the fringes to the mainstream. From Bitcoin as a reserve asset to stablecoin adoption in payments, the market offers more opportunities for ordinary investors. Whether you are interested in Bitcoin’s long-term value or short-term gains through ETFs or Meme tokens, 2025 is a pivotal year.