KEYTAKEAWAYS

- An ETH whale used high leverage and liquidation arbitrage, causing a $4M loss to HLP and exposing flaws in Hyperliquid’s risk control system.

- JELLY token’s sudden surge hinted at market manipulation. Hyperliquid delisted the pair and refunded users, raising concerns about its decentralized governance.

- Both events show how HLP is vulnerable to whale strategies, with users questioning the platform’s stability and commitment to decentralization.

CONTENT

In the fast-growing world of decentralized finance (DeFi), Hyperliquid has gained attention as a platform focused on perpetual contract trading. With its efficient Hyperliquid Pool (HLP) and high-leverage features, it attracted many users. But in March 2025, two major events — the “ETH Whale Liquidation” and “JELLY Token Surge” — caused serious controversy.

These incidents exposed weaknesses in risk control and raised deeper concerns about how vulnerable decentralized exchanges (DEXs) can be to market manipulation and high-risk strategies.

Related Reading:

Inside Hyperliquid’s Success: A Deep Dive Into Its Dominance and Challenges

1. THE ETH WHALE LIQUIDATION: THE COST OF HIGH LEVERAGE

On March 12, 2025, a trader with the wallet address starting “0xf3f4” opened a $306.85 million long position on Ethereum (ETH) with 50x leverage on Hyperliquid. The initial margin was $15.23 million USDC, and ETH was around $1,915. At one point, the position showed $8 million in unrealized profit.

However, the trader later withdrew $17.09 million USDC, which caused the margin level to drop sharply. This triggered an automatic liquidation by the platform. The HLP took over the position and sold it at an average price of $1,895 — leading to a $4 million loss. The whale, however, still walked away with $1.86 million in profit.

The community called this a “liquidation arbitrage” — a strategy to avoid slippage from large sell orders by triggering liquidation and shifting losses to the HLP.

Hyperliquid responded quickly, saying this was not a bug but a high-risk strategy. They lowered leverage limits (BTC from 50x to 40x, ETH from 50x to 25x) and increased margin requirements. Even though HLP has earned over $60 million historically, the incident showed the risks of extreme leverage on the platform.

Related Reading:

Whale Trading, Exchange Pays the Price: The Hyperliquid 3.12 Event Explained

2. THE JELLY TOKEN SURGE: MANIPULATION FEARS

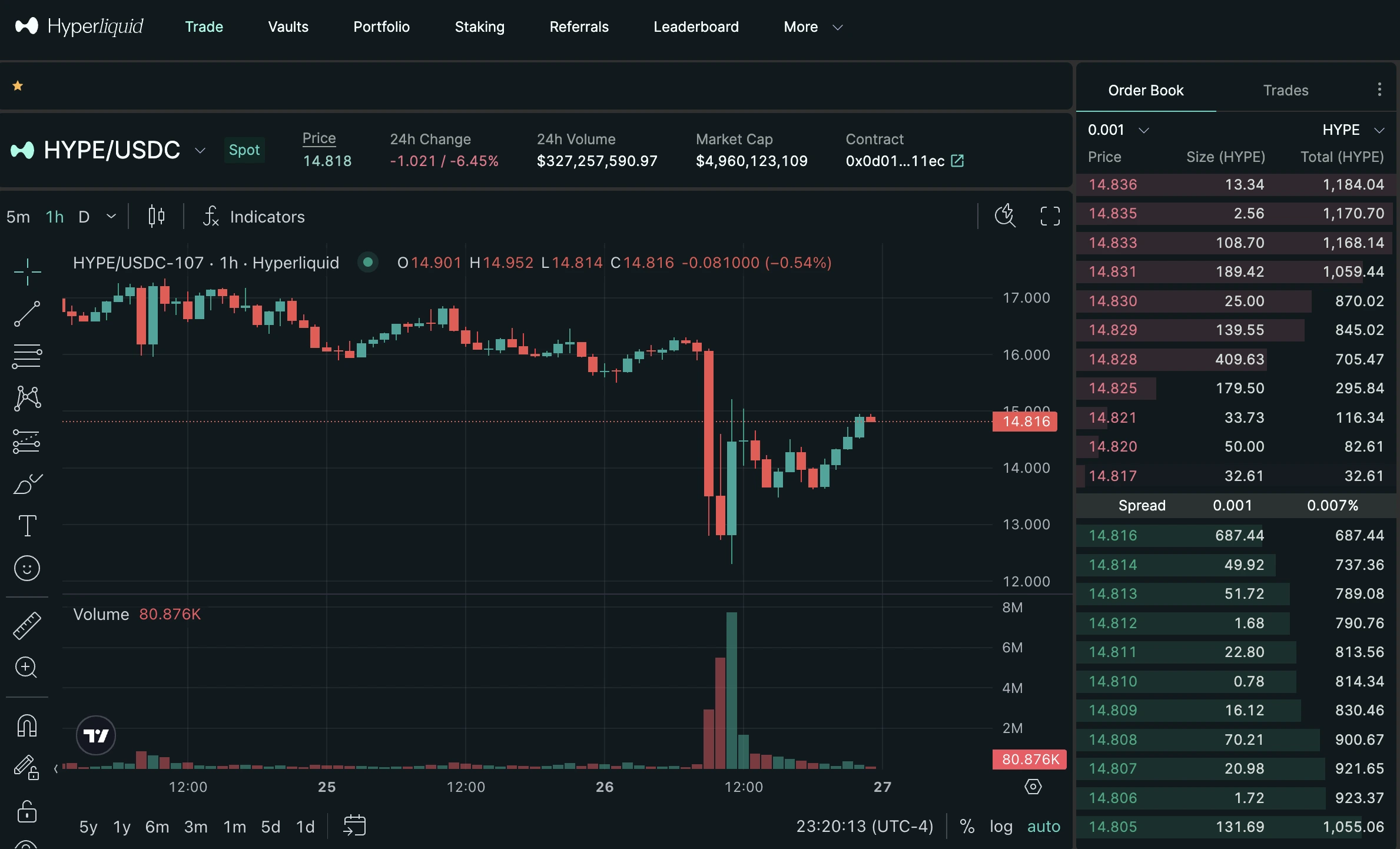

Just two weeks later, on March 26, another crisis hit — this time involving the meme token JELLY.

A trader with a wallet starting “0xde95” opened an $8 million short position on JELLY, then removed the margin, causing HLP to take over. Right after, the price of JELLY spiked from $0.0095 to $0.16 — a 230% jump. This led to big unrealized losses for HLP. If the price had hit $0.17, up to one-third of HLP’s $240 million pool might have been at risk.

Unlike the ETH case, this seemed like market manipulation. Community members suspected that JELLY insiders or large holders pumped the price to hurt HLP. At the same time, Binance and OKX listed JELLY perpetual contracts, which pushed the price higher and added pressure on Hyperliquid.

In response, Hyperliquid validators voted to delist the JELLY pair and promised full compensation to affected users (excluding suspicious accounts). The platform claimed HLP still made $700,000 in the last 24 hours, but some users believed losses could be as high as $8 million.

Although their quick action helped stop the bleeding, the situation made people question if Hyperliquid is truly decentralized, since validator votes and fast delisting resembled centralized control.

3. THE COMMON THREAD: WHALES VS. HLP

Both events share key similarities. First, whales used high-risk strategies: in the ETH case, extreme leverage and margin removal; in the JELLY case, price manipulation. Second, HLP took over these risky positions and suffered losses, becoming the “buyer of last resort.” Third, both events involved possible manipulation, highlighting how exposed the platform is to abnormal trading behaviors.

At the core is a big issue: the risk exposure of decentralized perpetuals platforms. HLP was designed to provide deep liquidity, but whales can exploit it, threatening its stability.

4. THE DIFFERENCES: COMPLEXITY AND RESPONSE

Despite similarities, the two incidents are quite different in nature and impact.

The ETH case involved just one trader and was fully on-chain. Losses were smaller ($4 million), and it didn’t threaten HLP’s safety. Hyperliquid responded with rule changes — a regular “stress test.”

The JELLY case was more complex, involving price manipulation and possibly coordinated actions off-chain. The losses were unclear but could’ve been massive (up to $80 million). Hyperliquid had to act fast with emergency measures, including delisting and refunds.

This fast reaction showed a more centralized response, which led to doubts about the platform’s decentralization. Can a truly decentralized protocol make such quick manual decisions?

5. REFLECTION: A CROSSROADS FOR HYPERLIQUID

These two crises are a big wake-up call for both Hyperliquid and the wider DeFi space.

•Risk control must improve. High leverage attracts users but also gives whales room to game the system. Hyperliquid may need better, more adaptive risk tools — like dynamic leverage limits or position caps.

•Token listings need better checks. JELLY showed how small tokens can be manipulated. Platforms should review a token’s liquidity and risks before listing.

•Decentralization vs. quick response is tricky. While validator votes helped stop the JELLY crisis, they raised concerns about centralization. DeFi platforms must find the balance between fast action and staying decentralized.

Hyperliquid’s future depends on how well it learns from these challenges. The team has promised improvements — like stronger liquidation systems, better HLP protection, and tools to detect manipulation.

For users, these events are a reminder: high leverage = high risk. And for DeFi as a whole, this might be the kind of hard lesson that pushes the space to mature.

▶ Buy Crypto at Bitget

CoinRank x Bitget – Sign up & Trade to get $20!