KEYTAKEAWAYS

- Open Interest drop signals lower leverage, reducing risk but also limiting rapid price growth.

- Funding Rates have stabilized, indicating a more balanced market sentiment.

- Current leverage levels suggest a healthier market, but investors should monitor changes to avoid volatility risks.

CONTENT

Leverage plays an important role in the crypto market. It can increase profits when prices go up, but it can also cause bigger losses when prices fall. This often leads to deleveraging, where traders reduce their positions, causing further price drops.

To understand the current leverage situation in the market, we can look at two key indicators:

- Open Interest (OI) in the futures market – This shows how much leverage traders are using.

- Funding Rate in perpetual contracts – This reflects the balance between long and short positions.

OPEN INTEREST: A KEY INDICATOR OF LEVERAGE IN THE MARKET

Open Interest (OI) measures the total number of outstanding futures contracts. A high OI means many traders are using leverage, while a drop in OI suggests that traders are reducing their positions.

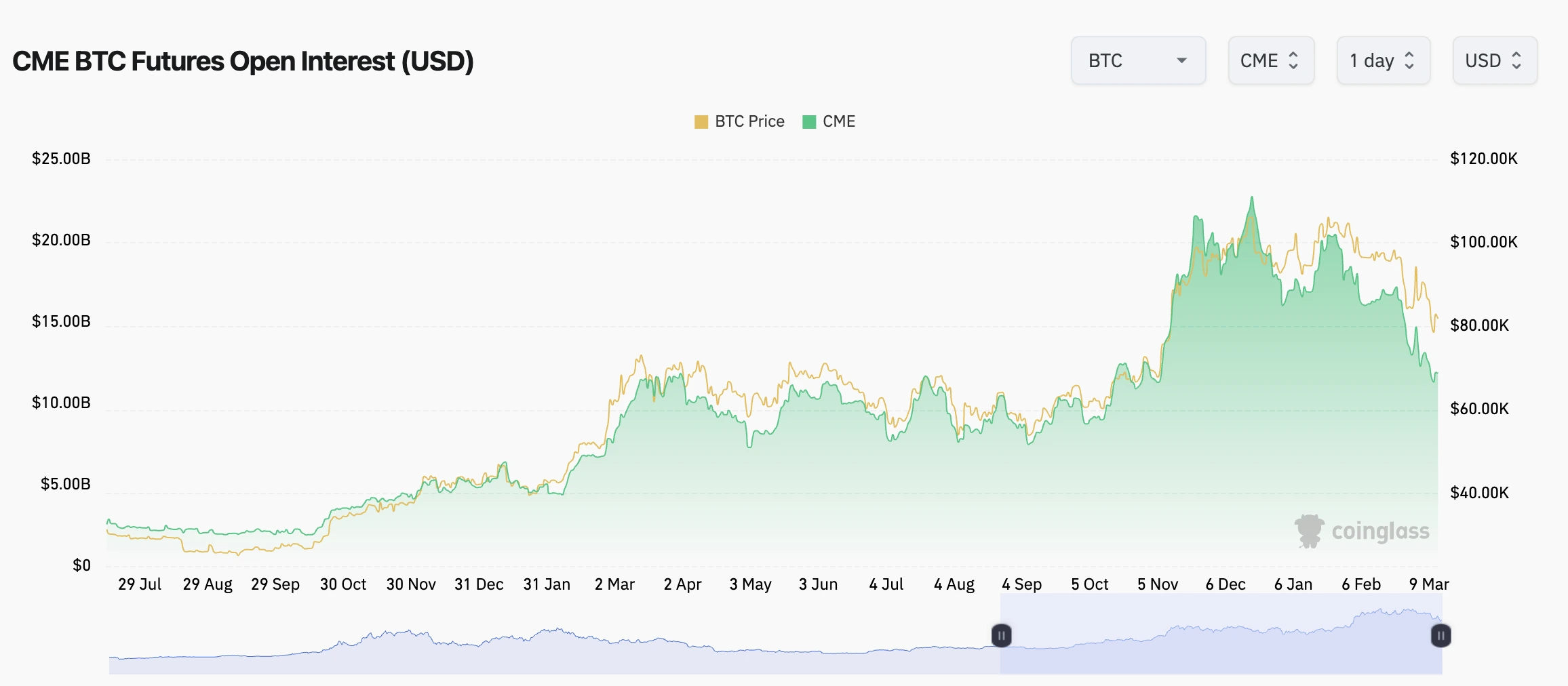

From the CME Bitcoin futures data:

•In late 2024, Bitcoin reached a new all-time high of $100,000, and OI also hit a record high. This suggests that traders were using high leverage and were very optimistic.

•However, since the start of 2025, Bitcoin has been going through a correction, and OI has declined significantly. This means that traders are using less leverage, and the market is becoming more cautious.

A decline in OI can be both good and bad:

- Good: It reduces the risk of a sudden crash caused by high leverage.

- Bad: It shows that fewer new funds are entering the market, making strong price increases less likely in the short term.

FUNDING RATE: UNDERSTANDING MARKET SENTIMENT

The funding rate is used in perpetual futures contracts to keep prices close to the spot market. A high positive funding rate means that long positions (bullish traders) are dominant, while a negative rate means that short positions (bearish traders) are in control.

From Binance’s USDT perpetual contract data:

- During the bull run in early and mid-2024, Bitcoin’s funding rate spiked above 30-40%, showing that traders were very bullish and using high leverage.

- However, since late 2024, the funding rate has dropped and is now below 10%, meaning that leverage in the market is much lower, and traders are more balanced between long and short positions.

This drop in the funding rate suggests that the market is no longer in an extreme bullish phase. Instead, it is in a more neutral and stable condition, reducing the risk of a sudden crash.

WHAT THIS MEANS FOR THE MARKET

Looking at these indicators, we can see that leverage in the crypto market has decreased significantly compared to the peak in 2024. This means:

- The market is healthier and more stable than before.

- The risk of a sudden liquidation event is lower.

- However, price increases may slow down due to lower leverage.

That being said, investors should still watch for potential risks:

- If OI rises sharply again, it could mean that leverage is increasing, raising the risk of volatility.

- If funding rates start rising again, it could signal that traders are becoming too bullish again.

CONCLUSION: A MORE STABLE MARKET, BUT STAY ALERT

Right now, leverage in the crypto market is at a reasonable level. The market is not as over-leveraged as it was in late 2024, meaning the risk of a major crash is lower.

For long-term investors, this could be a good time to accumulate assets, as the market is not in a bubble. However, it is still important to monitor OI and funding rates to avoid surprises.