KEYTAKEAWAYS

- Retail investors drive the $TRUMP and $MELANIA markets, causing price swings influenced by emotions and short-term decisions.

- A small number of whale accounts control most of the market, creating volatility and influencing price movements.

- High concentration of holdings and emotional retail behavior amplify market fluctuations, making caution and long-term thinking crucial for investors.

CONTENT

With the launch of $TRUMP and $MELANIA tokens, the market has shown strong volatility and unique structural characteristics. According to on-chain data and market trends, although retail buyers dominate, the concentration of whale accounts remains a key factor driving the market’s movements.

This situation not only reveals the high concentration of the market but also brings significant uncertainty and volatility. Here’s a deeper analysis of this market structure.

1. RETAIL INVESTORS LEAD THE CHARGE

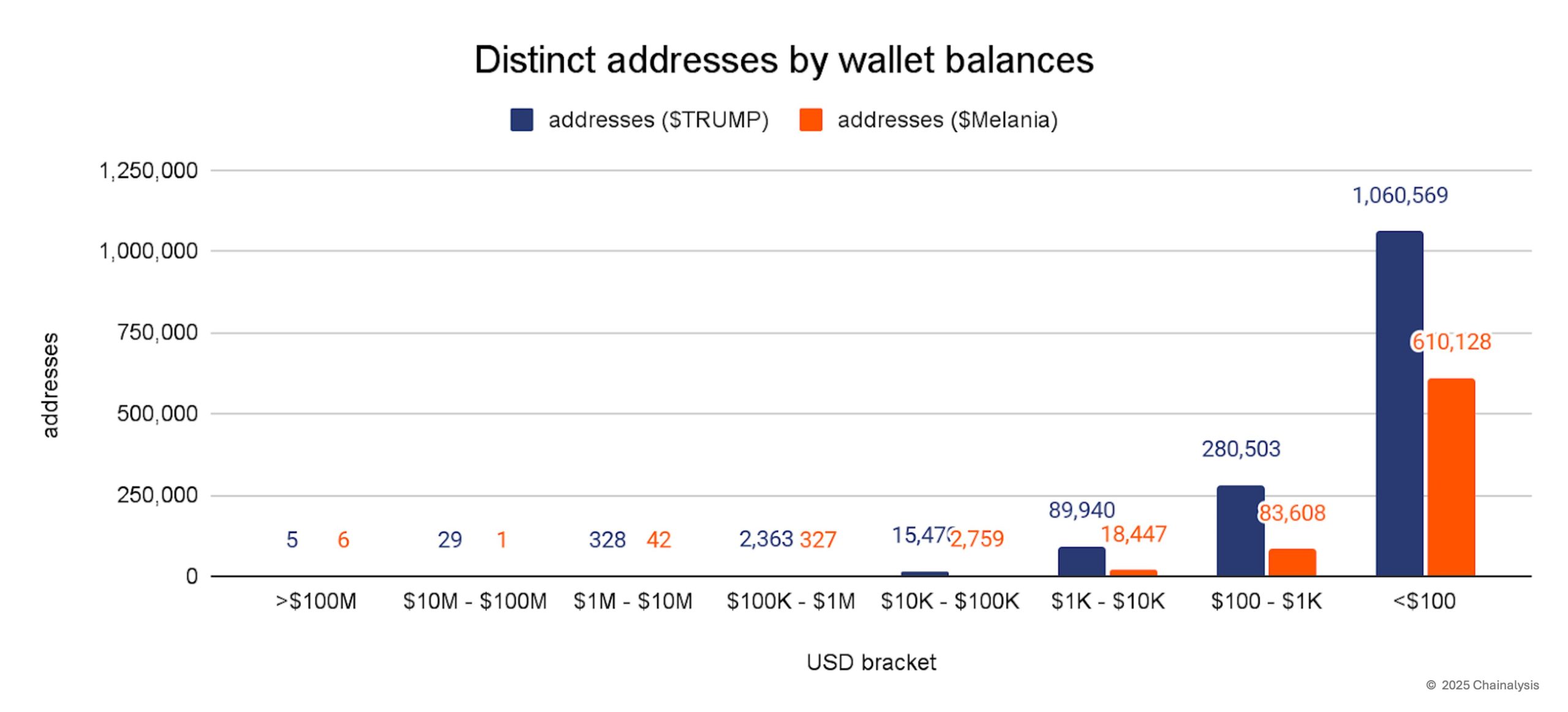

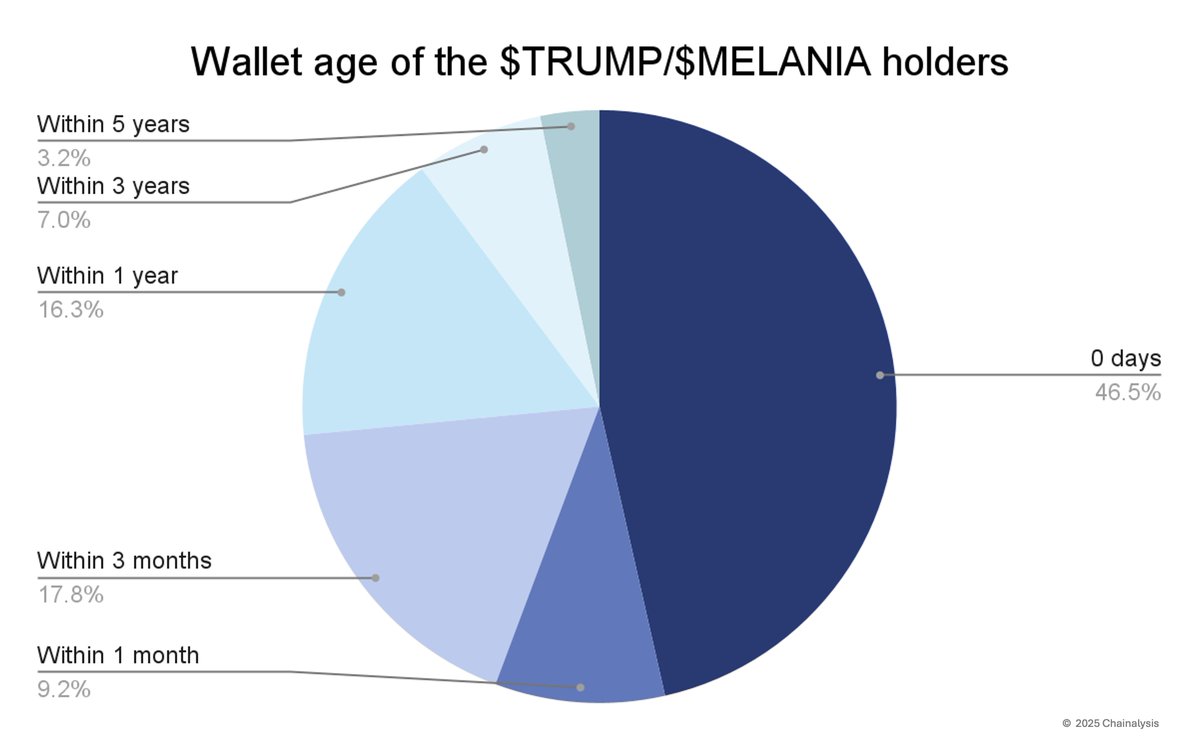

On-chain data shows that $TRUMP and $MELANIA tokens are primarily driven by retail investors. Most wallets hold assets worth less than $100, indicating broad retail participation in the market. Notably, around 50% of token holders are new buyers in the Solana ecosystem, which shows that cryptocurrency markets are attracting a lot of new users.

These investors tend to make short-term decisions and are highly influenced by emotions. When the market rises, they often become overly optimistic, pushing prices up. However, during market pullbacks, their fear drives prices down significantly. This behavior adds to market volatility and brings more liquidity and activity to the market.

2. WHALE ACCOUNTS HOLD THE KEY

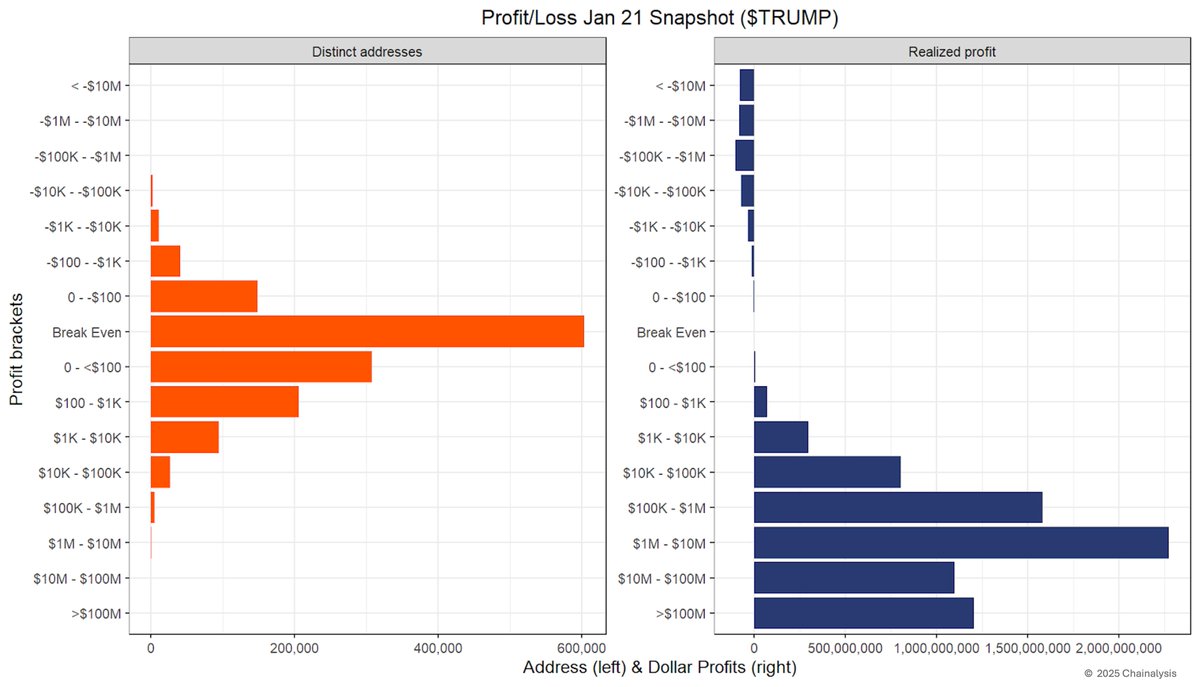

Despite the dominance of retail buyers, whale accounts hold significant influence. Data reveals that around 50 whale accounts control a large portion of the market, each with assets exceeding $10 million, and these whales play a major role in the market. These accounts typically use their large capital to impact market movements, driving prices up or down.

Whale accounts tend to be more strategic in their decisions, often with strong risk management skills. However, the high concentration of these accounts makes their decisions more impactful, further increasing market volatility and imbalances.

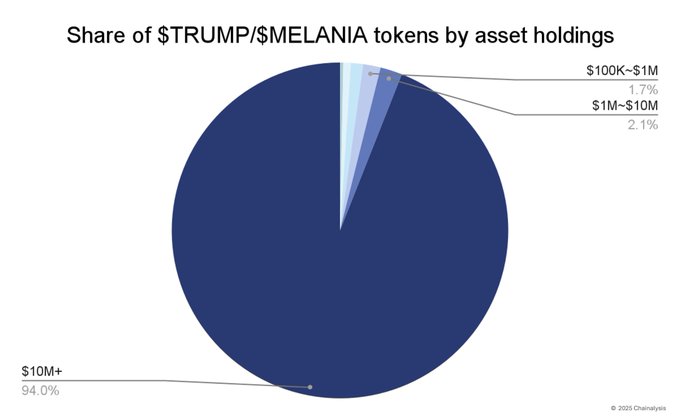

3. MARKET CONCENTRATION: A FEW HOLD MOST OF THE TOKENS

Looking at the overall holdings, the $TRUMP token market shows a clear trend of concentration. Specifically, 77% of $TRUMP token holders have profits under $100, while “dolphin” accounts (those holding over $10 million) control 94% of the total supply. This illustrates the high concentration of funds in the hands of a few large players.

Such concentration leads to greater volatility, as even small movements of capital can trigger large price swings, especially when there’s a huge gap between whale accounts and retail investors. This imbalance often leaves retail buyers in a disadvantaged position, facing price manipulation and market fluctuations.

4. THE SURGE OF NEW RETAIL BUYERS

Another noteworthy trend is the rise of new retail buyers. Around 50% of purchasers have created new wallets specifically to buy these tokens, signaling that the crypto market is attracting fresh blood. The involvement of these new users brings vitality to the market, expanding its reach to a broader audience.

However, these new buyers typically lack experience and are more vulnerable to market emotions and short-term fluctuations. This amplifies speculative behaviors and increases risks. Although their entry helps inject liquidity in the short term, it may also fuel market bubbles.

5. VOLATILITY INTENSIFIES WITH MARKET IMBALANCES

Due to the structural imbalance of market participants, the volatility of $TRUMP and $MELANIA tokens is particularly intense. At one point, $TRUMP reached a market value of over $80 billion, but following market adjustments and profit-taking, its price saw a significant decline. Meanwhile, the launch of $MELANIA added competitive pressure, further impacting the $TRUMP market price.

When considering market volatility, the interplay between retail buyers’ emotions, whale capital movements, and the influx of new retail buyers all contribute to dramatic price swings. This volatility not only affects price trends but also influences investor sentiment and market stability.

CONCLUSION: RETAIL VS. WHALES IN A VOLATILE MARKET

Overall, while retail investors dominate the market, whale accounts still play a critical role. The market’s concentration and whale dominance create strong imbalances, which lead to heightened volatility. Retail investors need to be cautious when navigating such a volatile market, avoiding being swayed by market emotions and short-term fluctuations.

Advice for Retail Investors:

-

Stay Calm and Don’t Follow the Herd: The cryptocurrency market is highly volatile, and retail investors are often influenced by emotional swings. Whether prices are rising or falling, remain calm and avoid making impulsive decisions based on short-term emotions.

-

Diversify Your Investments to Avoid Single-Asset Risk: While $TRUMP and $MELANIA tokens have attracted many investors, the uncertainty in the market means that single-asset exposure carries higher risk. Diversifying your investments can help reduce that risk.

-

Set Stop-Loss and Target Price Levels: In a volatile market, setting reasonable stop-loss orders and target prices can help control losses and lock in profits. This approach can prevent emotions from driving your decisions.

-

Understand the Fundamentals and Avoid FOMO (Fear of Missing Out): While there may be opportunities in the short term, retail investors should delve into the fundamentals behind the tokens and avoid blindly chasing prices, especially during market bubbles.

-

Take a Long-Term Perspective: The crypto market is full of uncertainty, and short-term price fluctuations can heavily affect investors’ emotions. For long-term investors, focusing on the project’s future development and technological innovations is more important than getting distracted by short-term price changes.

By making rational decisions and managing risks effectively, retail investors can better navigate market volatility and uncertainty, and potentially seize long-term investment opportunities.

▶ Buy Crypto at Bitget

CoinRank x Bitget – Sign up & Trade to get $20!