KEYTAKEAWAYS

- Trump's election victory and Republican control could pressure the Fed to accelerate rate cuts, potentially lowering rates to 3%-3.25% by end of 2025, compared to the expected 3.5%-3.75%.

- Historical patterns suggest Bitcoin's fourth halving bull run will likely feature three major price surges with 2-3 month consolidation periods between each surge.

- Predictions indicate Bitcoin could reach $200,000 by early 2026, with intermediate targets of $100,000 by March 2025 and $140,000-160,000 by August 2025.

CONTENT

Explore how Trump’s presidential victory could influence Fed rate cuts and shape Bitcoin’s fourth halving bull run. Analysis includes historical patterns, price predictions, and potential market scenarios through 2026

At 3 AM today (UTC+8), the Federal Reserve announced its rate decision, cutting rates by 25 basis points to 4.50%-4.75%, meeting market expectations. This is the first rate meeting since September’s rate cut and the second-to-last rate meeting in 2024.

Previously, on November 5th, the US presidential election took place, and on the 6th, Trump confirmed his victory. The crypto market immediately surged, with Bitcoin breaking its historical high after 8 months of volatility.

The market consensus is that after Trump becomes US President, he will pressure the Federal Reserve to accelerate rate cuts, which is the fundamental logic behind this round of increases. On January 20, 2025, Trump will officially take the oath of office. Before that, there is one more Fed rate meeting (December 17-18, 2024), and just over a week after Trump takes office, there will be another Fed rate meeting (January 28-29, 2025).

It can be said that Trump’s inauguration coincides with the Fed’s rate cut cycle. Trump’s influence on the Fed’s rate cut pace before and after his inauguration will be the most important factor affecting the crypto market’s fourth bull market. Currently, Bitcoin has completed its fourth halving for over 6 months. Based on historical patterns, the major halving bull run is about to officially begin. So how will this fourth halving bull market progress?

HISTORICAL IMPACT OF FED RATE CUTS ON BITCOIN PERFORMANCE

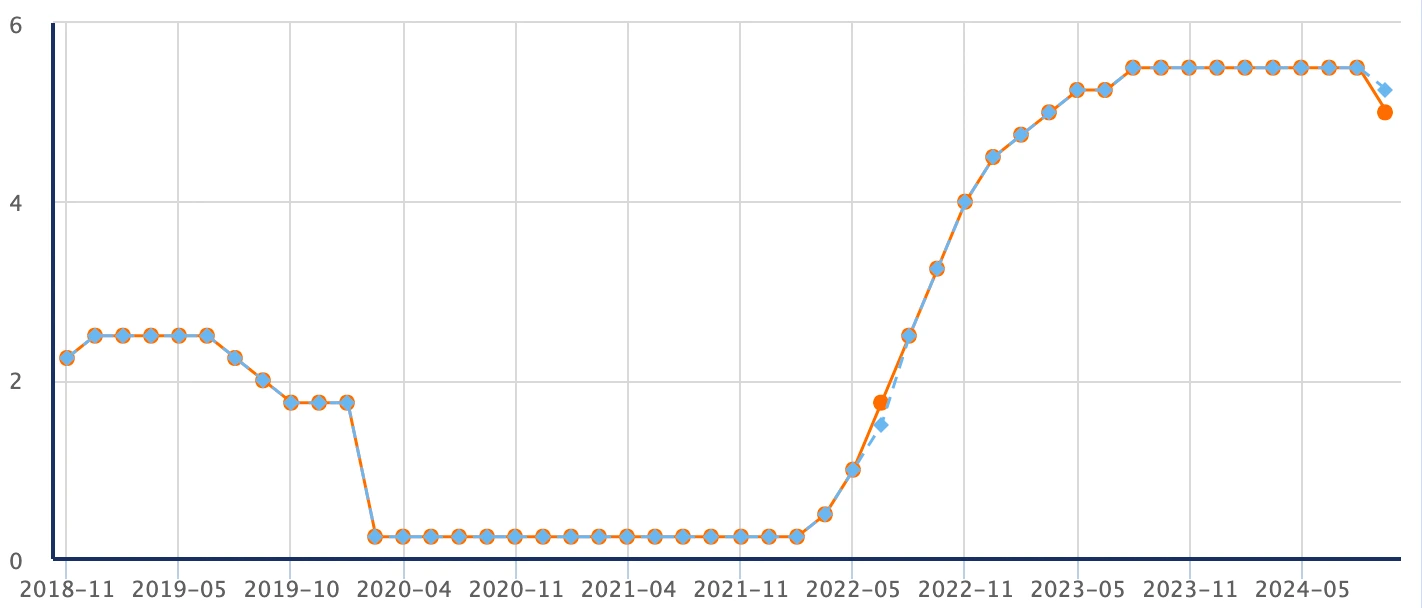

After Bitcoin’s first halving in 2012, the Fed has had three rate cut or low interest rate cycles. All three cycles drove Bitcoin prices higher.

2012-2015: The Fed maintained a sustained low interest rate policy. At that time, the global financial crisis had not fully dissipated, and the Fed adopted an extremely low interest rate policy. The main goal during this phase was to stimulate consumption and investment to help the economy gradually recover from the financial crisis. Therefore, the Fed mainly maintained low interest rates rather than making frequent adjustments, keeping rates between 0% and 0.25%. Besides the low interest rate policy, the Fed also expanded its balance sheet by purchasing Treasury bonds and mortgage-backed securities (MBS) to inject further liquidity into the market.

During this phase, although Bitcoin experienced its first major surge, it was mainly due to the halving effect. Bitcoin was still in its early development stage and was relatively less affected by macroeconomic policies, but it gradually entered investors’ radar.

2019 rate cut cycle: mainly preventive rate cuts. The Fed made three rate cuts in July, September, and October 2019, each cut being 25 basis points, totaling 75 basis points. These cuts weren’t due to economic recession but were preventive measures aimed at maintaining economic stability when signs of economic slowdown appeared. Therefore, each cut was relatively small, with longer intervals between cuts.

During these rate cuts, Bitcoin was in a bear market after the end of the second halving bull run. Under the influence of the rate cuts, Bitcoin quickly rose from around $3,000 to a high of over $14,000, creating a mini bull run during the bear market.

Federal Reserve Interest Rate Changes 2018-2024

(Source: fx678)

2020 rate cut cycle: emergency cuts in response to the COVID-19 pandemic. Rate cuts began in March, with two large cuts of 50 and 100 basis points respectively, totaling 150 basis points, with approximately two weeks between the two cuts. This was mainly due to the massive economic impact of the COVID-19 pandemic, with global markets experiencing panic selling. The Fed took emergency rate cut actions to address the sudden economic crisis. Besides rate cuts, the Fed also implemented large-scale quantitative easing policies, including purchasing government bonds, mortgage-backed securities (MBS), and corporate bonds to prevent financial market liquidity from drying up.

This rate cut cycle was characterized by large and rapid cuts, using multiple policy tools. Bitcoin prices first experienced large downward volatility but subsequently surged as global quantitative easing policies were implemented, initiating the third halving bull run in an explosive mode.

From the above content, we can see that different causes led to different rate cut patterns. Faster and larger rate cuts cause Bitcoin to rise more quickly and higher, but the duration of the increase becomes shorter, leading to shorter overall crypto market bull runs. More moderate and sustained rate cuts extend the duration of bull markets, giving other cryptocurrencies besides Bitcoin opportunities to rise.

TRUMP’S POTENTIAL INFLUENCE ON FED POLICY POST-ELECTION

Looking at common Fed rate cut cycle patterns, there are mainly 3 modes:

- Gradual cuts: Small cuts each time, usually 25 basis points, suitable for situations where economic growth is slowing but not in recession.

- Large cuts: Rapid, significant cuts, usually 50 basis points or more each time, used to address sudden economic crises or recession risks.

- Maintaining low rates: Keeping extremely low rates for an extended period to support long-term economic recovery, mainly applicable during economic crisis recovery periods.

Looking at the purpose of this round of cuts, it’s mainly to address inflation and economic slowdown. Therefore, based on historical experience, the Fed should adopt gradual small cuts to avoid creating new inflationary pressures while supporting stable economic development. Currently, after a 50 basis point cut in September and a 25 basis point cut in November, market pricing leans toward another 25 basis point cut in December, followed by a pause in January, then multiple rate cuts in 2025, totaling 50-75 basis points.

However, after Trump’s election, his main policy agenda includes tax cuts and increased spending to promote rapid economic development, all of which require money. As we mentioned in our previous article “Musk Endorses Trump: What Impact Would Trump’s Victory Have on the Crypto Sphere?“, if Trump implements such economic policies, he can only raise funds through debt issuance – massive debt issuance and unlimited QE. Trump also frequently criticized Powell and the Fed during his first term (2017-2021) and supported low interest rate policies.

Currently, not only has Trump won the presidential election, but his Republican Party has also won control of the Senate, and in the House of Representatives, Republicans are also in the lead. It can be said that Trump’s return to the White House this time presents a complete opportunity to establish a strong government. Therefore, Trump will likely use his strong position to pressure the Fed through various means to accelerate and increase rate cuts.

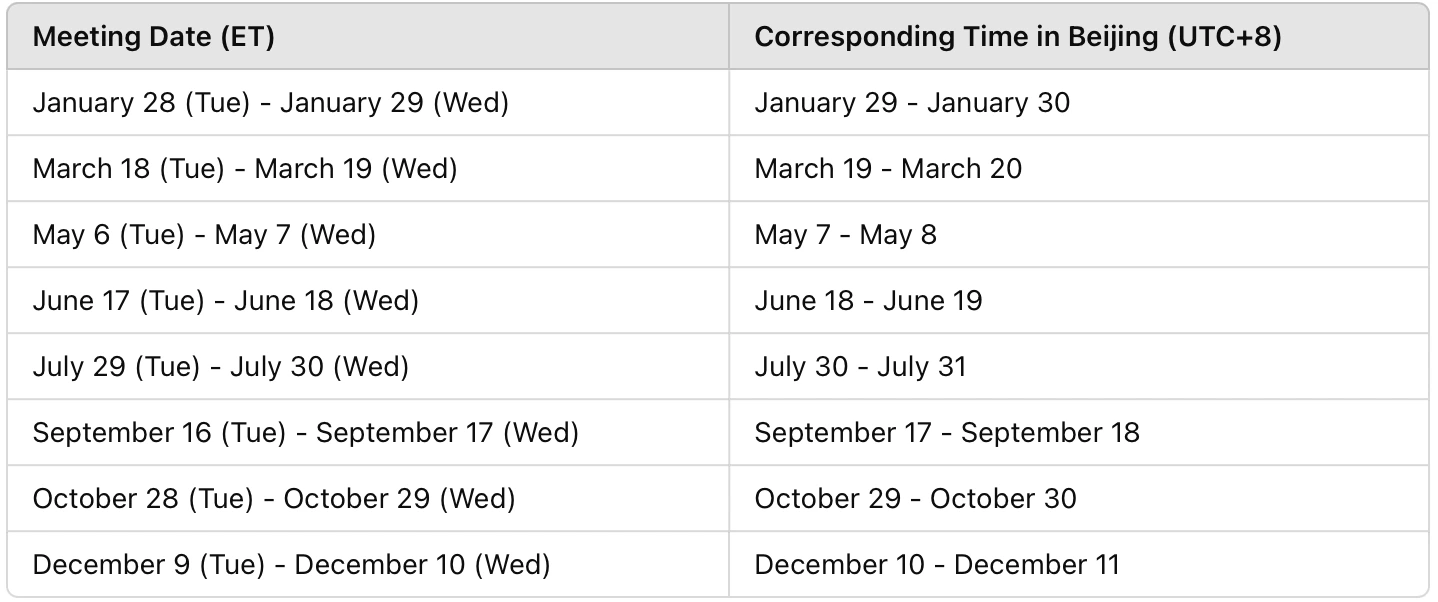

If as expected, the Fed cuts rates by another 25 basis points in December, bringing rates to 4.25%-4.50%, and there are 8 rate meetings in 2025, as shown in the chart below:

2025 Fed Rate Decision Timeline Comparison Table

(Created by: CoinRank)

Under normal circumstances, there might be 3-4 rate cuts in 2025, totaling 50-75 basis points, with final rates around 3.5%-3.75%. However, if Trump exerts influence, there could be more cuts, perhaps 100-125 basis points, bringing final rates to around 3%-3.25%, or even larger cuts.

PREDICTING BITCOIN’S PRICE TRAJECTORY THROUGH 2026

Based on the above analysis, if Trump does force the Fed to accelerate rate cuts after taking office, how will the upcoming bull market progress? We can analyze and compare this with the second and third halving bull markets.

The second halving bull market lasted for 1 year, from early 2017 to December, covering almost the entire year. There were 2 notable increases: First, from early 2017 to May, Bitcoin rose from $1,000 to $2,500, a 150% increase over about 4 months. Second, from May to December 2017, Bitcoin price rose from $2,500 to $20,000, a 700% increase over about 7 months. Between these two increases, from May to August 2017, Bitcoin experienced a correction from $3,000 to $1,800, about a 40% drop.

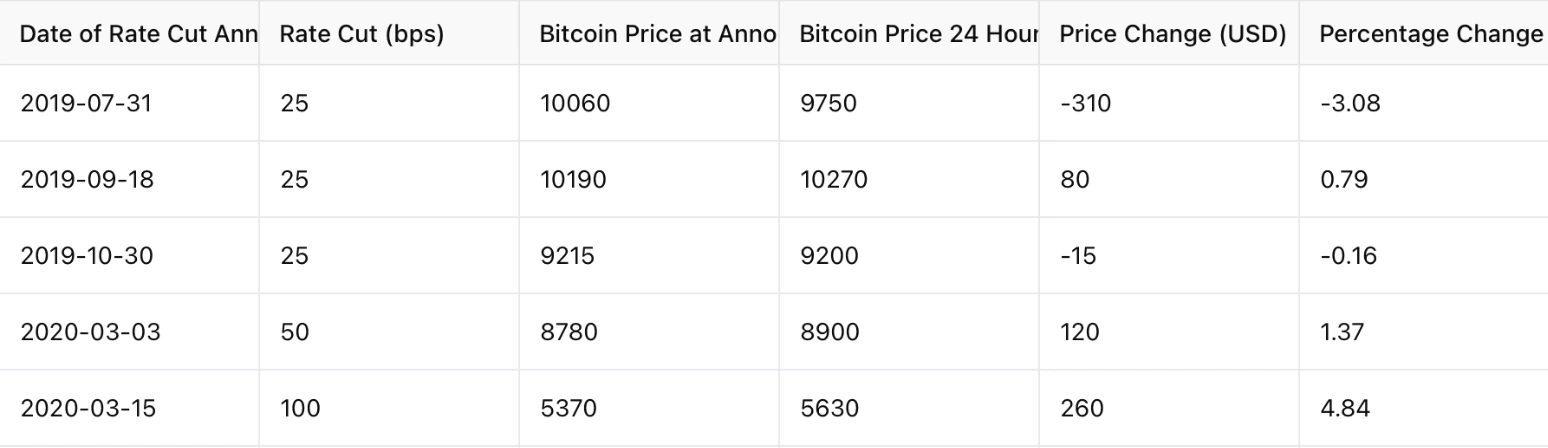

24-hour Bitcoin Price Changes Following Historical Federal Reserve Rate Decisions

(Created by: CoinRank)

The third halving bull market lasted for 1.5 years, from March 2020 to November 2021. There were 3 notable increases:

First increase: March to December 2020, Bitcoin rose from $3,800 to $30,000, approximately 700%, followed by a correction from $30,000 to around $20,000, about a 33% drop over about 2 months.

Second increase: January to April 2021, from $30,000 to $64,000, about 113%, followed by a correction from $64,000 to around $30,000, about a 50% drop over about 3 months, mainly triggered by policy black swan events.

Third increase: July to November 2021, Bitcoin rose from $29,200 to $69,000, about 136%, after which the third halving bull market ended.

From the above, we can see that in each halving bull market, Bitcoin experienced several major increases, typically showing a pattern of alternating main upward waves and correction/consolidation phases.

Upward waves typically last 4-6 months. Corrections and consolidations usually last 2-3 months, typically related to market overheating, black swan events such as regulatory changes, technical issues, etc.

The current rate cut pace and overall environment are more similar to the third halving bull market, so let’s predict how the fourth halving market might progress in 2025.

September 2024 – March 2025: Bitcoin’s first increase, breaking through $100,000, followed by a 20%-30% correction to around $70,000, consolidating for 2 months.

May 2025 – August 2025: Bitcoin’s second increase, breaking through $140,000-160,000, followed by a 30%-40% correction to around $90,000, consolidating for 2-3 months.

November 2025 – February 2026: Bitcoin’s third increase, reaching this bull market’s peak of around $200,000.

Then the fourth halving cycle might end, at which point it would be time to take profits and secure gains. Of course, a final risk disclaimer: all of the above content represents the author’s personal views, is for reference only, not investment advice. Markets carry risks, and entry should be approached with caution.

▶ Buy Crypto at Bitget

CoinRank x Bitget – Sign up & Trade to get $20!