KEYTAKEAWAYS

- Funding rate is a fee in perpetual futures to balance long and short positions, keeping prices close to the spot market.

- It adjusts based on price gaps and market sentiment, encouraging a stable and fair trading environment.

- Understanding funding rates helps traders manage costs, read market trends, and refine strategies in crypto futures trading.

CONTENT

In the world of cryptocurrency trading, especially in perpetual futures markets, you might often hear the term “funding rate.” It may sound technical or mysterious, but it’s actually one of the key mechanisms behind how these markets work. Whether you’re a beginner or an experienced trader, understanding funding rates can help you better follow market trends and even improve your trading strategy.

So what exactly is a funding rate? Where does it come from? And why does it matter? Let’s break it down, step by step.

1. WHAT IS A FUNDING RATE?

In simple terms, the funding rate is a periodic payment between traders who are long (buyers) and short (sellers) in a perpetual futures contract. Its main purpose is to keep the futures price close to the spot (real-time) price of the asset, like Bitcoin.

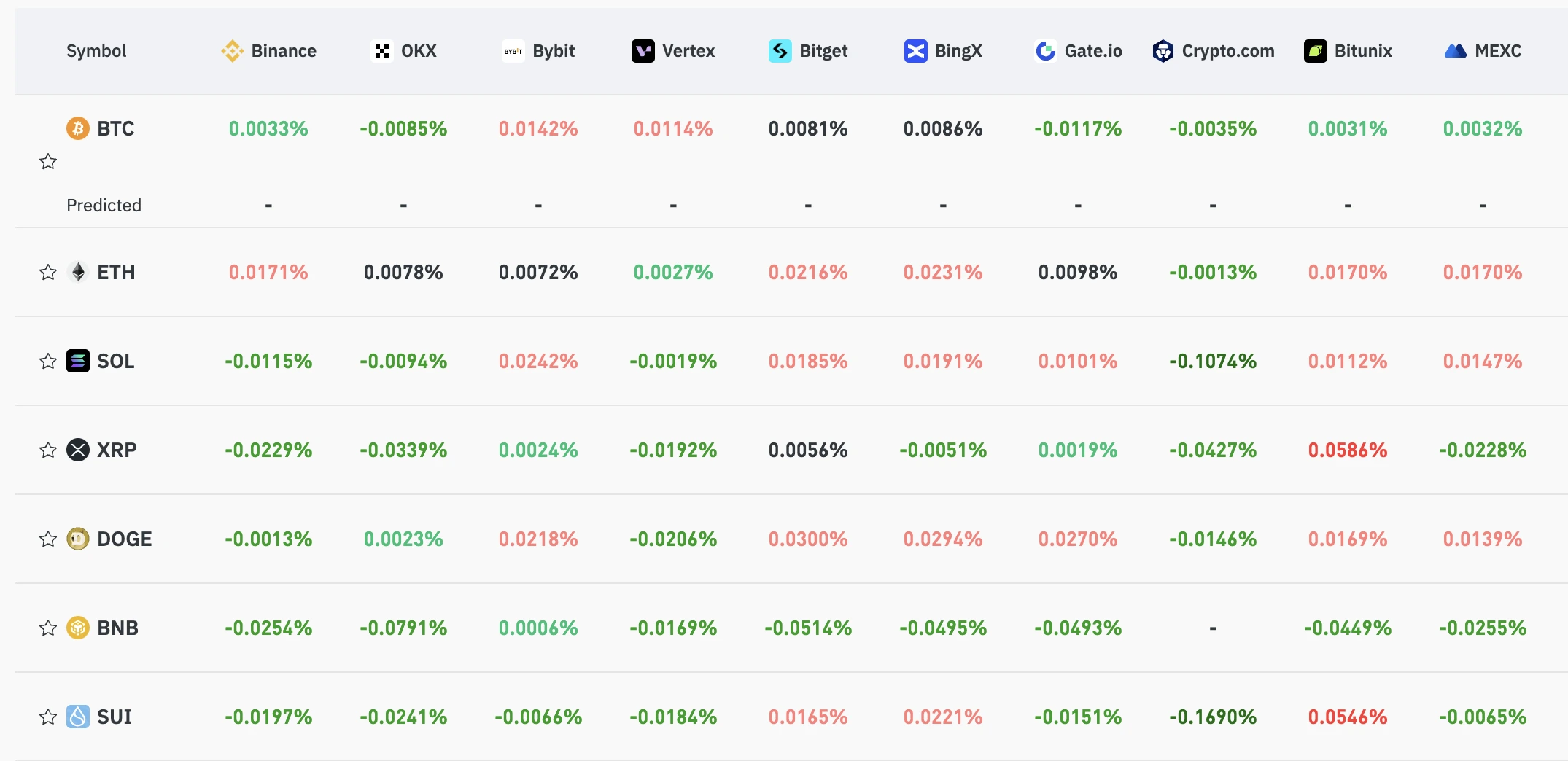

(Source:Coinglass)

In traditional futures, the contract has an expiry date, and the price naturally moves closer to the spot price over time. But perpetual futures never expire, so the funding rate works as a “price anchor” to prevent the price from drifting too far away.

The funding rate can be:

- Positive: Longs pay shorts

- Negative: Shorts pay longs

This payment usually happens at fixed intervals, like every 8 hours (common on Binance, Bybit, etc.), or every 1 hour depending on the exchange.

2. HOW IS THE FUNDING RATE GENERATED?

The funding rate comes from the way perpetual futures markets operate. It mainly depends on:

1) Price Difference: Premium or Discount?

The price of perpetual futures can go higher or lower than the spot price, depending on market sentiment:

•Premium: If the futures price is higher than the spot price, it shows strong demand from buyers. In this case, the funding rate is usually positive — longs pay shorts to balance the market.

•Discount: If the futures price is lower than the spot, it means sellers dominate. The funding rate is negative — shorts pay longs, encouraging buyers to step in.

Exchanges monitor this difference and adjust the funding rate accordingly.

2) Supply and Demand Balancer

The funding rate acts like a pressure valve to balance buying and selling:

•If there are too many longs, prices go up, the funding rate increases, and holding a long position gets more expensive. This discourages more buying and attracts sellers.

•If there are too many shorts, the rate goes negative, and shorts have to pay, attracting more buyers to bring the market back up.

This keeps the market from tilting too far in one direction.

3) How It’s Calculated: Premium Index + Interest Rate

Funding rates are calculated based on two parts:

- Premium Index: Measures the difference between futures and spot prices, usually based on average prices over time.

- Interest Rate Component: A fixed rate that adjusts for borrowing costs (like 0.03% daily).

Formula (simplified):

Funding Rate = Premium Index + (Interest Rate – Lending Rate)

Some exchanges also set upper and lower limits (e.g. ±0.5%) to avoid extreme spikes.

4) Payment and Settlement

Funding rates don’t apply in real-time. They are settled at set times (like every 8 hours on Binance: 00:00, 08:00, 16:00 UTC).

At those times, if you’re holding a position, you either pay or receive the funding fee based on the rate and your position.

3. EXAMPLE: HOW FUNDING RATES AFFECT YOU

Let’s say you are holding a long BTC position worth $10,000. The current funding rate is +0.02%, and settlement happens every 8 hours.

You will pay:

$10,000 × 0.02% = $2

This $2 will be paid to traders holding short positions.

If the rate were -0.02%, you would receive $2 from the shorts instead. So your cost or profit changes depending on market sentiment.

4. WHY FUNDING RATES MATTER

Funding rates are more than just a fee. They play several key roles in the market:

✔ Price Anchor

Funding rates help futures prices stay close to spot prices through periodic payments between longs and shorts.

✔ Market Sentiment Control

High funding rates raise the cost of holding positions. This can stop extreme bullish or bearish trends from continuing unchecked.

✔ Trading Signal

The direction and size of the funding rate show what the market is feeling.

- High positive funding rate = market may be overheated

- Negative funding rate = bearish sentiment

Some traders use this data as part of their strategy.

5. REAL IMPACT ON TRADERS

For traders, funding rates can affect profit and loss directly:

- Short-term traders may not notice the impact much, since funding is only charged at specific intervals.

- Long-term holders can see costs add up, especially if the funding rate stays high for a while.

In extreme conditions (like during major volatility), funding rates can even jump to 1% or more, which significantly affects your returns.

6. HOW TO MONITOR AND USE FUNDING RATES

Most major exchanges (like Binance, Bybit, OKX) show real-time funding rate info on their trading pages, including:

- Current funding rate (%)

- Next settlement time

- Historical funding rates

You can use this info to:

- Open positions when funding rates are low

- Avoid high funding rate costs

- Even trade against the crowd when funding rates get extreme

7. FINAL THOUGHTS

The funding rate is like a quiet force working behind the scenes in perpetual futures trading. It keeps the system fair, prices balanced, and gives traders extra tools to read the market.

Next time you’re trading, take a moment to check that little “Funding Rate” number — it might be quietly telling you a lot about where the market is headed.

▶ Buy Crypto at Bitget

CoinRank x Bitget – Sign up & Trade to get $20!