KEYTAKEAWAYS

- The ETH/BTC ratio reflects the relative strength of Ethereum and Bitcoin, offering a key indicator for understanding market risk appetite and asset allocation.

- Bitcoin's dominance as "digital gold" and its institutional appeal have intensified, significantly impacting the ETH/BTC ratio and investor confidence in Ethereum.

- Ethereum faces mounting competition from emerging blockchains and new challenges post-PoS transition, necessitating strategic patience for long-term investment gains.

CONTENT

ETH/BTC: BASIC CONCEPTS AND SIGNIFICANCE

The ETH/BTC ratio is one of the most intriguing and practical indicators in the cryptocurrency market. It not only reflects the relative strength of Ethereum compared to Bitcoin but also serves as a barometer of the market’s risk appetite.

When the ratio rises, it signals a preference for innovative assets like Ethereum. When it falls, it indicates a shift toward Bitcoin, the “digital gold,” as a safe haven.

For investors, this ratio is more than just a number. It acts as a compass for guiding capital allocation and timing strategic moves. Moreover, it offers insights into the future trajectory of the two leading ecosystems.

CURRENT MARKET CONDITIONS: LOWS AND INSIGHTS

Looking at the ETH/BTC ratio since 2020, the market has experienced a rollercoaster-like journey. In mid-2021, the ratio surged to a high of 0.085, marking a peak of optimism. However, it has since declined steadily, reaching just 0.03638 as of December 30, 2024—a drop of over 57% from its peak.

(Source: TradingView)

Trading volume tells another side of the story. After the exuberance of 2020-2021, market activity has cooled, with a notable decline in trading volume. This reflects a more cautious sentiment among participants, though it may also indicate the formation of a potential bottom.

Also Read:

What Is Ethereum & How Does It Work?

Michael Saylor|21 Rules of Bitcoin: Why You Should Never Sell BTC

DEEP DIVE INTO THE REASONS BEHIND THE DECLINE

1. Bitcoin’s Dominance Reasserted

Amid growing global economic uncertainties, Bitcoin’s appeal as a “safe haven” asset has strengthened. Both institutional investors and retail traders are gravitating toward Bitcoin, favoring its stability during turbulent times.

The data reinforces this trend:

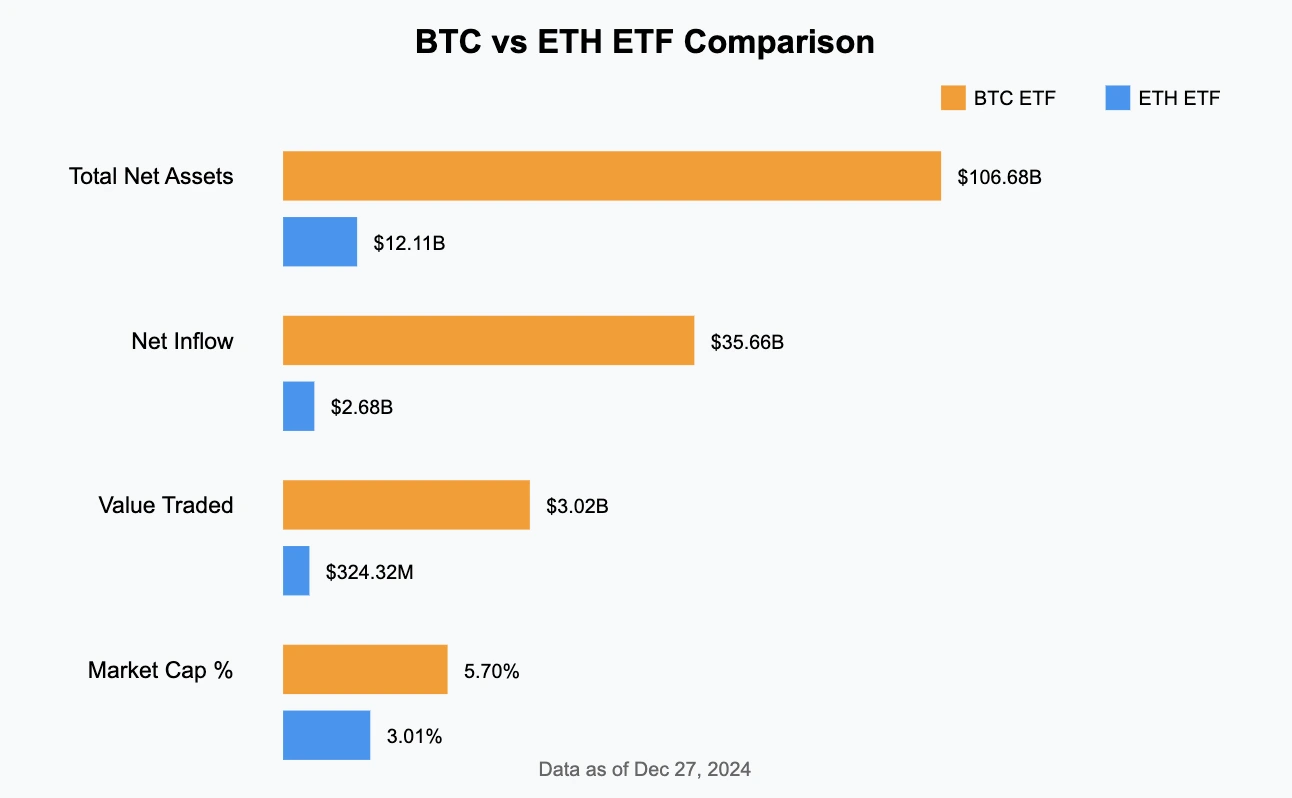

- Bitcoin ETFs boast $106.68 billion in net assets, compared to just $12.11 billion for Ethereum ETFs—a difference of 8.8 times.

- On the capital flow side, Bitcoin ETFs have seen cumulative net inflows of $35.66 billion, while Ethereum ETFs have attracted only $2.68 billion, a staggering 13-fold difference.

This disparity in capital allocation reflects not just numbers but also the market’s psychological and confidence preferences.

Also Read:

Bitcoin Spot ETFs: Risks You Need to Know Beyond the Hype

2. Ethereum’s Challenges and Transformation

While Ethereum remains the king of smart contract platforms, challengers are increasingly vying for the throne. Emerging blockchains like Solana and Avalanche are capturing developer and user interest with their high performance and low fees.

Additionally, Ethereum’s recent transition to Proof of Stake (PoS), while beneficial for sustainability in the long term, has introduced short-term pressures. The unlocking of staked ETH has increased market supply, leading some investors to cash out and exert downward pressure on prices.

What’s more, competitors are offering lucrative incentives to projects and users, aiming to carve out a share of the DeFi and NFT markets. This competitive landscape is testing Ethereum’s ability to capture value like never before.

Also Read:

XRP VS SOL: A Deep Dive into the Two Rising Stars in the Crypto Market

INVESTMENT INSIGHTS

The prolonged slump in the ETH/BTC ratio may raise concerns, but it also presents opportunities. While this may not be the perfect moment to call a bottom, for long-term investors, it could be a good time to gradually accumulate positions. Markets are ever-changing, and patience often pays off.

A phased buying approach can help mitigate risks during uncertainty. Keep some liquidity on hand to adapt to potential market fluctuations. Think of it as storing grain in winter—preparing for the eventual arrival of spring.

The low ETH/BTC ratio reflects shifts in market dynamics and serves as a chance for investors to reassess strategies. Amidst volatility and uncertainty, focusing on core value assets and patiently waiting for the market’s recovery might be the most prudent course of action.

▶ Buy Crypto at Bitget

CoinRank x Bitget – Sign up & Trade to get $20!