KEYTAKEAWAYS

- Bitcoin and the Nasdaq Index show increasing price correlation, driven by shared market sentiment, risk appetite, and macroeconomic factors like inflation and Fed policy.

- Institutional investors' entry into Bitcoin has strengthened its ties to the U.S. stock market, as both are now seen as innovation-driven assets.

- Short-term market reactions, such as economic data releases, often lead to synchronized fluctuations in Bitcoin and U.S. stock prices, highlighting their interconnectedness.

CONTENT

Explore the growing correlation between Bitcoin and the U.S. stock market, analyzing recent trends, historical performance, and key factors driving their synchronized movements.

I. INTRODUCTION

Bitcoin, a decentralized digital currency, has attracted global investors’ attention since its inception in 2009. The U.S. stock market, particularly the Nasdaq Index, has always been considered a benchmark for technology stocks.

Although these two asset classes play different roles in the investment market, their correlation has become increasingly noticeable in recent years. This article will analyze the correlation between Bitcoin and the U.S. stock market through recent market trends and historical performance and explore the reasons behind this correlation.

II. RECENT MARKET ANALYSIS

U.S. Economic Data and Market Reactions

On January 8, 2025, U.S. employment data exceeded expectations, and inflation in the service sector accelerated. Specifically, November JOLTS job openings unexpectedly increased by 259,000 to 8.098 million, while the ISM Non-Manufacturing PMI rose from 52.1 in November to 54.1, and the price index increased from 58.2 to 64.4, reaching an 11-month high.

These data suggest that inflationary pressures persist, and market expectations for Federal Reserve rate cuts have diminished accordingly.

(Source:TradingView)

The market anticipates a more than 95% probability that the Federal Reserve will not cut rates in January, and only a 37 basis point cut in 2025, lower than the two rate cuts predicted in the dot plot.

These developments led to a sell-off in both the U.S. stock and cryptocurrency markets, with the Nasdaq dropping nearly 1.9%, Nvidia plunging 6.22% after reaching a new high, Tesla falling 4%, and Bitcoin dropping more than 6%, falling below $94,000.

Short-term Correlation Between Bitcoin and the U.S. Stock Market

Recently, the price trends of Bitcoin and the Nasdaq Index have shown significant linkage. Influenced by market data and expectations, both Bitcoin and the stock market have exhibited synchronous fluctuations in the short term.

This synchronization indicates that despite their different fundamentals, the short-term market sentiment drives a degree of correlation in their performances.

III. HISTORICAL PERFORMANCE CORRELATION

Price Trends of Bitcoin and the Nasdaq Index Over the Years

Since 2020, the price trends of Bitcoin and the Nasdaq Index have increasingly displayed positive correlation characteristics.

(Source:TradingView)

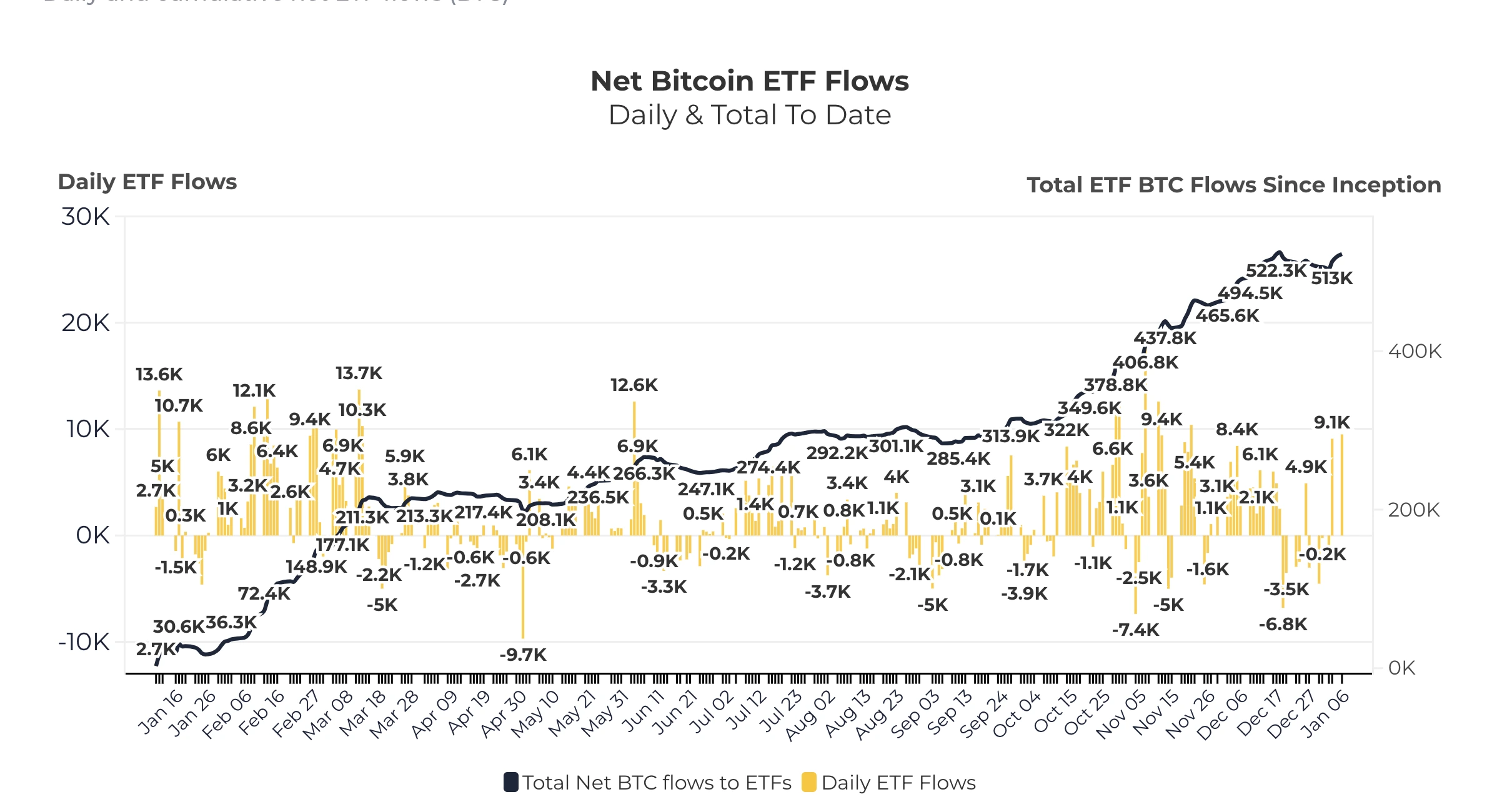

Key events such as Bitcoin’s entry into the U.S. futures market in 2017, Tesla’s large-scale purchase of Bitcoin in 2021, and the approval of Bitcoin spot ETFs in 2024 have made Bitcoin more financially market-oriented, representing technological innovation.

Long-term Correlation Analysis

In the long term, the correlation between Bitcoin and the Nasdaq Index has gradually strengthened. Data show that during various macroeconomic events and shifts in market sentiment, the two markets have displayed a high degree of synchronization.

Between 2018 and 2021, both exhibited volatile trends, and in mid-to-late November 2021, both reached a historical high. Following this peak, both experienced a correction, reaching a low point between October and November 2022.

Since then, their trajectories have continued to rise, with both hitting new all-time highs. This demonstrates an increasingly strong positive correlation between the two.

This correlation reflects investors’ preferences for technology and innovation and indicates the trend of Bitcoin being increasingly accepted by mainstream financial markets.

IV. REASONS BEHIND THE CORRELATION

Market Sentiment and Risk Appetite

Market sentiment and risk appetite are crucial factors influencing the price trends of Bitcoin and the U.S. stock market.

In times of high market sentiment and increased risk appetite, investors are more inclined to invest in high-risk, high-reward assets such as technology stocks and Bitcoin. This leads to a synchronized price movement between the two during changes in market sentiment.

Influence of Institutional Investors

The entry of institutional investors has altered the structure of the Bitcoin market. More and more institutions view Bitcoin as part of asset allocation, including it in their portfolios alongside technology stocks, thus enhancing the correlation between Bitcoin and the U.S. stock market.

Macroeconomic Factors

Macroeconomic factors such as the Federal Reserve’s monetary policy and inflation expectations significantly impact the price trends of both Bitcoin and the U.S. stock market. As the macroeconomic environment changes, the demand for these two assets adjusts accordingly, resulting in synchronized price trends.

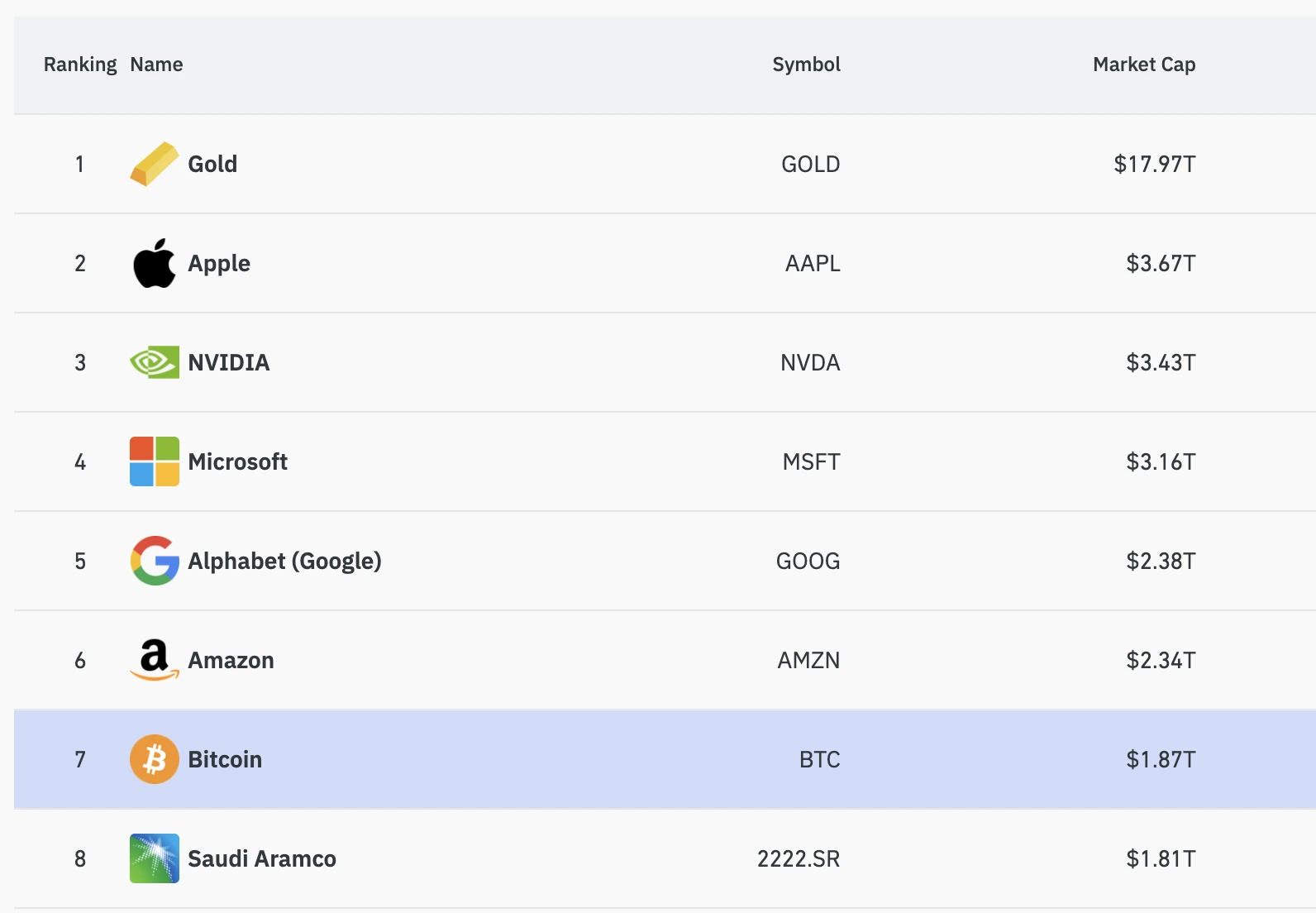

The Nasdaq Index’s most important weighted stocks currently consist of seven companies (Microsoft, Apple, Alphabet, NVIDIA, Amazon, META, and Tesla), and Bitcoin can be likened to an eighth significant weight in the Nasdaq.

While this perspective lacks strict logical basis, Bitcoin’s attributes of technological innovation and high risk align closely with those of these seven companies. Moreover, the correlation in their price movements further supports this view.

Additionally, with the approval of Bitcoin ETFs, this alternative asset has become directly linked to the U.S. stock market, to some extent strengthening the stock market’s ability to price Bitcoin.

Also Read:

ETFs Continue to Attract Capital – How Institutional Investors Are Reshaping the Bitcoin Market

V. CONCLUSION

The correlation between Bitcoin and the U.S. stock market has been strengthening, reflecting the market’s recognition of technology and innovation and the elevated status of Bitcoin as a financial asset.

In the future, this correlation may continue to evolve with further policy changes and market developments. Investors should pay close attention to these changes to make more informed investment decisions.

Also Read:

MicroStrategy Joins Nasdaq 100: From Software Pioneer to Bitcoin Giant

▶ Buy Crypto at Bitget

CoinRank x Bitget – Sign up & Trade to get $20!