KEYTAKEAWAYS

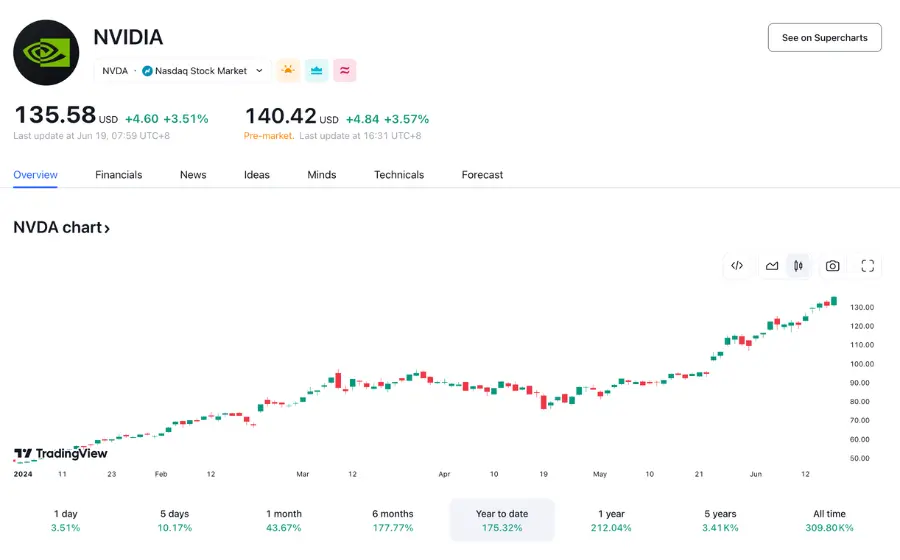

- Nvidia’s stock price escalation has been dramatic this year, with a 160% increase, highlighting its dominance in the data center chip market for major tech firms.

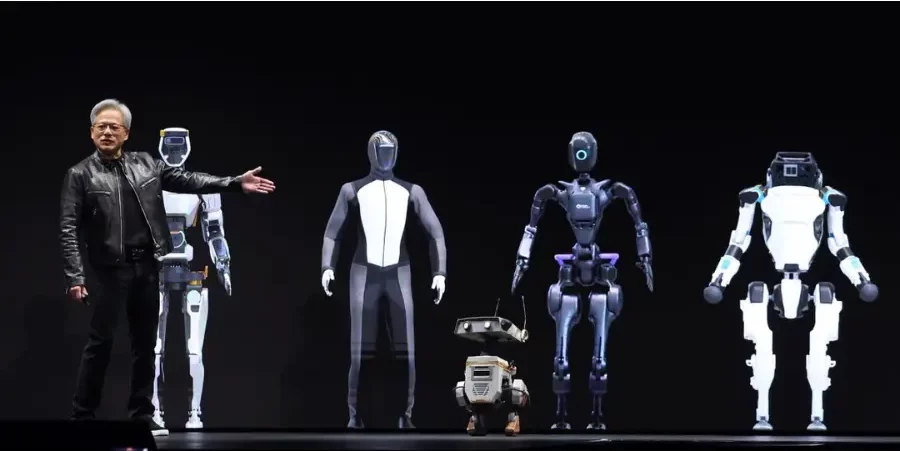

- The company’s innovation extends into robotics, with significant advancements like the new Blackwell GPU and plans for next-generation humanoid robots.

- Despite Nvidia’s success and rising market valuation, financial analysts urge caution, noting that any minor errors could lead to substantial stock price corrections.

CONTENT

Nvidia surpasses Microsoft as the world’s most valuable company with a $3.34 trillion market cap, fueled by robust demand for AI technology and strategic innovations.

ALL HAIL THE MOST VALUABLE COMPANY IN THE WORLD

Nvidia has surpassed Microsoft to become the company with the highest market value globally, driven by the surge in demand for artificial intelligence (AI) computing capabilities. As of the latest reports, Nvidia’s share price reached $135.58, pushing its market cap to $3.34 trillion, with Microsoft trailing slightly at $3.33 trillion.

This milestone comes as Nvidia announced a collaboration with Hewlett Packard to launch NVIDIA AI Computing and Private Cloud AI services. Jensen Huang, CEO of Nvidia, stated, “Generative AI and accelerated computing are driving a fundamental transformation, and all industries are eager to join this industrial revolution.”

He noted that the partnership with HP would provide cutting-edge computing infrastructure and services to corporate clients and AI professionals, advancing the frontier of AI.

HOW NVIDIA BECAME THE POWERHOUSE BEHIND THE AI BOOM

Founded in 1991, Nvidia initially served as a supplier of high-resolution 3D graphics hardware for video gamers. With the rise of cryptocurrency mining chips and cloud-based online gaming, Nvidia gradually transitioned into the AI sector. Particularly in the past two years, Wall Street investors have increasingly recognized Nvidia’s critical role in powering the AI boom, which has propelled its stock price to new heights.

This year alone, Nvidia’s stock has soared over 160%, with its market value growing from $1 trillion to $3 trillion in just nine months, and from $2 trillion to $3 trillion in just over three months. CNBC analysts point out that Nvidia’s products dominate the tech industry’s data center chip market by eighty percent, with major companies like OpenAI, Microsoft, Google, Amazon, and Meta rapidly placing additional orders to meet their AI computing needs.

NVIDIA’S VISION: ROBOTICS AND AUTOMATION

Nvidia’s rapid growth also reflects the ongoing evolution in the AI sector. Recently, the company launched the new Blackwell GPU and has collaborated with competitors like Google, Meta, Microsoft, and OpenAI, utilizing Nvidia technology to drive AI projects. Discussing Nvidia’s future plans, Huang remarked, “We are doing some truly great work in the next generation of robotics. The next generation of robots is likely to be humanoid, and we now possess the necessary technology to envision general-purpose humanoid robots.”

(source: Fortune)

Nvidia’s success also showcases the company’s collaborative efforts across various sectors, including manufacturing and automotive industries. Huang explained, “The era of robotics has arrived. Everything that moves will one day be autonomous.”

INVESTOR CAUTION AMID SURGING MARKET VALUE

Despite the significant stock price increase to $135.87 this Tuesday, boosting its market value to $3.34 trillion and making Nvidia the world’s highest-valued publicly traded company, investors are advised to remain cautious. (Worth noting, Nvidia is currently not a component of the Dow Jones Industrial Average, but its performance in the S&P 500 index has far surpassed other constituent stocks.)

(source: TradingView)

Hans Mosesmann, an analyst at Rosenblatt Securities, has raised Nvidia’s target price from $140 to $200, suggesting its market value could approach $5 trillion. Mosesmann favors Nvidia’s hardware but emphasizes that its software, which enhances all its hardware, is the real driver of the stock’s performance.

However, Oliver Pursche, Senior Vice President at Wealthspire Advisors, warns investors that while Nvidia has received a lot of positive attention and made several correct decisions, a small misstep could lead to a significant correction in its stock price, hence the need for caution.

>>> Read more:

- Should Politics and Tech Go Hand in Hand? The Answer is…

- Nvidia CEO Jensen Huang’s 2024 Computex Keynote Address in Taipei

- Tech Giants’ Q1’24 Performance – How Financial Forecasts Shape Stock Prices?

Looking for the latest scoop and cool insights from CoinRank? Hit up our Twitter and stay in the loop with all our fresh stories!